SPAIN35 Index

SPAIN35 is an Stock Index which keeps track of the top 35 stocks in Bolsa Madrid - Spanish Stock Bourse. This Index tracks capitalization of 35 most liquid stocks in Madrid Stock Exchange. The component stocks used to calculate this stock index are revised twice a year.

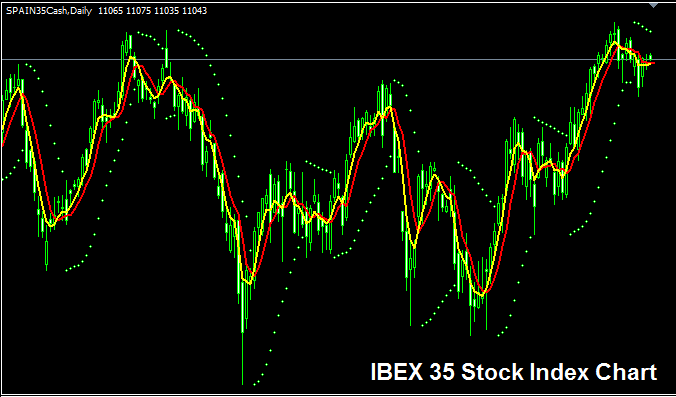

The SPAIN 35 Chart

SPAIN35 trading chart is illustrated and displayed above. On the above example this Index is named SPAIN35CASH. As a trader you want to find a broker that provides SPAIN35 chart so that you as a trader can begin to trade it. The example That is illustrated & shown above is that of SPAIN35 Index on MT4 Forex Platform Software.

Other Data about SPAIN35 Indices

Official Indices Symbol - SPAIN35

The 35 component stocks that makes up the SPAIN35 Index are selected from top companies in Spain. The 35 stocks make up most of the total turnover volume in the Madrid Stock Exchange.

Index Trading Strategy for Trading SPAIN35 Index

SPAIN35 Index tracks capitalization of top 35 corporations in Spain. This Stock Index in general moves upward over long-term but it's more volatile in its trend movement. When compared to other indexes such as EUROSTOXX 50 and DAX 30 which have lower volatility in their market trend movements, this stock index has wider swings in its trend movement.

Over a long period of time this index will in general moves move upwards, as a trader you want to be biased & keep on buying as the index heads and moves upward.

A good strategy for a trader to use when trading this stock index would be to keep buying and buy the dips - though as a trader wanting to trade this stock index, be prepared for generally much wider swings(more volatile swings) when it comes to trading this stock index.

During Economic Slow-Down & Recession

During economic slowdown and recession periods, companies begin and start to report slower revenues, slower profits & slower growth projection. It is due to and because of this reason that investors start to sell stocks of companies that are recording and announcing lower profits & hence Indices tracking these specified stocks will also start and begin to move downwards.

Therefore, during these times, market trends are much more likely to be moving downward & you as a trader should also adjust your strategy accordingly to suit the prevailing downwards trends of the index which you are trading.

Contract Specifications

Margin Requirement for 1 Lot - € 140

Value per Pips - € 1

Note: Even though general and overall trend is generally moves upwards, as a trader you've got to consider and factor on daily market price volatility, on some of the days the Indices may move in a range or even retrace & retracement, the market correction/retracement move may also be a substantial one at times & therefore as a trader you need to time your trade entry strictly using this trading strategy: Stock strategy & at the same time use the appropriate & appropriate and proper & suitable money management guideline/rules just in case there's unexpected market volatility. About equity money management techniques in stock indices tutorials: What's money Index management and indices equity management methods/strategies.

More Guides and Lessons:

- Calculating Forex Trade Profits & Losses

- What is EURPLN Spreads?

- IT40 Indices Trading Strategy How to Create Indices Strategy for IT40

- Standard Gold Account & Micro XAU USD Accounts Types Described

- Stock Index Trading Strategy Strategy

- List of All The Trade Topics Required by a Trader

- Money Management Strategy for Serious Traders

- How Can I Use MT5 Balance of Power Indicator?

- What is Alligator Indicator?

- Bears Power MT5 Technical Analysis in Trade