Bollinger Bands Strategies

- Functioning of Bollinger Bands

- Bollinger Bands: Tools for Market Volatility Analysis

- Understanding Bollinger Band Expansion and Contraction

- How do Bollinger Bands show price action in trends?

- Bollinger Bands: Price Action in Ranging Markets

- Bollinger Bands and Trend Reversal Indicators

- Summary of Bollinger Band Strategy

Bollinger Bands Indicator Strategy

Bollinger Bands Explained: This price overlay indicator serves as a measure of market volatility for enhanced trading insights.

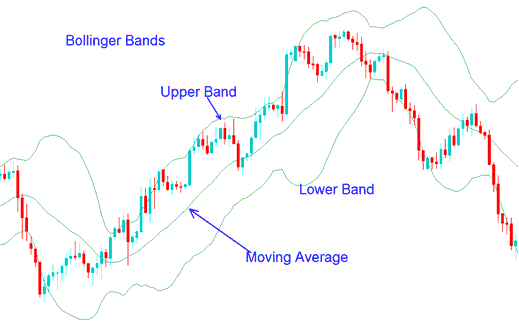

Bollinger Bands have three lines: a middle moving average band, plus upper and lower bands. Price stays inside these bands during action.

Bollinger Bands create upper and lower lines around a moving average. The default is a 20-period simple moving average. They use standard deviation to build those upper and lower bands.

The example of Bollinger Band is shown below.

Bollinger Band - How to Trade with Bollinger Bands Strategy

Standard deviation measures how much prices swing, and since market volatility never sits still, Bollinger Bands keep adjusting their width. When prices get jumpy, standard deviation goes up and the bands stretch wider. If things calm down, the bands pull in tighter.

Bollinger Bands provide extensive data on price action movement. The information offered by this indicator is essential for understanding and analyzing price behavior.

- Periods of low volatility - consolidation phase of the market.

- Periods of high volatility - extended trends, trending markets.

- Support & resistance zones of the market price.

- Buy & Sell points of the price.

Get More Courses:

- GER 30 Indicator and How to Use it on MT4

- Using the Bulls Power Indicator in MT4

- What is a Stop Loss for XAU USD?

- 3 XAUUSD Bollinger Band: What the Upper, Lower, and Middle Bands Mean

- Average True Range ATR Strategies Buy and Sell Technical Indicators Checklist

- Gold Margin Risks

- How to find the SWI 20 index in MetaTrader 5.

- IBEX 35 Lot Size, Position Size, and Risk Calculator

- Best Trading Hours to Consider

- The Plan Training Lesson Instructions for Top Plan for Beginner Traders