What is Accumulation/Distribution Indicator? - Definition of Accumulation/Distribution Indicator

Accumulation/Distribution - Accumulation/Distribution indicators is a popular technical indicator that can be found on the - Indicators Listing on this website. Accumulation/Distribution is used by the traders to forecast price movement based on the chart price analysis done using this Accumulation/Distribution indicator. Traders can use the Accumulation/Distribution buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Accumulation/Distribution indicator. By using Accumulation/Distribution and other indicators combinations traders can learn how to make decisions about market entry & market exit.

What's Accumulation/Distribution Indicator? Accumulation/Distribution Indicator

How Do You Combine Indicators with Accumulation/Distribution? - Adding Accumulation/Distribution on the MT4

Which Indicator is the Best to Combine with Accumulation/Distribution?

Which is the best Accumulation/Distribution combination for trading?

Most popular indicators combined with Accumulation/Distribution are:

- RSI

- Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic Indicator

- Ichimoku Kinko Hyo Indicator

- Parabolic SAR

Which is the best Accumulation/Distribution combination for trading? - Accumulation/Distribution MT4 indicators

What Indicators to Combine with Accumulation/Distribution?

Get additional indicators in addition to Accumulation/Distribution that will determine the trend of the market price and also others that confirm the market trend. By combining indicators which determine trend and others that confirm the trend & combining these indicators with Accumulation/Distribution a trader will come up with a Accumulation/Distribution based system that they can test using a practice demo account on the MetaTrader 4 platform.

This Accumulation/Distribution based system will also help traders to determine when there is a market reversal based on the technical indicators signals generated & hence trade positions can know when to exit the market if they have open trades.

What is Accumulation/Distribution Based Trading? Indicator based system to interpret and analyze price & provide signals.

What is the Best Accumulation/Distribution Strategy?

How to Select and Choose the Best Accumulation/Distribution Strategy

For traders researching on What is the best Accumulation/Distribution strategy - the following learn tutorials will help traders on the steps required to guide them with coming up with the best strategy for market based on the Accumulation/Distribution system.

How to Create Accumulation/Distribution Systems

- What is Accumulation/Distribution Strategy

- Creating Accumulation/Distribution Strategy Template

- Writing Accumulation/Distribution Strategy Trade Rules

- Generating Accumulation/Distribution Buy and Accumulation/Distribution Sell Signals

- Creating Accumulation/Distribution System Tips

About Accumulation/Distribution Example Explained

Accumulation/Distribution Trading Technical Analysis Signals

Developed and Created by Marc Chaikins

This indicator is used to assess the cumulative flow of money into & out of a Forex currency pair.

Originally used for stock trading, when it comes to stock trading "volume" is the number and amount of shares traded and transacted in a particular stock, this volume is a direct reflection of the money that is coming into and out of a stock.

The basic principle behind AD is that volume(or money flow) is a leading indicator of the market price. (Volume precedes price).

In the market-Forex, there's no central exchange for trades as compared to stock trade transactions where there a central exchange for stocks, e.g. NYSE - the New York Bourse.

Since there is no true measure of volume (actual money) that is flowing into and out of a currency market, brokers have come up with a substitute for actual money volume, this substitute is referred to as "tick volume".

Tick volume is the measure of price changes (ticks) received by a online broker during a given period/interval. The tick volume is incorporated by many online brokers in their charting software platform.

Interpretation

This volume indicator is used to determine if volume is increasing or decreasing as the price of a currency pair is moving up or moving down.

UpTrend

If the price of a forex pair is moving upwards then the Ac Dc should also be moving upwards. This portrays the price move is being supported by volumes and the move upwards has strength and is sustainable.

If on the other hand price is going up & the volumes are not, the strength behind the move is waning: this creates a divergence between price and indicator & warns of a possible move in the opposite trend market direction.

DownFX Trend

If the price of a forex pair is moving downwards then the AD indicator should also be moving downwards. This illustrates that the price move is being supported by volumes and the move downward has power behind it.

If on the other hand price is moving down and the volumes are not, the strength behind the move is waning: this creates a divergence between price and AD and warns of a possible move in the opposite market trend market direction.

