MACD Whipsaw Scenarios in XAUUSD Trading: Identifying Fake-Out Patterns

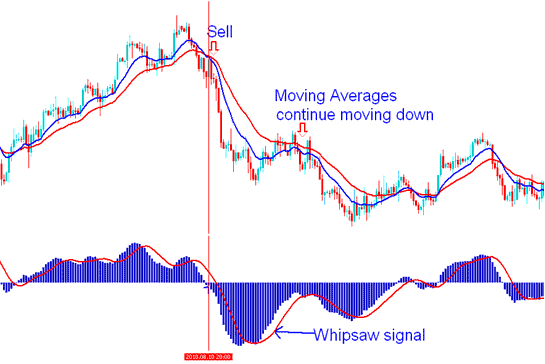

Given that the MACD serves as a leading trading indicator that can occasionally produce false signals, we will examine an instance of a whipsaw fakeout created by this MACD indicator. This will illustrate the importance of remaining patient and awaiting a confirmation signal.

MACD Indicator Whipsaw - XAUUSD Whipsaws

The MACD showed a buy signal below the zero line. It was not confirmed yet. This led to a false move, as moving averages kept falling.

A whipsaw signal in xauusd occurs due to sudden fluctuations in price over a brief period, resulting in distorted data that affects the calculations for the moving averages used to generate the MACD data. Such misleading signals are often triggered by news events or announcements that create market volatility.

Traders should have the ability to gauge a whipsaw and withstand the whipsaw: a whipsaw might result in to an upswing session and then a downswing session. To minimize the risk of whipsaw fakeouts, it is good to wait for confirmation of signals by waiting for MACD to cross above/below the zero centerline mark.

Combining MACD Crossovers with Center-Line Crossovers to Minimize Whipsaw Risks

Buy signal - The buy signal gets verified when there's a crossover, followed by a big price increase, and then a cross over the centerline.

A sell trade alert is confirmed when a crossover event takes place, followed immediately by a sharp price drop, and subsequently a cross of the centerline.

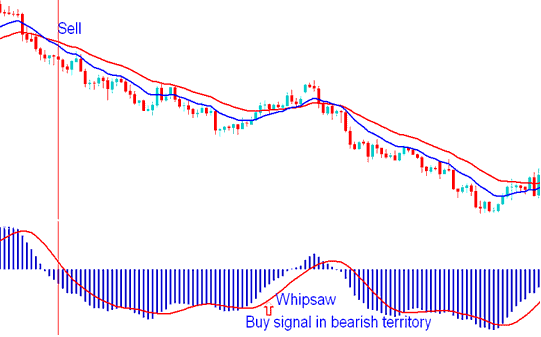

1. Buy Trading Signal in Bearish Territory Whipsaw

If a buy signal shows up in a bearish market, it could lead to a xauusd false signal, particularly if the MACD doesn't soon go above the centerline.

In the chart below, MACD signals a buy in bearish zone. But it soon drops, causing a false signal on gold. Waiting for a centerline cross helps dodge such tricks.

In this case, there was a quick center-line crossover - a whipsaw move that's tough to handle if you're only watching the MACD. That's why it helps to pair MACD with another indicator. In the example below, you can see how combining MACD with moving average analysis gives you a clearer signal.

MACD XAUUSD Whipsaw - Buy Trading Signal in Bearish Territory

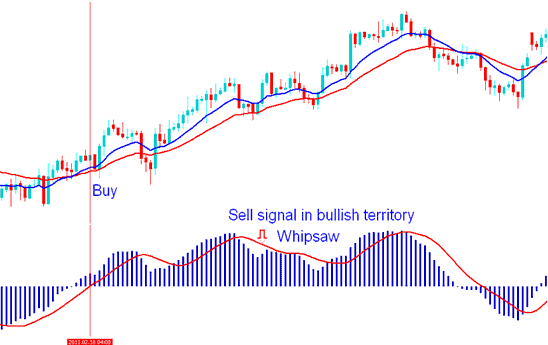

2. Sell Signal in Bullish Territory Whipsaw

When a sell signal happens in a rising market, there could be a false move in xauusd, especially if the MACD doesn't soon cross the middle line.

In the chart below, MACD signals a sell in bull area. But it flips up soon, causing a false move. Wait for a centerline cross to skip that trap. Pair MACD with MA crossovers below. You dodge the fake signal that way.

MACD XAUUSD Whipsaw - Sell Signal in Bullish Territory

To skip false signals with the MACD, rely on centerline crossovers. These act as the main buy or sell triggers.

Learn More Lessons and Topics:

- Putting Line Studies Tools on the MT4 Gold Software

- Understanding and Analyzing Base Currency versus Variable Currency Components in Forex Pairs

- Bollinger Bands with Fibonacci Ratio Indicator

- Seeing FX Buy and Sell Signals

- Instructions on How to Add the USDPLN Chart to the MetaTrader 4 Software

- How to Calculate Forex Position Size with Leverage

- Drawing Trendlines Correctly on FX Charts