About MA Trade Strategy - Strategy Example

The moving average indicator is widely used in index trading due to its simplicity and effectiveness.

This Stock Index Trade Indicator functions as a trend-following tool for stock index traders targeting three specific areas.

- Identify the starting of a new market trend

- Measure the sustainability of the new trend

- Identify the ending of a trend & signal a reversal signal

The moving average smooths price ups and downs for indices. This overlay indicator sits on top of the index chart.

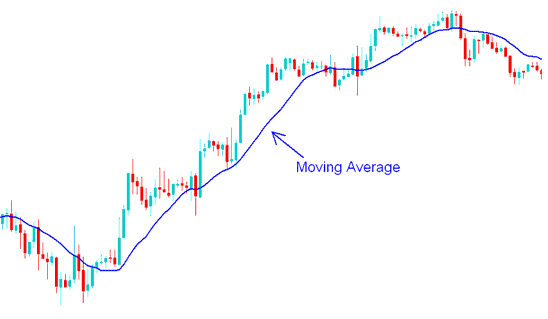

In the example Indices trade chart below, the blue line is a 15 period Moving Average, which helps to smooth out the changes in price action.

Indices MA MA Indicator - MT4 Trade Chart Indicators

Calculation of the MA

The Moving Average (MA) Index, also called MA, is found by taking the average or mean of the price using the newest price data.

If the MA Moving Average uses the 10 period to calculate the average of the Indices price then it is referred to as a 10 period moving average, because most Traders use the day as the standard price period we shall just refer to it as the 10 day Moving Average.

To find the ten-day moving average, add up prices from the last ten days and divide. The index MA tool updates after each new price. It recalculates with the fresh ten periods. That's why it moves as index prices change.

Study More Guides & Guides:

- Major Forex Pairs: What Forex Pairs are the Best for Day Trading?

- Comparative Analysis: CFDs, Futures, and Forex Trading Instruments

- Fundamental Economic Reports & Forex News Reports: The Major Market Movers

- Coppock Curve – Making Sense of Forex Buy & Sell Signals

- Breaking Down the Williams Percent R Indicator

- MetaTrader 4 Forex Charts Options Settings on Tools Menu in MT4 Platform

- Utilizing Chande Momentum Oscillator in Forex

- Automatic software robots for expert trading explained simply.

- Guidance on Selecting the Optimal Broker for Opening and Registering a Mini Account

- What is the Way to Use Signals with FX Systems Explained?