Guide on Implementing the MACD Indicator onto MetaTrader 4 Charts - Adding the MT4 MACD Tool

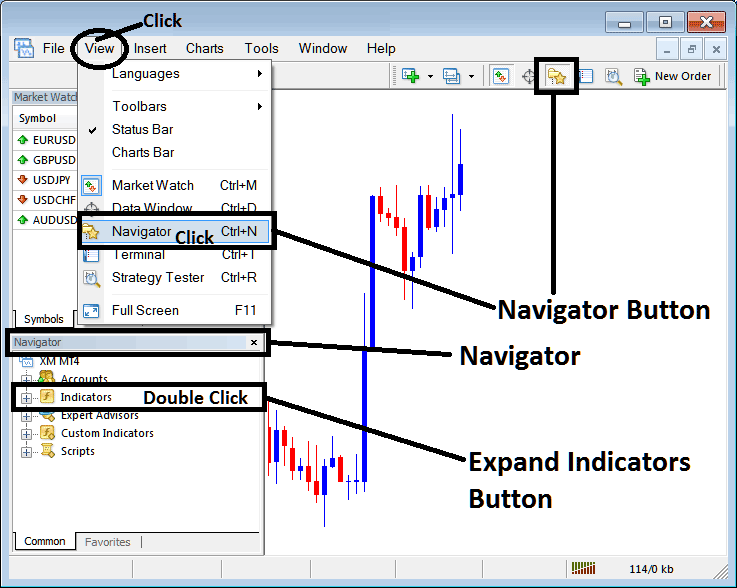

Step 1: Access the Navigator panel in the trading software platform

Open Navigator window like is shown: Go to the 'View' menu (press on it), then select 'Navigator' window (click), or From Standard ToolBar click 'Navigator' button or press key board short cut keys 'Ctrl+N'

On Navigator window, select 'Indicators', (DoubleClick)

How Do You Add MACD on MT4 - MT4 MACD Indicator

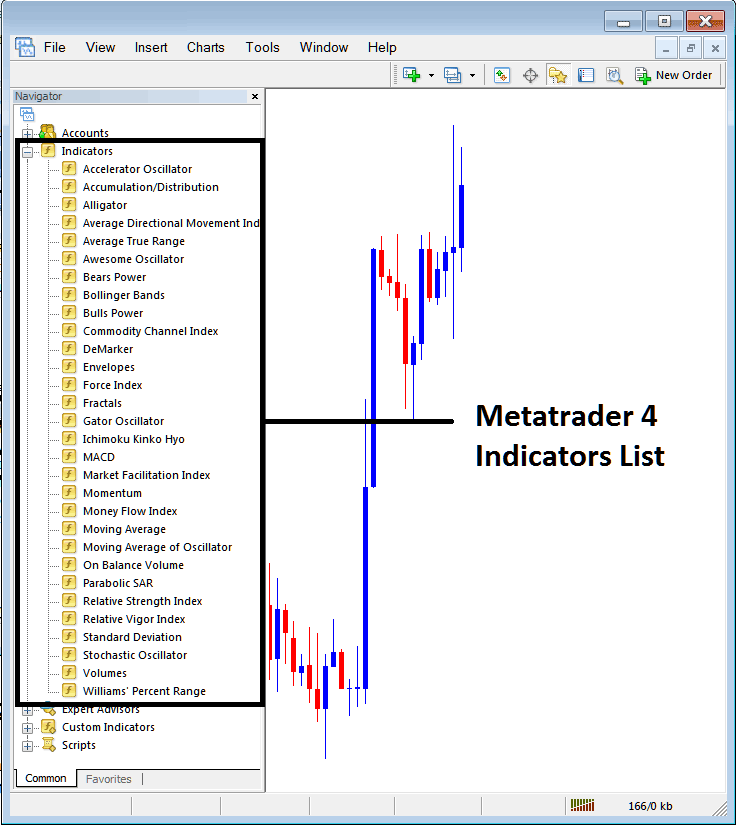

Step 2: Open Indicators in Navigator to Add MACD on MT4

Expand this menu by clicking the expound tool mark off "+" or double-click the 'indicators' menu, after which this particular specified button will appear and be shown as (-) & will now display a list just as shown below - select the MACD technical indicator from this list of trading technical indicators so as to add the MACD to the chart.

To add MACD, open the relevant window and place the indicator you wish to use on the chart.

