Analysis of Events Following an Evening Star Candle Formation - Determining the Bullish or Bearish Nature of the Evening Star Candle

What follows the formation of an Evening Star Candle Pattern? – Analysis of the Bearish Evening Star Candle Pattern

Analysis of Evening Star Candlestick Pattern

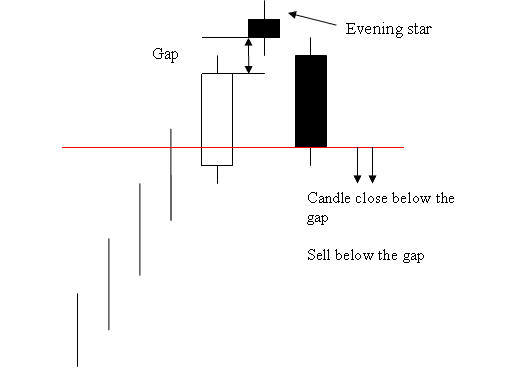

Evening star candlesticks setup is a 3 day bearish reversal pattern.

First day is a long white candle.

The second day is Evening star which gaps away from the long white candle.

Third day is a long black candlestick which fills the gap.

The filling of the gap and remaining of the black candlestick underneath the space is a sturdy bearish.

Forex Traders are advised to enter a sell transaction after the market closes below the gap created by an Evening Star candlestick formation. This provides the necessary confirmation signal for a short trade derived from this specific Evening Star pattern.

Study More Tutorials and Lessons:

- How to Use Engulfing Candle Shapes Guide Instruction

- Trading the Hk50cash Index

- How Can I Analyze MT4 Chart Trading Analysis?

- Indicators to Buy and Sell Gold and XAUUSD Exit Tools

- McClellan Histogram XAU/USD Indicator Analysis in XAUUSD

- USDX Chart: How to Trade with the US Dollar Index

- What Is Standard Lot Trading in Forex?