TIPS: MAXIMIZING PROFITS OF Bitcoin SYSTEMS

1. Define Simple Bitcoin Rules and Follow the Trend

Keep trading systems simple for better results. Complex systems make it hard to follow rules. Simple bitcoin strategies are easy to stick with and understand.

2. Eliminate Risk Quickly and Let Profits Run

Cut trading risks before chasing gains. In bitcoin crypto deals, our top goal is safe trades. Enter only solid setups. Use stop losses. End losses fast. Skip adding to losers. Let winners ride a bit, but not forever, to grow profits. Keep good spots open while the plan shows the trend holds. Close them right away when exit signals hit from the system.

3. Select/Choose the Right Crypto Instruments

Once you've built your bitcoin trading system, start testing it on a demo account. Systems behave differently for each bitcoin crypto, so testing matters.

To get the most profit from your plan, learn when the bitcoin market is busiest and only trade at those specific times.

4. Use Bitcoin Trade Funds Management Principles

Always risk less than 2% for each bitcoin trade. With growth, you'll be amazed at how fast your bitcoin account grows when you trade with a winning plan.

5. Keep a Bitcoin Journal

Keeping a log of all your trade positions will help you as a trader to become a better & better & will help you as a trader follow the rules of your system. A btcusd trading journal will also monitor your profitable trade positions & losses and you can analyze & interpret why a trade setup was profitable and why it was not.

6. Add take Profit Targets

When trading btcusd, set goals for how much profit you want to make each day, week, and month. After you, as someone who trades, reach that goal, stop trading and take a break. This will help you avoid trading too much and prevent you from losing your profits back to the btcusd market. Make sure your potential gains are much bigger than your potential losses, like aiming for a 3:1 ratio. This means only starting bitcoin trades when you have a good chance of earning three times what you're risking.

A Detailed Clarification of the Trading Triggers Produced by Our Bitcoin Trading System

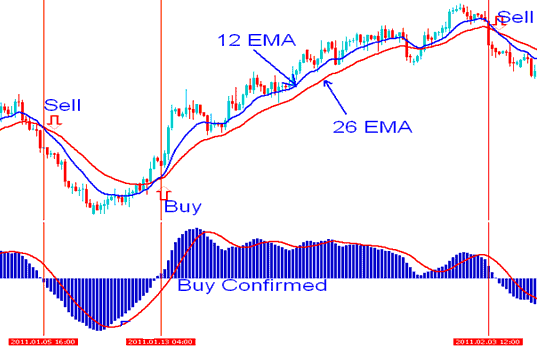

Sample Buy and Sell Signals from Bitcoin Trading System

A buy signal is derived and generated by the technical indicator-based trading system, followed by the generation of an exit signal before a subsequent, opposing sell cryptocurrency signal emerges on this specific bitcoin chart.

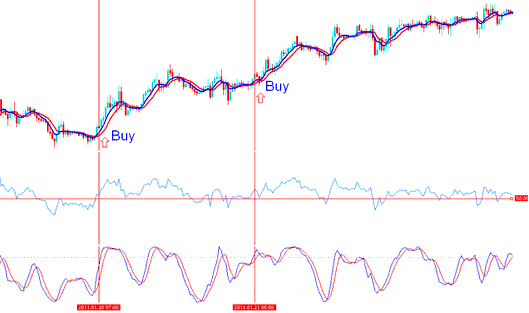

Two Buy Signals from System: Example Trades

Upward Markets Produce Two Key Buy Signals

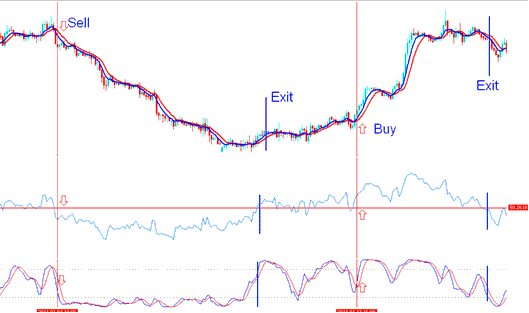

Examples 3: Exit Trade Signal Generated by System

Examples of Signals Generated by a System

Other Tips

Learn Bitcoin Education

First tip is to learn about the Bitcoin Market (Learn Tutorials), those who don't learn the required knowledge from the various tutorials online will not improve their btcusd results no matter how many tips they have read. By not learning bitcoin trading, these traders will keep making the obvious mistakes made by bitcoin novice traders without even realizing what they are doing, CryptoCurrency is a wide topic and in order and so as to earn profits a trader will be required to learn bitcoin trading first.

