What is Bollinger Band Indicator? - Definition of Bollinger Band Indicator

Bollinger Bands indicator - Bollinger Band indicators is a popular forex technical indicator that can be found on the - Indicators List on this site. Bollinger Band is used by the traders to forecast price movement based on the chart price analysis done using this Bollinger Band indicator. Traders can use the Bollinger Band buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Bollinger Bands indicator. By using Bollinger Band and other indicators combinations traders can learn how to make decisions about market entry & market exit.

What's Bollinger Band Indicator? Bollinger Band Indicator

How Do You Combine Trading Indicators with Bollinger Band? - Adding Bollinger Band in the MT4

Which Indicator is the Best to Combine with Bollinger Bands?

Which is the best Bollinger Band combination for forex trading?

The most popular indicators combined with Bollinger Band are:

- RSI

- Moving Averages FX Indicator

- MACD

- Bollinger Band

- Stochastic Indicator

- Ichimoku Kinko Hyo Indicator

- Parabolic SAR

Which is the best Bollinger Band combination for Forex trading? - Bollinger Band MT4 indicators

What Indicators to Combine with Bollinger Bands?

Get additional indicators in addition to Bollinger Band that will determine the trend of the forex market & also others that confirm the trend. By combining forex indicators which determine trend and others that confirm the trend & combining these indicators with Forex Bollinger Band a trader will come up with a Bollinger Band based system that they can test using a forex demo account on the MetaTrader 4 platform.

This Bollinger Band based system will also help traders to determine when there is a market reversal based on the technical indicators signals generated & hence trade positions can know when to exit the market if they have open trades.

What is Bollinger Band Based Trading? Indicator based system to interpret and analyze price and provide signals.

What is the Best Bollinger Band Strategy?

How to Select and Choose the Best Bollinger Band Strategy

For traders researching on What is the best Bollinger Band forex strategy - the following learn forex tutorials will help traders on the steps required to guide them with coming up with the best strategy for trading forex market based on the Bollinger Band system.

How to Create Bollinger Band Systems

- What is Bollinger Bands Indicator Strategy

- Creating Bollinger Band Strategy Template

- Writing Bollinger Band Strategy Trade Rules

- Generating Bollinger Band Buy and Bollinger Band Sell Signals

- Creating Bollinger Band System Tips

About Bollinger Bands Indicator Example Explained

Bollinger Band Technical Analysis & Bollinger Bands Signals

Created and Developed by John Bollinger

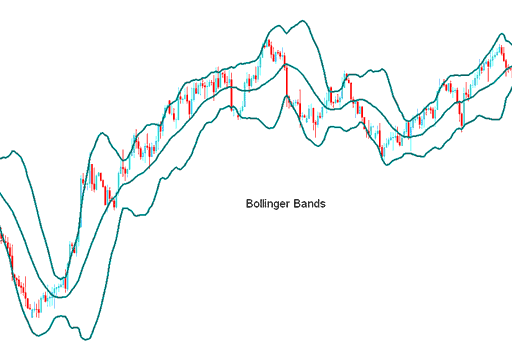

Bollinger Band are formed by 3 lines. Middle line is a Moving Average - 20 period Simple MA Moving Average.

The bands are then plotted at a distance away from the MA These are the bands that form the lower and upper lines.

The distance where the bands are drawn is determined by another indicator called the standard deviation. Standard deviation is a measure of volatility in the fx market or that of a forex pair.

Since the market price volatility keeps on changing, the standard deviation will keep changing, and since Bollinger band are plotted using the standard deviations method the distance method/calculation of the bands will keep on self adjusting themselves to the volatility conditions.

When the prices become more volatile, the bands widen & they contract during less volatile periods.

The 3 Bands are designed and intended to encompass majority of a fx currency price action. The middle band forms the basis for the market trend, generally a 20-periods simple MA Moving Average.

This band also serves as the base for the upper & lower bands. The upper band's & lower band's distance from the middle band is determined by market volatility. The upper bollinger band is drawn at +2 standard deviations above the middle band while lower bollinger band is plotted at -2 standard deviations below middle band.

