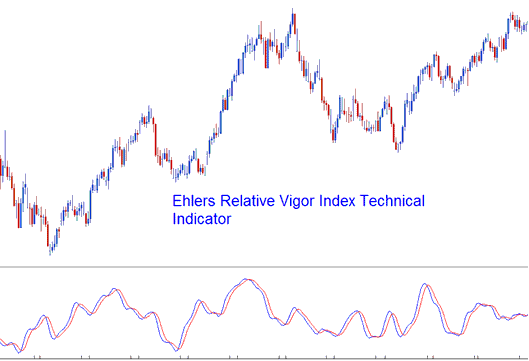

RVI Technical Analysis & RVI Signals

Developed and Created by John Ehler

The RVI mixes older ways of studying with modern digital theories and filters to make a useful and helpful indicator.

The fundamental concept behind it is straightforward -

- Prices tend to close higher than where they open in up trending markets and

- Prices close lower than where they open in down trending markets.

The intensity (vigor) of a price move is then determined by where participants close the current candlestick. The RVI computes and charts two distinct lines: the RVI Line and its associated signal Line.

The RVI index is really about measuring the average difference between the price at the end of the day and the price at the beginning, and then this number is averaged over the average daily range and shown.

This makes the index a quick-to-react tool that has fast turning points that match the ups and downs of market prices.

Technical Analysis and Generating Signals

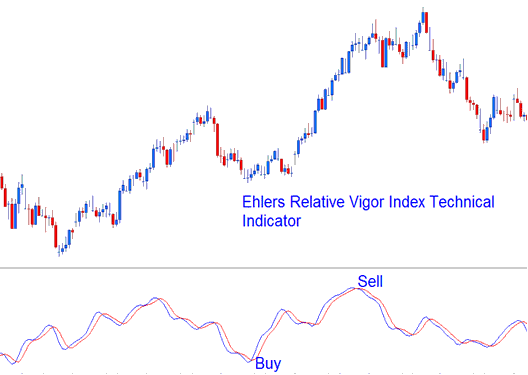

RVI acts as an oscillator. Read it by watching crossovers with the signal line. Signals form at those line crosses.

Bullish sign: Buy when RVI crosses over the signal line.

Bearish signals - a promote sign takes place whilst the RVI crosses below the sign-Line.

Buy & sell signals derived and generated using the cross over method

Check Out Extra Subjects and Lessons: