RSI Patterns and Trend-Lines

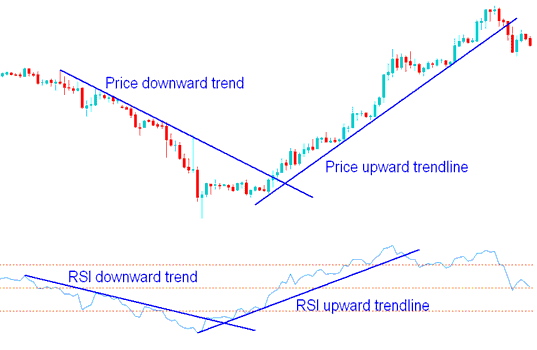

Forex traders draw trend lines on RSI much like they do on price charts. These RSI lines connect back-to-back peaks or dips on the indicator, just as with standard forex chart lines.

RSI Trend-Lines and Trend lines in Forex Charts

RSI Chart Setups in Forex Trading

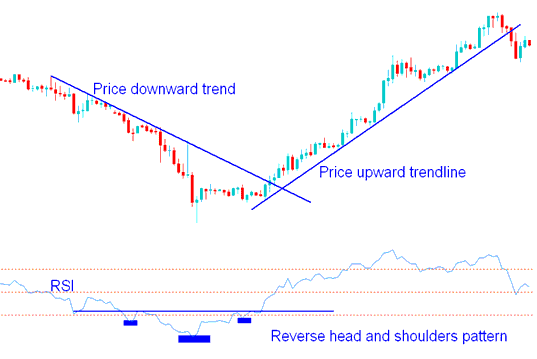

RSI chart patterns like head-and-shoulders or triangle formations, which may not always be visible on Forex price charts, often appear within the RSI indicator itself.

RSI also often makes patterns like head and shoulders or triangle shapes that you might or might not see on the forex price chart. As you can see on the forex chart below, the Inverse Head and Shoulders turnaround pattern is very clear on this RSI tool.

FX Chart Setups on RSI Chart Indicator

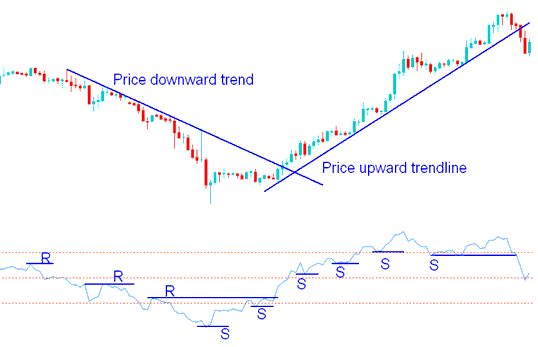

Support & Resistance Levels Trading using RSI Indicator

Sometimes, the important levels on a chart are clearer on the RSI than they are on the regular price chart for forex trading.

In an up forex trend, support levels hold firm. A break means price drops through them. The uptrend then flips down.

In a declining forex trend, staying vigilant about resistance levels is vital. A breach of these levels can indicate an impending reversal of the downward trend.

Support and Resistance Zones Shown on the RSI Indicator

In the forex example above when the third resistance level was broken the downward forex trend reversed to an upward forex trend & when the sixth support was broken the upward forex market trend reversed and broke the upward trend-line.

More Topics:

- Bears Power Analysis in Forex

- What FX Currency Pairs Move the Most?

- How to utilize the Acceleration/Deceleration technical indicator in trading.

- How to Write Index Trade Journal

- How to Add Ehlers Fisher Transform Technical Indicator in Chart

- SWI 20 Trade Strategy Example

- Forex SMI 20 in MT4 Index SMI 20 Symbol on MetaTrader 4 Software Platform

- Where Can I Find a Learn Online XAU USD Guide Website?

- How to Set and Place a Forex Stop Loss Order in MetaTrader 5 Android App

- How Can I Use MetaTrader 4 DeMarks Range Extension Indices Technical Indicator?