FX Analysis and How to Generate Signals

- Bands provide a relative definition of high and low

- Used to identify periods of high and low market volatility

- Used to identify periods when prices are at extreme levels

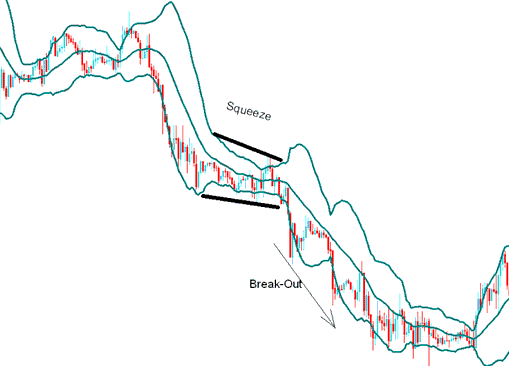

Consolidation - the Squeeze

The bands tighten as volatility lessens, this identifies the periods of consolidation. Sharp price breakouts tend to occur after the bands tighten.

Consolidation Chart Pattern

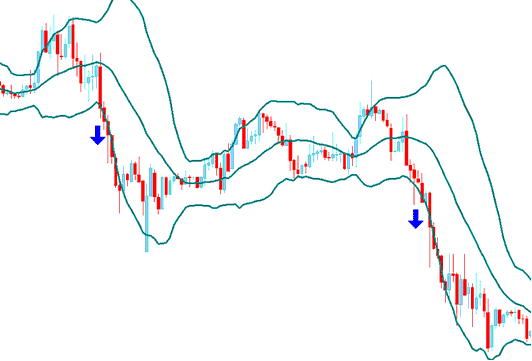

Continuation Signal - the Bulge

If the prices break through upper or lower band and move outside the bands a continuation of the current market trend is expected.

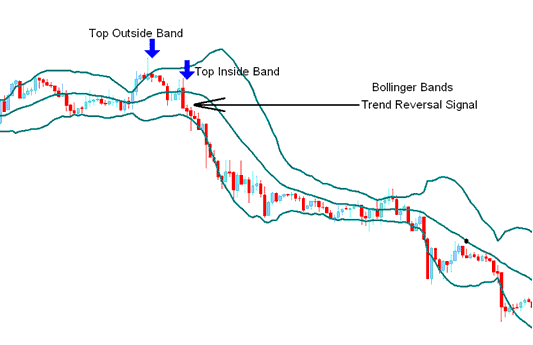

Reversal Signals - Double Top and Double Bottoms Setups

Bottoms and tops made outside the bands followed by bottoms and tops made inside the bands call for reversals in the market trend

The Head Fake - FX Whipsaw

Traders should be on the lookout for false breakouts known as fake outs or head fakes.

Price often breaks out towards one given direction immediately following the Bollinger Squeeze Pattern theefore causing many traders to think the break out will continue in that given market direction, only for the price direction to turn and quickly reverse and make the true and more significant and substantial price break out in the opposite direction.

Traders reacting quickly on the initial breakout commonly get caught up on the wrong side of the price action, while those traders expecting a 'false breakout' can quickly close out their original position and enter a trade transaction in direction of reversal. It is always good to combine Bollinger band with other confirmation Indicators.

More Courses & Courses:

- Factors To Consider When Selecting Your Forex Broker

- How Can I Add Bears Power Indicator in Chart on MT4 Platform/Software?

- What are the Different Types of FX Technical Indicators?

- How to Trade DowJones 30 Guide to DowJones30 Trading Lesson Guide and Trade Dow Jones Tutorial

- Accumulation/Distribution XAU/USD Indicator Technical Analysis Ac Dc XAU/USD Indicator

- Trading Leverage Tips

- Setting Up Kase Peak Oscillator and Kase DevStop 2 Automated EA

- Calculating FX Profits and Losses

- Learn Bollinger Band Index Trading Strategy for Beginner Traders

- FTSEMIB40 Strategy Tutorials