Hang Seng 50 Index

The Hang Seng 50 Index monitors the market capitalization of the leading 50 companies listed on the Hong Kong Stock Exchange, selecting firms from the most profitable sectors within Hong Kong's economy.

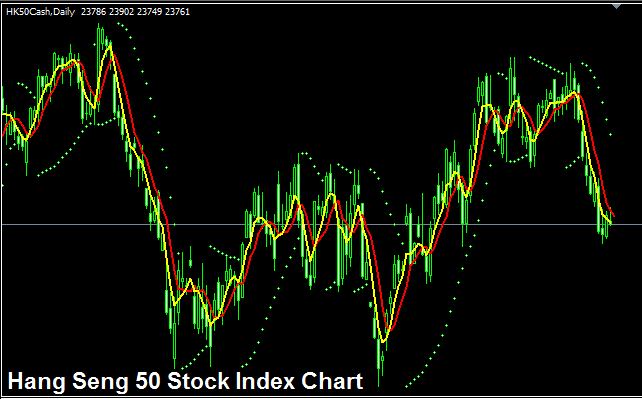

The HANGSENG50 Index Chart

The HANGSENG 50 Index chart is displayed above. On the exemplification put on display above this Index is referred to as as HK50CASH. As a forex trader you want to search and find a broker that offers this The HANGSENG50 Index chart so that you can begin to trade it. The example above is of HANGSENG 50 Index on the MT4 FX & Stock Index Platform .

Other Data about HANGSENG50 Index

Official Symbol - HSI:IND

The Hang Seng 50 Index includes 50 stocks from Hong Kong's top firms. These stocks drive most trading volume on the Hong Kong Stock Exchange. The index covers 60% of the market value for all stocks there.

Strategy for Trading HANG SENG 50 Index

The HANGSENG50 Index follows the market value of Hong Kong's top 50 firms. It tends to rise over time but swings more wildly in trends. Compared to steadier indices like EURO STOXX or DAX 30, this one shows bigger ups and downs in its moves.

Overall, this index tends to rise over time, so you should lean towards buying as it goes up.

A good plan might be to buy when prices drop - but if you are a forex trader who wants to trade this index, get ready for prices to swing up and down much more when you trade it.

Contracts and Specifications

Margin Required Per 1 Lot/Contract - HKD 450

Value for a single Pip (Point) - 1 HKD

Note: The broad trend rises overall. But as a forex trader, account for daily price changes. Some days, stocks might wobble or dip back. Dips can be deep now and then. So time trade starts well with the indices trading plan. Also apply sound money rules if market shifts surprise you. On money rules lessons: What are equity management and money methods.

More Courses:

- Use Broker VPS to Host Your Forex EA Robots Safely

- FX Trading Ultimate Oscillator EA(Expert Advisor) Setup

- How to Set IT40 in MT5 IT40 Trade App

- MetaTrader 4 Online XAU USD MetaTrader 4 Brokers

- Forex Divergence Trading Setups of M-Shapes Price Highs and W-Shapes Price Lows

- Examples of How to Set Up Forex Currency Trades

- Stochastic Indicator Bullish and Bearish XAUUSD Divergence Trading Setup

- Moving Average Envelope XAUUSD Indicator Technical Analysis

- Rainbow Trading Charts FX Technical Indicators

- Dow Jones 30 MetaTrader 4 Dow Jones Name in MT4 Platform