Choppiness Index Signals - Buy and Sell Trading Alerts

Choppiness Index Buy Signal

Generating Forex Buy Trading Signals Using the Choppiness Index Indicator

Creating Forex Buy Signals with the Choppiness Index Tool:

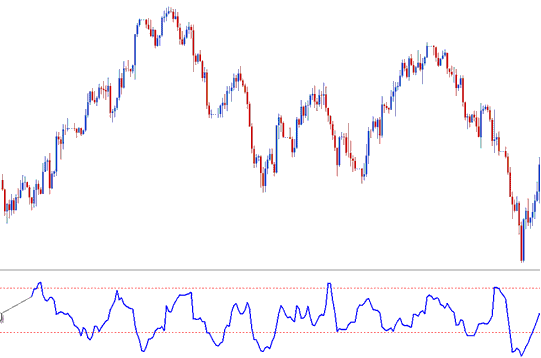

This Choppiness Index buy signal tutorial describes and explains how to generate forex buy signals using the Choppiness Index just as is shown:

How to Generate Forex Buy Trading Signals Using Choppiness Index Indicator

Choppiness Index Sell Trade Signal

How to Produce a Forex Sell Signal Using the Choppiness Index Indicator

Steps for generating forex sell trade signals utilizing the Choppiness Index indicator:

This Choppiness Index sell trading signal guide describes how to generate forex sell signals using the Choppiness Index just as is shown:

Procedures for Generating Forex Sell Trade Signals Employing the Choppiness Index Indicator

Choppiness Index was designed and built to be an easy but practical indicator to help the online traders to determine if the currency prices are trending or consolidating.

This indicator matches ADX. It measures trend strength. It spots if the market trends or sides.

The Choppiness Index indicator uses a scale of between 0 & 100. It also typically uses upper & lower bands at 61.8 & 38.2 respectively.

The plotted value of this indicator is derived by first determining the true range for each period and subsequently summing the values over 'n' periods.

Secondly, it computes the highest and lowest values over n periods and calculates their difference.

Firstly, it computes the total of the true ranges and then determines the base-10 logarithm of this figure.

Finally, it divides this value by base-10 logarithm of n price periods & multiplies the results by 100.

Technical Analysis and How to Generate Signals

Choppiness Index is a directionless indicator meaning it doesn't determine in which direction the market is heading.

Its basic principle is that the more heavier the market is trending over the last number of n-periods the closer to zero Choppiness Index will be and the more heavily the market is consolidating that is heading sideways in a range or chopping manner, over the last n periods the closer to 100 the Choppiness Index will be.

Readings above 61.8% show the market is in a range or choppy phase. Prices move side to side and consolidate.

Higher values typically occur during or after periods of consolidation. They may also signal potential breakout opportunities following significant consolidation phases.

Choppiness Index values of below 38.2 indicate that the market is trending.

Low values follow strong trends. They hint at coming flat periods after big moves.

Explore Further Programs and Subject Areas:

- Which Broker Do I Use to Trade Nikkei 225?

- Technical Analysis Using the Chande Momentum Oscillator for Gold Trading

- What are the AEX25 Spreads? A Look at AEX25 Stock Indices Bid/Ask Spread

- Index Bollinger Band Trading Strategy

- Forex USDNOK Pip Calculator

- What Are Typical Chandes Trendscore FX Buy/Sell Signals?

- How to Find and Get Best MT5 Technical Indicator Lesson Tutorial

- Entry Stop Forex Orders: Buy Stop Forex Order and Sell Stop Order

- Index Trade Strategies for Trading AUS200 Indices