How to Set Custom MACD to MT4

If the indicator you want to add is a custom indicator - for example if the MACD you want to add is a custom indicator you will need to first add this custom MACD on the MetaTrader 4 software and then compile the custom MACD so that as the newly added MACD custom technical indicator pops up on the list of custom technical indicators on MT4 software.

Learn to install MACD indicators on MetaTrader 4. This covers adding the MACD panel and custom indicators to MT4. See how to add a custom MACD in the software.

About MACD Tutorial Explained

MACD Analysis Signals

Developed & Created by Gerald Appel,

The Moving Average Convergence/Divergence, abbreviated as MACD, is recognized as one of the most straightforward, dependable, and frequently employed indicators in trading.

It's a momentum oscillator and also a trend following technical indicator.

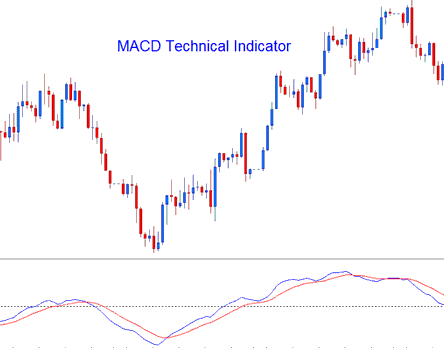

Construction

The methodology for constructing this technical indicator involves calculating the disparity between two Moving Averages (MAs) and plotting this result as the 'Fast' line: subsequently, a second line, the 'Signal' line, is derived from the 'Fast' line calculation and charted within the same display area as the 'Fast' line.

- 'Fast' line - Blue Line

- 'Signal' line - Red Line

The usual MACD values for the 'Fast' line use a 12-period exponential Moving Average, a 26-period exponential Moving Average, and a 9-period exponential moving average applied to the fast line, making the 'Signal' line.

- Fast-line = difference between 12 and 26 exponential moving averages

- Signal Line = MA of this difference of 9-periods

FX Analysis and How to Generate Trading Signals

The Moving Average Convergence Divergence (MACD) is frequently employed as a technical indicator that follows market trends, proving most useful when interpreting movements within a trending market. Three common methodologies for generating signals using the MACD are:

FX Crossovers Signals:

Fast line/Signal line Cross-over:

- A buy signal is generated/derived when the Fast Line crosses above SignalLine

- A sell trade signal is derived/generated when the FastLine crosses below Signal-line.

In strongly trending markets, certain signals may produce frequent false entries. Using the Zero Line Crossover Signal instead minimizes the risk of such errors.

Zero Line Cross-over Signals:

- When the Fast Line crosses above zero center-line a buy trade signal is generated.

- when the FastLine crosses below zero center line a sell trade signal is generated.

Divergence Trading:

Searching for divergences between the MACD and price action can be highly effective for pinpointing potential points where the trend might reverse or continue. There exist two different kinds of divergences:

- Classic Divergence Trading Setup Signals

- Hidden Divergence Setup Signals

Overbought/Over-sold Conditions:

MACD helps spot overbought or oversold spots in price moves.

These levels and regions are derived & generated if the shorter MACD Lines separate significantly from the median, this is an indication that price action is over-extending and it'll soon return to the more realistic levels.

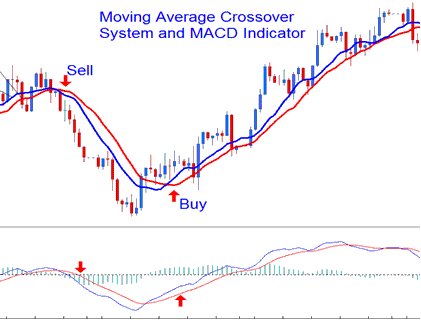

MACD and MA Cross over System

This trading indicator can be paired with other tools to develop a comprehensive strategy. It works especially well alongside the Moving Average (MA) crossover system. A trade signal is generated when both indicators align in the same direction.

Analysis in FX Trading

Get More Courses & Lessons:

- How to Interpret/Analyze FX Base Currency Exchange Rate Quotes

- Interpret Fibonacci Retracement Indicator on MetaTrader 4 Charts

- How is S and P ASX200 Index Traded on the MetaTrader 4 and MetaTrader 5 Trade?

- How to Add FTSE MIB40 on the MT4 Android App

- JP 225 – How It Appears on MetaTrader 4

- An Introduction to Trading Methods for Beginner Traders

- Overview of IBEX 35 Stock Indices in Trading

- Choppiness Index: Buy and Sell Forex Signals Explained

- Understanding the Concepts of Used Margin and Free Margin within the MetaTrader 4 Interface.

- GBPNZD Bid-Ask Spread