Index Trends - Trading Analysis of Trend Trading

In trading the market, there is one saying that says "the trend is your friend". This is because the market trend has been found to be the most reliable strategy of trading the markets as when compared and analyzed to any other technical analysis method. Traders should therefore aim to base their technical analysis on the market trend of the Indices that they are trading.

Markets suit short-term bets on price shifts better than long-term investments. Traders can follow long trends if they want. But this site sticks to day trading tactics, which focus on quick moves.

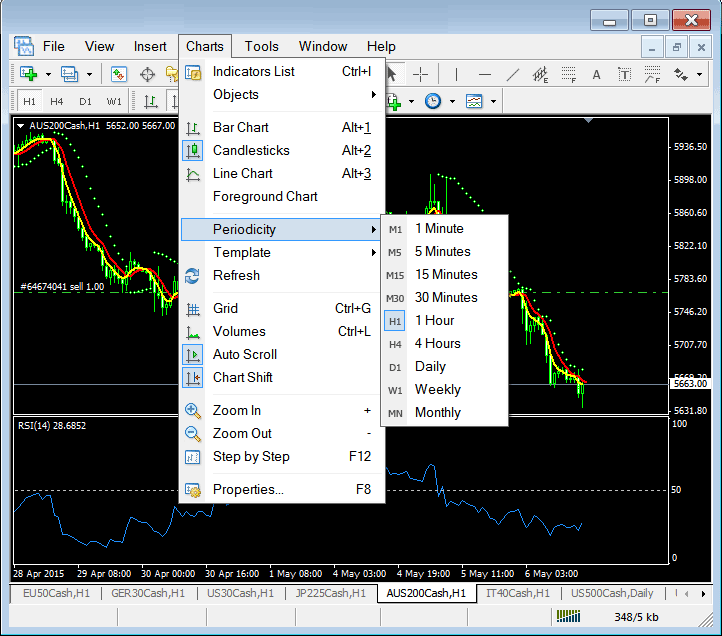

For our examples & our we shall use the H1 chart time frame, the example below shows where to set the H1 chart on your software.

To see the H1 chart, simply select the chart menu as shown above, then select the time frame, and after that, pick the H1 chart.

With the H1 timeframe set, spot the index trend. See if it's up or down. That helps pick buy or sell positions.

First let us look what is an uptrend & what is a down trend

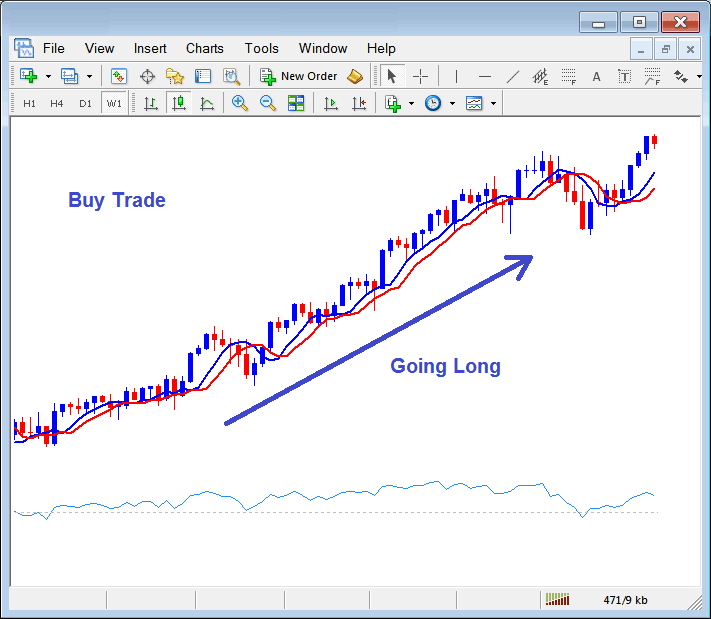

Upwards Trend

The upward market trend means the general market direction of a Indices is upward as is illustrated - when the market trend is upward traders will open buy trades also known as "going long".

Upwards Trend - Open Buy Trade or Going Long

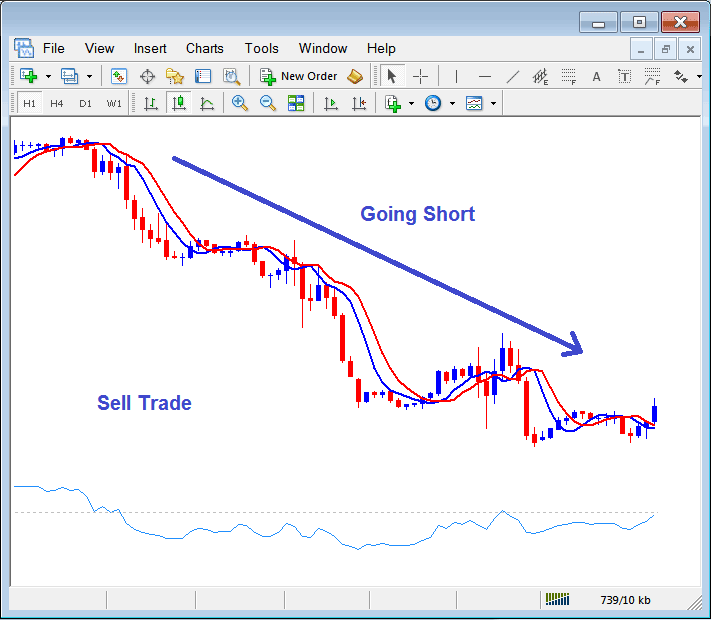

Downward Trend

The downward trend means the general market direction of a Indices is downward as is shown - when the market trend is downward traders will open sell trades also known as "going short".

