Index MA Crossover Strategy for Trading Moves

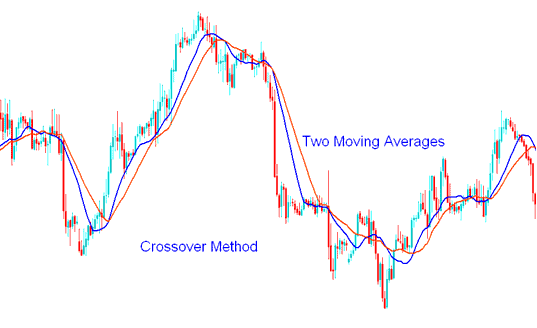

The MA Moving Average cross over method uses 2 moving averages to generate signals. The first Moving Average MA is a shorter price period MA Moving Average and the second average is a longer price period Moving Average.

Moving Average Cross Over Method - Moving Average Cross over Trading

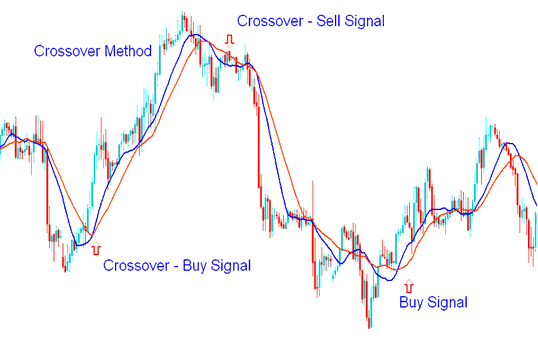

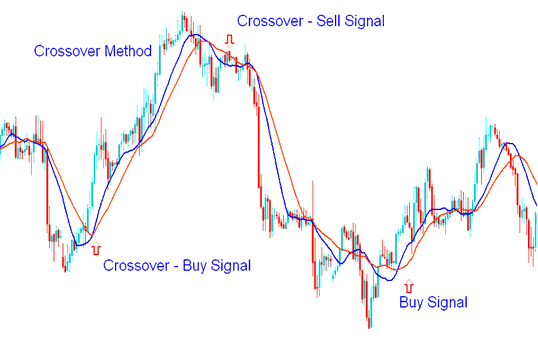

This way of using moving averages that cross over is called the crossover method because Index signals happen when the two averages go across or intersect with each other.

Buy Signal

A buy signal for Indices is generated when the shorter MA (Moving Average) line crosses above the longer MA Moving Average line.

A Buy Generated when the Shorter MA Crosses above the Longer MA - Indices Moving Average Cross over Method

Sell Signal

A selling opportunity emerges and is generated when the shorter Moving Average (MA) cuts beneath the longer MA.

A sell happens when the faster MA(Moving Average) goes under the slower MA(Moving Average) - Indices Moving Average Cross over Method

The trading strategy based on the aforementioned MA crossover is arguably the most fundamental of all approaches employed by Traders when engaging in Index trading.

More Guides & Tutorials:

- Tips on Trade the HangSeng 50 Stock Index

- How to View a Gold Chart on the MetaTrader 4 Platform?

- Generating Trading Signals for Indices Using Indicator Systems

- Setup Instructions for Automated Forex Trading Software

- Learning to Trade FX – The Best Way for Beginners

- NZDCHF Trading System Strategy

- The MT4 MarketWatch Window for Finding MT4 XAU USD Symbols.

- Analysis and Interpretation of MetaTrader 4 Automated Expert Advisors (XAU/USD Robots)

- Applying Darvas Box Analysis to Forex Market Charts