H1 Moving Average Trading Method

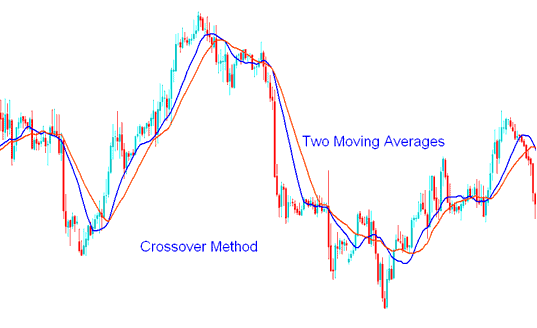

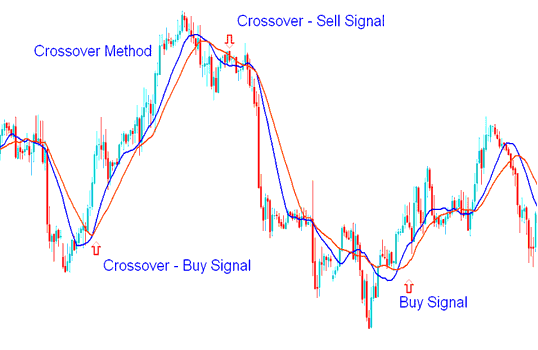

The bitcoin moving average crossover bitcoin strategy uses 2 moving averages to generate trading bitcoin trading signals. First Moving average uses a shorter bitcoin price period and the second moving average uses a longer bitcoin price period.

1 Hour Moving Average(MA) Trading Method - 1 H Time-frame Strategy Method

This bitcoin trading strategy is called the MA cross-over strategy. It generates BTCUSD signals when the two averages cross each other.

1 Hour Strategy - 1 H Strategy - Trading 1 H Time Frame Bitcoin

A buy bitcoin signal or CryptoCurrency buy bitcoin trade signal is generated when shorter moving average crosses above the longer moving average - Both MAs Indicators Moving Up.

A sell bitcoin signal or a sell bitcoin trade signal gets derived/generated when the shorter average crosses below the longer moving average - Both MAs Indicators Moving Down.

Examine More Tutorials and Courses:

- How Do I Interpret a BTCUSD Candle Pattern?

- How to Implement and Set the Relative Strength Index (RSI) Indicator for Gold on MT5

- What's an Example illustration of a Trading Trend Line Trading Analysis?

- How to Analyze MT4 Bitcoin Trade Chart Guide Tutorial

- How to Add Accumulation Distribution Indicator on MT4 for Bitcoin Tutorial

- How Do You Trade BTC USD & Modify a Take Profit BTC USD Order on MetaTrader 5 Platform?

- How Do I Analyze More Charts on MT4 Trade Platform?

- Understanding Candlesticks in BTC USD Trade

- How to Analyze MT4 BTCUSD Trend Line on MT4 Bitcoin Charts

- How to Trade BTC USD Support and Resistance Levels