Downward Trend - Open Sell Trade or Going Short

Techniques & Methods of Determining the Trend Direction

The different methods used to figure out the general market direction of a Indices.

One of the most conventional techniques employed to determine the prevailing trend across any market involves the utilization of trend lines. However, for Indices trading, applying trend lines is generally not the most effective methodology. Therefore, this tutorial will bypass that approach, choosing instead to examine the moving average crossover method, which stands as the superior technique for ascertaining the directional trend of an Index.

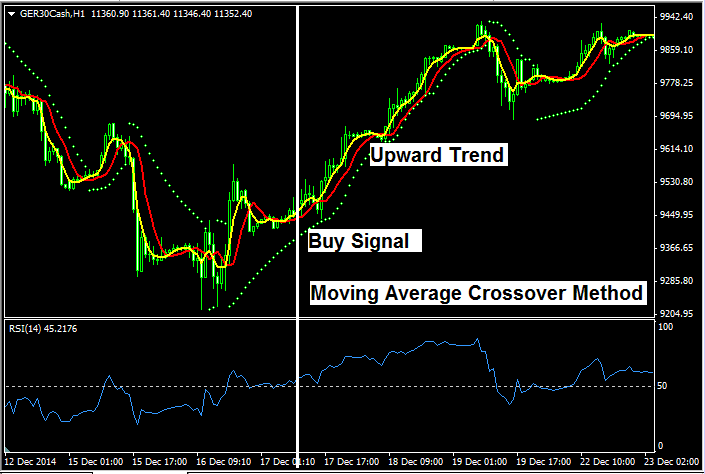

MA Cross over Method - Trend Trading

The moving average cross over trading strategy is a trading method where two moving averages are used to figure out the trend direction. A buy/sell signal is derived & generated when there is a cross over between these two moving averages. The buy signal is when the two moving averages are moving upward & a sell signal is when the two moving averages are moving downward.

Moving Averages(MAs) - Buy Signal

The moving averages crossover method shows a buy signal when the 2 moving averages cross each other and start to move upwards, as you can see below: this is when a trader would have started a buy trade as this upward trend went on for a while after the buy signal appeared. A trader would have ended their trade when the moving averages crossed in the opposite direction.

The second thing to watch for in the setup below helped make sure the upward trend was real - The RSI numbers above 50 tell us prices are rising and ending higher than they began.

Moving Averages - Sell Signal

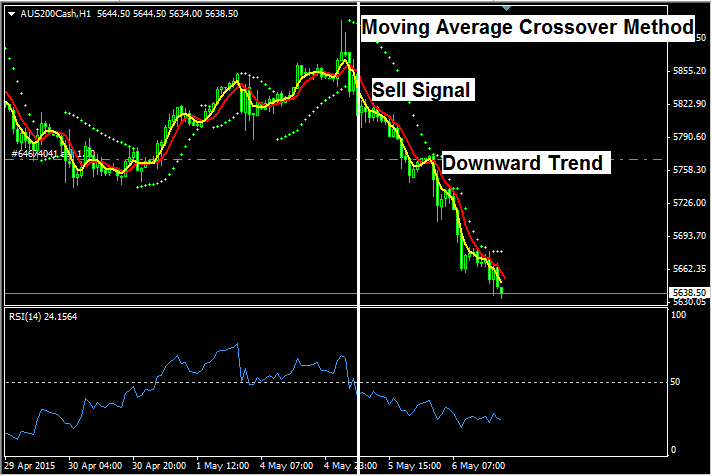

The Moving averages crossover method generated a sell signal once Moving averages crossed each other & started moving downward, the downward trend continued moving down such as shown below by the moving averages which continued to move downward. A trader would wait until the MAs cross in the opposite trend direction to close-out this sell trade position.

The RSI confirms sell direction as long as the RSI is below 50 level it shows prices are moving lower & closing lower than where they opened.

Once you have mastered the skill of discerning the prevailing direction of price movement, this understanding can become the foundation for all your execution decisions in the electronic marketplace.

More Guides:

- Finding the FTSE Name for FTSE 100 on the MetaTrader 4 Platform.

- Forex Bollinger Bands Limits Explained - Upper and Lower Range Analysis

- Coppock Curve Analysis for XAUUSD Indicator Performance Evaluation

- How to Set McClellan Histogram in MetaTrader 4 Charts

- Analyzing the Forex Ehler MESA Adaptive Moving Average

- How Much is 0.01 Lot in Forex Trade?