Get a Bitcoin System

A defined trading strategy is indispensable for every trader: a trading system provides the framework necessary to decide on the appropriate Bitcoin trading action. A trading strategy offers a participant a quantifiable advantage over those who lack a BTCUSD plan. A commendable plan is one that has undergone rigorous back-testing and demonstrated a capability to yield profitable trade outcomes consistently. After formulating your strategy, ensure you back-test it on a Demo BTCUSD Cryptocurrency Account.

Learn Bitcoin Equity Management

It's crucial to learn about various money management lessons related to Bitcoin trading: attempting to trade without equity management rules can be risky. Two key management lessons to grasp include:

What is BTCUSD Capital Management

BTCUSD Crypto Money Management Methods & Techniques

Learn about Bitcoin Leverage & Margin

If you don't know what trading leverage is, how it works, or how it affects your bitcoin margin, you'll lose money fast in BTCUSD trading. You've got to understand leverage to make any profits here.

Have a Written Bitcoin Plan

A Bitcoin trading plan includes all these tips. It sums them up in one document for trading the crypto market.

In General

The first aim should be spending time to really find out what you want to achieve with bitcoin trading and how much money you hope to make. Once you know this, these three tips will help you get going with Bitcoin Trading. It is key to remember these three aims when making all your bitcoin trade choices, but remember this isn't a guaranteed guide to making money with bitcoin.

First, keep in mind that you should really focus on short-term trades until you start making money and understand how to properly keep an eye on these trade transactions. You should trade bitcoin short term because this way you can monitor your bitcoin positions and quickly close any bitcoin trading position whose trading signal setup reverses. To get the most out of the system, you need to be willing to put in the effort to watch the btcusd trading market to know exactly how long you can keep your money invested in the online bitcoin crypto market. By trading Bitcoin for short periods, you can carefully watch your trades and handle any risks involved. Don't leave trades open when you're away from your computer or sleeping. Only trade when you can actively keep track of how they're doing.

Although it proves quite important to augment the volume of trade positions you are committing in each transaction - some bitcoin trading precepts & directives ought to be observed. The general guideline for bitcoin trading tends to be never to risk more than two % of your total bitcoin account equity. This naturally appears sensible when you as a trader possess substantial capital in your bitcoin account, but what if you only hold a couple of hundreds? Two % of $10,000 equals $200. Even though adhering to this standard is safer, it doesn't present much fiscal rationale with smaller bitcoin trading accounts. If you are investing in BTCUSD, this is where bitcoin trading leverage becomes effective and makes all the distinction. Generally, the greater btcusd trading capital you have available to commit, the superior it is regarding bitcoin trading equity administration.

The ultimate piece of advice is to dedicate sufficient time to meticulously confirm all your Bitcoin trading data and parameters are accurate before committing to any trade execution: this diligence will prove to be the most effective practice. Maintaining simplicity holds just as much merit in this market as in any other. While establishing Bitcoin profits through this conservative path might require greater time investment and effort initially, it will ultimately safeguard capital in the long run.

Maintaining maximum mental clarity will simplify your venture into bitcoin trading, yet recognizing opportune moments to diverge from conventional methods is equally vital. Progressing along the correct trajectory significantly enhances the achievability of success, and by thoroughly analyzing the procedures and rationale, you can sustain profit generation. Grasping Bitcoin is not inherently difficult, but numerous traders incur rapid losses due to and stemming from neglecting requisite preparatory and educational measures.

Get More Lessons and Tutorials & Guides:

- How to Initiate BTC USD Simulation Trading on a MetaTrader 5 Bitcoin Demo Account?

- Need a beginner's guide for BTC/USD trading? Here's where to find a solid training tutorial.

- How to Trade in Bitcoin Where to Place a Stop Loss BTC USD Order

- How to Look at/Understand BTC USD Candles and BTC USD Strategies

- Guide to Setting Up the MT4 App Course

- The M Pattern Explained for Bitcoin Trading Dynamics

- Indicators for Entering (Buy/Sell) and Exiting BTC/USD Trades

- How Do You Day Trade Bitcoin Price Moves in BTC USD Trading?

- MetaTrader 4 BTCUSD Trading Platform