Technical Analysis and Price Charts for Silver - XAGUSD Spot Metal

Silver acts as a safe haven like gold. It stores value during economic downturns. Silver ranks as a precious metal with gold. It's second in value after gold. Its price is lower, but demand matches gold's.

NB: 1 point movement for Spot Silver is equal to $100 dollars per lot, unlike 1 pip for currencies which is equal to $10 dollars per lot. Hence, when the price for this spot metal moves 1 pip, a trader makes $100 dollars, but the leverage and margin required for this 1 lot of this commodity is equivalent to that of 1 lot of currencies.

Ancient times silver and gold coins used to be the currency for buying items; now in forex market these metals are becoming more popular in the online market, where it is transacted as a commodity, as options or futures.

Silver as a treasured steel has additionally won a lot of popularity among currency investors and speculators as an opportunity investment instrument for hedging forex trades. Gold costs have also been trending due to sufficient liquidity shopping for and selling this treasured steel. The trending of expenses of this commodity whether up or down has attracted forex speculators who now have introduced this spot steel to their portfolio. maximum agents now offer it as an tool within their platform.

USA traders can't transact silver and gold as a leveraged products, this is according to some law that restricts trading spot metals using leverage: however, they can only use 1:1 leverage, which means no leverage. (USA brokers do not provide this as a leveraged product)

Technical Analysis in FX Trading

Silver Analysis in Recession Time

This specific precious metal is often chosen as the secondary safe-haven asset for value preservation, following Gold.

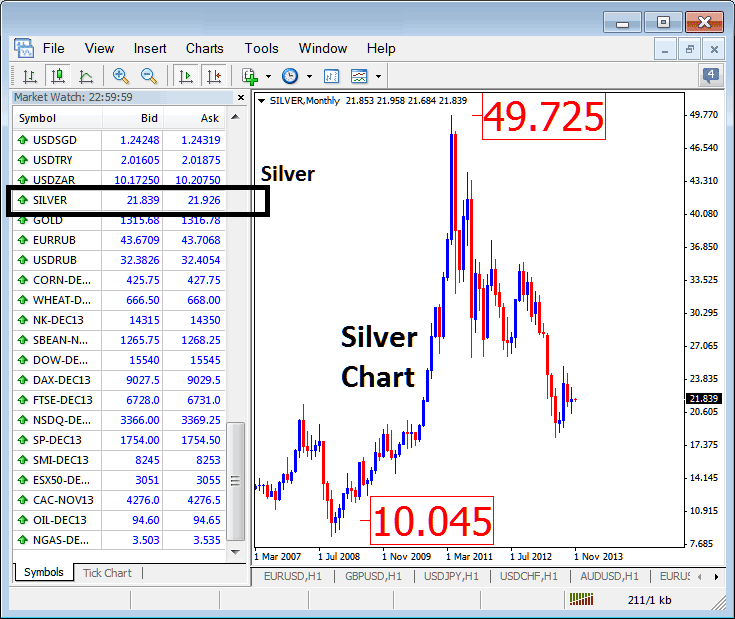

For example in the chart below, the prices of this commodity started Moving up after the economic recession of 2008 started. The prices at the time were averaging $9 dollars per Ounce of Silver. Then the traders started to buy and accumulate value in terms of Silver contracts driving the price for the next few months a total of 39 dollars, the value of this commodity moved from the value of $10 dollars per Ounce up to $49.7 dollars per ounce

XAGUSD Technical Analysis

The Price of this spot metal moved up in Recession gaining 39 dollars as investors fled from the stock market, sold shares, sold currency contracts to invest their money into this precious metal which is a Safe Haven commodity after Gold used to store Value.

Silver Analysis in Economic Boom Time

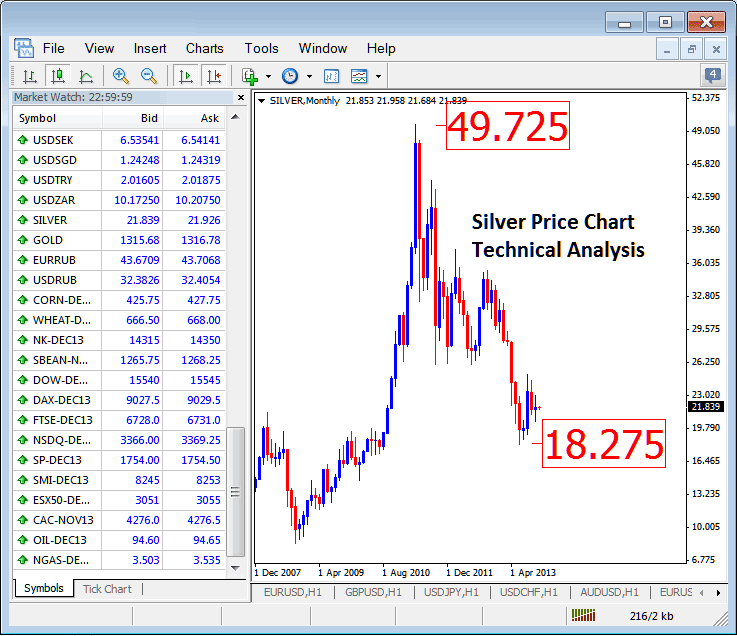

After the Economies of the world started to show signs of economic recovery and a bit of Growth, investors immediately started to close their silver trades so as to start investing this money in higher yielding instruments such as currencies, stocks and Shares. This Why the Shares in Major Stock Markets Started to gain value as people felt with the economic recovery they should close the Silver Contracts, Silver is a lower profit yielding Instrument compared to currencies, shares and stocks which have a higher profit yield and give the best value in times of economic growth and there is also less risk of holding these currencies, shares and stocks when the economies are growing; this is because economic growth always supports these securities gaining value as there is more business opportunities and business growth for companies that own these shares.

In the chart presented below, following initial indications of economic expansion, the price of this commodity experienced a drop from a high point of $49 down to $18, continuing its descent as economic growth persisted.

XAGUSD Monthly Chart

XAGUSD - As a Spot Metal Commodity

Silver's become a magnet for speculators, and now most brokers offer it as one of the financial instruments on their platforms.

In the online market, traders handle this commodity as a Spot Metal. Prices show up in US Dollars. Like currency pairs, it trades as a pair named XAG/USD or XAGUSD. This means the price per ounce of silver in US Dollars.

Consequently, within your Forex interface, for instance in the "MT4 Market Watch," the metallic instrument will bear the designation XAGUSD. Some brokerage firms might simply label it using its common name.

Contracts

Silver contracts are the favored method for trading this commodity metal. If you possess the same quantity of this precious metal at home, it may be challenging to locate a buyer, and if you do find one, they might offer a lower price, making it quite difficult to liquidate your Silver. In contrast, contracts traded in the online spot market always have buyers and sellers willing to transact at the current price at any moment. This liquidity enhances the popularity of spot trading for this metal.

More Courses & Courses:

- How to Add Nasdaq on MetaTrader 5 Mobile

- How to Use the SMI for Buy and Sell Signals

- How Can I Add EUROSTOXX 50 Index on MT5 Software?

- Online Gold Trading Options

- Three Variants of Stochastic Oscillators

- Strategy for Trading SPAIN35 Indices

- How to Open a Trade Chart that Works Offline in the MT4 Platform

- Chaikins Money Flow MetaTrader 4 Technical Indicator on Charts