What is Ichimoku Kinko Hyo Indicator? - Definition of Ichimoku Kinko Hyo Indicator

Ichimoku Kinko Hyo indicator - Ichimoku Kinko Hyo indicators is a popular technical indicator that can be found on the - Indicators Listing on this website. Ichimoku Kinko Hyo indicator is used by traders to forecast price movement depending on the chart price analysis done using this Ichimoku Kinko Hyo indicator. Traders can use the Ichimoku Kinko Hyo buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Ichimoku Kinko Hyo indicator. By using Ichimoku Kinko Hyo and other forex indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Ichimoku Kinko Hyo Indicator? Ichimoku Kinko Hyo Indicator

How Do You Combine Indicators with Ichimoku Kinko Hyo? - Adding Ichimoku Kinko Hyo Trading Indicator in MT4

Which Indicator is the Best to Combine with Ichimoku Kinko Hyo?

Which is the best Ichimoku Kinko Hyo indicator combination for forex trading?

The most popular indicators combined with Ichimoku Kinko Hyo are:

- RSI

- MAs Forex Indicator

- MACD

- Bollinger Band Indicator

- Stochastic Technical Indicator

- Ichimoku Kinko Hyo Trading Indicator

- Parabolic SAR

Which is the best Ichimoku Kinko Hyo indicator combination for Forex trading? - Ichimoku Kinko Hyo MT4 indicators

What Indicators to Combine with Ichimoku Kinko Hyo?

Get additional indicators in addition to Ichimoku Kinko Hyo indicator which will determine the trend of the forex market as well as others that confirm the market trend. By combining indicators that determine trend & others that confirm the trend & combining these indicators with Forex Ichimoku Kinko Hyo indicator a trader will come up with a Ichimoku Kinko Hyo based system that they can test using a practice demo account on the MetaTrader 4 platform.

This Ichimoku Kinko Hyo based system will also help traders to determine when there is a market reversal based on the indicators signals generated and therefore trades can know when to exit the market if they have open trades.

What is Ichimoku Kinko Hyo Indicator Based Trading? Indicator based system to interpret price and provides.

What is the Best Ichimoku Kinko Hyo Forex Strategy?

How to Choose the Best Ichimoku Kinko Hyo Forex Strategy

For traders researching on What is the best Ichimoku Kinko Hyo forex strategy - the following learn forex tutorials will help traders on the steps required to tutorial them with coming up with the best strategy for trading market based on the Ichimoku Kinko Hyo indicator system.

How to Create Ichimoku Kinko Hyo Forex Systems

- What is Ichimoku Kinko Hyo Indicator Strategy

- Creating Ichimoku Kinko Hyo Forex Strategy Template

- Writing Ichimoku Kinko Hyo Forex Strategy Rules

- Generating Ichimoku Kinko Hyo Forex Buy and Ichimoku Kinko Hyo Sell Signals

- Creating Ichimoku Kinko Hyo Trading Indicator Forex System Tips

About Ichimoku Kinko Hyo Trading Indicator Explained

Ichimoku Kinko Hyo Indicator

Ichimoku Kinko Hyo is a Japanese charting technique that was developed before by a Japanese newspaper writer, with the pen name of Ichimoku Sanjin.

- Ichimoku means 'a glance' or 'one look'

- Kinko means 'equilibrium' or 'balance'

- Hyo is the Japanese word for "chart"

Thus, Ichimoku Kinko Hyo means, 'a glance at an equilibrium chart'. Ichimoku attempts to identify the likely direction of price & help the trader to figure out the most suitable time to enter or exit the market.

Calculation

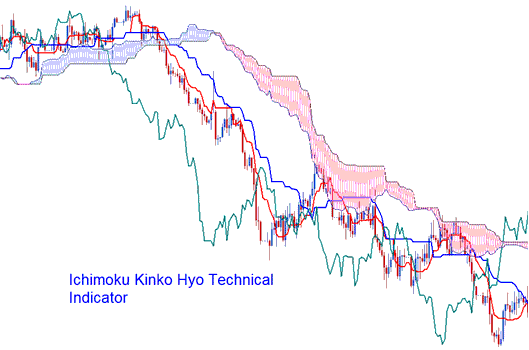

This indicator consists of five lines plotted using the midpoints of previous highs and lows. The five lines are calculated as follows:

1) Tenkan-Sen: Conversion Line: Red Line (Highest High + Lowest Low) / 2, for last 9 price periods

2) Kijun-Sen: Base Line: Blue Line (Highest High + Lowest Low) / 2, for last 26 price periods

3) Chikou Span: Lagging Span: Green Color Line Today's close price drawn 26 price periods behind

4) The Senkou Span A: Leading Span A = (Tenkan-Sen + Kijun-Sen) / 2, drawn 26 price periods ahead

5) Senkou Span B: Leading Span B: (Highest High + Lowest Low)/2, for the past 52 price periods, drawn 26 price periods ahead

Kumo: Cloud: area between Senkou Span A and B

FX Analysis & How to Generate Signals

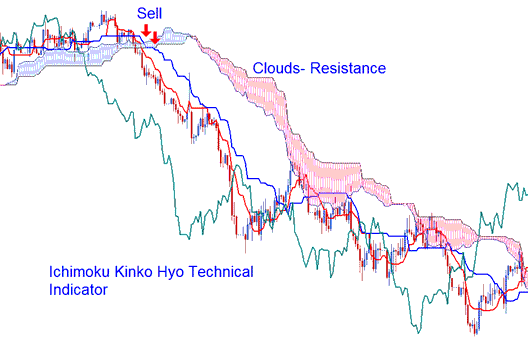

Bullish signal - Tenkan-Sen crosses Kijun-Sen from below.

Bearish signal - Tenkan-Sen crosses Kijun-Sen from above.

However, there are different areas of strength for the buy and sell trade signals generated.

Analysis in Forex Trading

Bullish cross over signal occurs above the Kumo (clouds),

Strong buy trading signal.

Bearish cross over signal occurs below the Kumo (clouds),

Strong sell trade signal.

If a bullish/ bearish crossover signal takes place within the Kumo (clouds) it's considered a medium strength buy or sell signal.

A bullish cross over that occurs below the clouds is considered a weak buy signal while a bearish crossover which occurs above the clouds is considered a weak sell signal.

Support and Resistance Areas

Support & resistance levels can be predicted by presence of Kumo (clouds). The Kumo also can be used to identify the prevailing trend of the forex market.

- If price is above Kumo, the ruling market trend is said to be upwards.

- If price is below Kumo, the ruling market trend is said to be downwards.

The Chikou Span or Lagging Span also is used to determine the strength of the buy or sell signal.

- If the Chikou Span indicator is below the closing price of the last 26 periods ago & a sell short signal is given, then the strength of trend is downwards, otherwise the signal is regarded to be a weak sell trade signal.

- If there's a bullish signal & the Chikou Span is above the market price of the last 26 periods ago, then the strength of trend is to the upside, otherwise it's considered to be a weak buy trade signal.

More Courses and Lessons:

- Desktop FX Platforms, Web Based Platforms & Mobile Phone Platforms

- Is Evening Star Candle Bullish or Bearish?

- Regulated Trading Broker Review

- FX Divergence Setups of M-Shapes Price Highs & W-Shapes Price Lows

- NZD JPY System NZD JPY Trade Strategy

- Insert Shapes in MetaTrader 4 FX Charts

- How to Calculate Pip For FTSE 100 Stock Indices

- What is Margin Account?

- Parabolic SAR Indicator Settings Described

- Linear Regression Slope Analysis