Trend Indicators

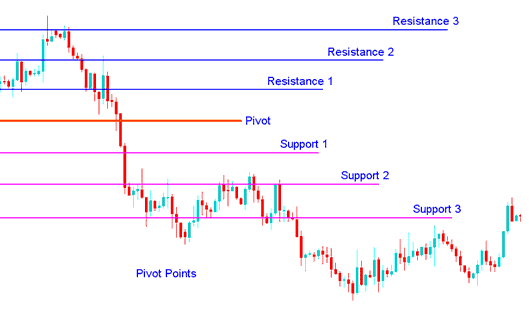

Traders use pivot points to spot support and resistance from the prior day's prices.

This indicator helps a lot. It uses past bars' highs, lows, and closes to predict future support and resistance levels.

This tool helps spot key support and resistance levels. Add pivot points to your charts. Prices often bounce off these spots. Traders use them to find tops, bottoms, or trend shifts.

- Daily pivots points are calculated from the previous day's high, low, close

This indicator is illustrated and shown below

Technical Analysis in XAUUSD Trading

Central pivot points serve as fundamental indicators for gauging prevailing market trends within trading environments.

The additional support and resistance zones are also essential for calculating areas that can lead to considerable market movements.

This technical indicator can be used in two ways

First, it tells the overall trend: if the pivot point goes up, then the market is rising, and the opposite is true. But, pivot levels are short-term signals, only useful for one day before needing to be figured out again.

The second method involves utilizing these points to enter and exit the markets. This technical indicator serves as a valuable resource for determining levels that may trigger price changes.

You should use these key points with other ways of looking at the market, like Moving averages, MACD, and stochastic oscillator tool.

Use this indicator in many ways. Common methods include these listed here.

XAU/USD Trend Direction: Pair the center pivot with overbought or oversold oscillators and volatility tools. It aids in spotting the main price trend. Enter trades only along the trend line. A buy signal fires when price sits above center pivots. A sell signal hits when price drops below them.

XAUUSD Price Breakouts: A sign to buy happens when the market goes up past the middle pivot points or one of the resistances (usually Resistance Area 1). A sign to sell happens when the market breaks down past the center points or one of the supports (usually Support Area 1).

XAU/USD Trend Reversals:

- A buy signal occurs when price moves toward a support level, gets very close to it, touches it, or only moves slightly through it, & then reverses and heads back in the opposite market trend market direction.

- A sell signal occurs when price moves toward a resistance level, gets very close to it, touches it, or only moves slightly through it, and then reverses and moves back in the opposite direction.

Stop-Loss and/or Limit Profit Values Determined by Support/Resistance: This indicator may prove useful in identifying appropriate stop-loss and/or limit profit placements. For example, when trading a long breakout above Resistance 1, it may be prudent to position a stop-loss order accordingly.

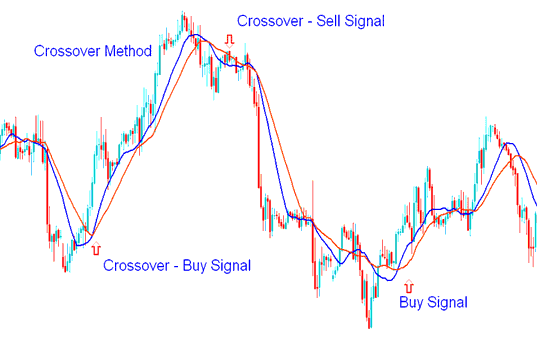

Combining Together with Moving Average Crossover System

A moving average crossover is useful for trading reversal signals, confirming a reversal's direction, making it a good combination indicator.

An investor can place an order when both indicators signal the same way.

Moving Average Crossover Method

You can pair the MA crossover method with this indicator. It helps build a system for buy and sell signals.

To download Pivot points Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

Once you download it. Open it with the MQ4 Language MetaEditor, Then Compile the indicator by pressing Compile Button & it'll be added to your MT4.

Notice: After incorporating this technical indicator into MT4, it introduces extraneous lines labeled Mid Points. To eliminate these extra lines, access the MQL4 MetaEditor (shortcut key: F4), and modify line 16 from the following setting:

Extern bool midpivots = true:

To

Extern bool midpivots = false:

Subsequently, press Compile again, and it will then appear exactly as displayed on this website.

Study More Topics and Tutorials:

- Introduction to Trading Softwares

- How to Use FX Signals From Systems Described with Examples

- Ehler RVI Indicator for XAU/USD Analysis

- FX Base Currency vs. FX Quote Currency

- How to Place US 500 on MT5 Mobile Phone App

- JP 225 MetaTrader 4 JP 225 Name on MT4 Software Platform

- Ichimoku Kinko Hyo MT4 Indicator in Charts

- Bollinger Bands Price Action in Upwards Forex Trend and Downward Trend

- EUR/SGD Pip Size Overview

- Adding IT40 to the MetaTrader 5 App: A Quick Guide