Technical Analysis and Generating Signals

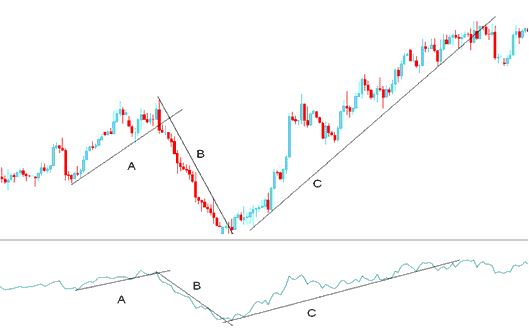

Illustrated Below is example illustration of a chart and the analysis explanation

From the chart above we can separate the trading chart into three parts, part A, B and C.

A - Upwards trendline on chart & also on the Accumulation Distribution

B - Downwards trendline on chart & also on the Accumulation Distribution

C - Upward trend line on chart & also on the Ac Dc

As long as the price and the indicator are heading in the same direction then the price move has enough energy to continue heading in that particular direction as is shown above

FX Trend-Line Break

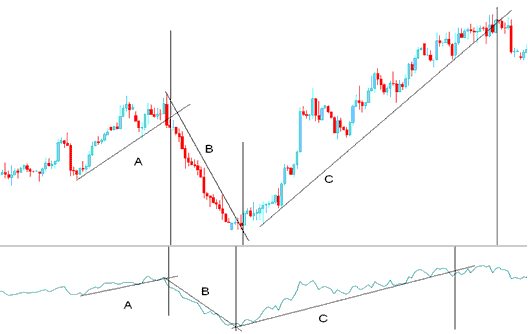

From the above chart we can see that once the trend-line on the AD indicator was broken then the price trendline was also broken.

Looking at the chart below we have added vertical lines to represent the points where the trend-lines were broken, both on the price chart & the technical indicator.

Comparing the trendlines on the indicator and the price those of the AD were broken before those of the chart. This is because volume always precede price.

Signals

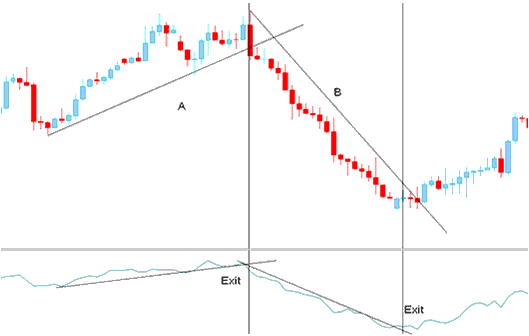

Exit

Exit signals are derived & generated when the trend-line on the Ac Dc is broken. A trend line break on the trading indicator warns of a potential reversal.

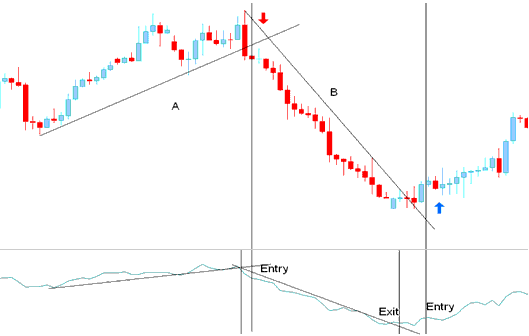

Entry

Once the trend-line on the AD indicator is broken it signals of a possible reversal in market direction of the price.

However if we want to take a trade transaction in the opposite market direction it is always best to wait for a confirmation trading signal.

A confirmation signal is considered complete once both the indicator & the price breaks both their trendlines.

Entry Trading Signal Derived and Generated by Trend Reversal

Get More Topics:

- Learn Technical Analysis for Forex Trading

- Commodities Channel Index Technical Indicator Technical Analysis

- Indicators Used To Interpret Charts

- How Do I Analyze MT4 Charts for Beginner Traders?

- How to Set Momentum in Chart in MetaTrader 4 Platform

- Learn Basics of Forex Strategies in Trading

- McGinley Dynamic Buy Sell Signal

- Learn How to Trade FTSE100 Index Course

- What is Gold Margin Level Definition in MT4 Platform/Software?