DeMarks XAU/USD Technical Analysis & Range Expansion Index XAUUSD Signals

Developed by Tom DeMark.

DeMark utilized the Range Expansion Index within his trading methodology for options: this specific xauusd indicator functions as an oscillator.

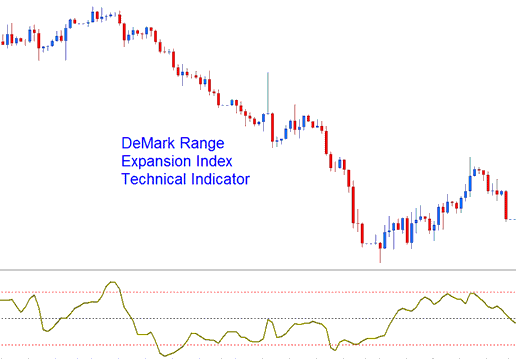

DeMarks Range Expansion Index Technical Analysis

This trading oscillator works as a technical tool for timing the market. It seeks to fix issues in oscillators that claim exponential calculations but use arithmetic ones. These tools often fall behind actual market moves.

Technical Analysis and How to Generate Trading Signals

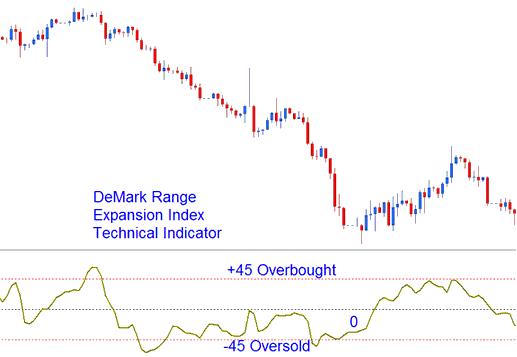

This Oscillator Indicator typically oscillates between values of -100 to +100.

Overbought Levels - Readings of +45 or higher signify overbought conditions.

Over-sold Zones - Readings of -45 or lower indicates over-sold conditions.

Overbought & Oversold Levels in Indicator

Exit Signals - DeMark suggests not trading in very over-bought areas shown by 6 or more bars over +45, leaving for buy signals occurs 6 bars after the price touches/tests +45.

Exit Signals - An exit signal for short trade positions will be generated when extreme oversold conditions are indicated by six or more bars below the -45 threshold.

Get More Courses and Tutorials:

- How Do You Use MACD in FX?

- Top 100 Index Brokers List

- Understanding Automated Trading Systems: Expert Advisors (EAs)

- True Strength Index (TSI) Analysis

- MT4 Terminal Trade FX Software Lesson Tutorial

- Methods to analyze and interpret forex price action scenarios.

- DeMarks Range Expansion Indices MT4 Indicator Analysis

- Defining the Core Components of a Successful XAU/USD Trading Plan: Your XAUUSD Program

- Hidden Divergence Explained Training Guide

- How Do You Analyze/Interpret Forex Price Action in Trading?