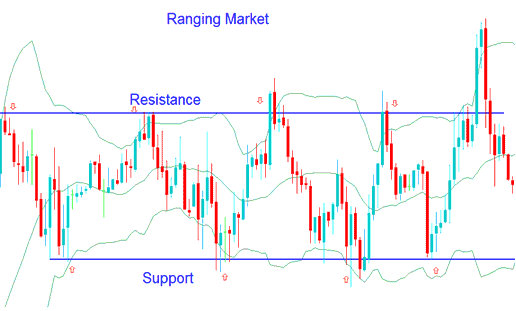

Bollinger Band Price Action in Ranging Forex Markets

Bollinger Band is also used to identify periods when a market trend is overextended. The guidelines below are considered when applying this technical indicator to a sideways trend.

Bollinger Bands play a critical role in forex predictions by signaling possible price breakouts ahead in the market trends.

During a trending market these techniques do not hold, this only holds as long as Bollinger Bands are pointing sideways.

- If the forex market price touches/tests upper band it can be considered overextended on the upside - overbought.

- If the forex market price tests/touches lower band the currency can be considered overextended on the bottom side - over-sold.

One way to use the Forex Bollinger Band is to follow the rules above for when forex is overbought and oversold to find good times to buy and sell in a stable market.

- If forex price has bounced off the lower band crossed the center-line moving average then the upper band can be used a sell level.

- If forex price bounces downwards off the upper band crosses below center moving average the lower band can be used as a buy level.

Bollinger Band in Ranging Forex Markets - Bollinger Band Strategy

In the above ranging forex market the instances when the price hits the upper or lower bands can be used as profit targets for long/short trades.

You can enter trades when the forex market reaches the upper resistance or lower support level. Place a stop loss a few pips above or below, based on your trade direction. This protects against breakouts from the Bollinger Bands range.

Get More Lessons: