MACD Indicator: Fast Line and Signal Line Breakdown

MACD technical indicator is used in various ways to give technical analysis info.

- MACD centerline crosses reflect bullish or bearish markets: below the zero is bearish, above zero is bullish.

- MACD Cross-overs indicate a buy or sell signal.

- Oscillations can be used to indicate oversold and overbought regions

- Used to look for divergence between price and indicator.

Construction of MACD

The MACD indicator utilizes two exponential moving averages (default settings of 12 and 26) and includes a smoothing factor of 9, designed to plot two distinct lines for analysis purposes.

Summary of how MACD indicator is drawn

MACD incorporates two Exponential Moving Averages (EMAs) along with a smoothing factor, specifically the 12-period and 26-period EMAs, smoothed further over 9 periods.

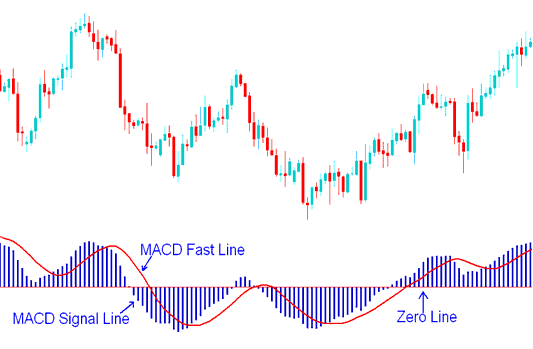

MACD only plots two lines - the MACD fast line & the MACD signal line

MACD Lines - MACD Fast Line & MACD Signal-lines Indices Signals

- The Fast Line is the difference between the 26 EMA and 12 EMA

- The Signal-line is the 9 period MA of the MACD fast line.

Implementation of MACD

The MACD shows the MACD line as a solid line. The signal line appears as bars. Use their crossovers to create trading signals.

There's also the MACD center-line, also called the zero mark, which shows a balanced point between buyers and sellers when trading.

Values that exceed the center mark are interpreted as bullish signals, whereas those that fall below are seen as bearish signals.

MACD, as an oscillator, swings above and below its center line.

Discover More Manuals & Training: