Coppock Curve Trading Indicator: Identification of Buy and Sell Trading Signals

Coppock Curve Buy FX Signal

Get Forex Buy Signals from Coppock Curve Indicator

Sequential instructions for generating foreign exchange buy signals employing the Coppock Curve indicator:

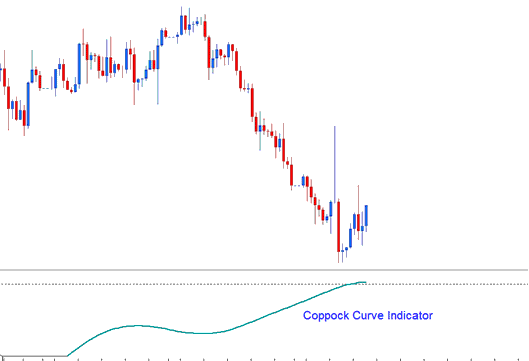

This Coppock Curve buy signal tutorial describes and explains how to generate forex buy signals using the Coppock Curve like shown below:

Create Buy Signals in Forex with Coppock Curve Tool

Coppock Curve Trading Indicator Sell Trade Signal

Generating Forex Sell Signals Using the Coppock Curve Indicator.

Procedures for generating forex sell trade signals by utilizing the Coppock Curve indicator:

This Coppock Curve sell trading signal guide describes and explains how to generate forex sell trade signals using the Coppock Curve just as is shown:

How to Generate Forex Sell Trade Signals Using the Coppock Curve Indicator

The Coppock Curve started for stocks and commodities analysis. Later, people used it for forex trading.

This is based on the idea of trading psychology, assuming that people's behavior is predictable, and that price movements always happen in a back-and-forth, or zigzag, way.

The concept of adaptive levels suggests that asset prices will exhibit similar reactions or patterns when encountering specific historical price levels, whether dealing with stocks or currencies.

FX Analysis and Generating Signals

The simplest type of adaptation-level in Forex trading is the moving average, around which prices will fluctuate. This serves as the foundation for this indicator, which is a longer-term oscillator technical indicator that is based on this adaptation-levels (MA) but in a different manner.

Oscillators typically commence their calculation by determining the percentage change between the current prevailing market price and a preceding price point, with that earlier price serving as the established benchmark (or levels of adaptation).

Edwin Coppock posited that traders' emotions during market transactions could be measured by aggregating the percentage fluctuations in price over a recent period, providing insight into the longer-term momentum of the market.

For instance, consider comparing current prices against those from precisely one year ago: if we observe that the market has risen by 20% this month compared to a 15% year-over-year gain last month, we could reasonably infer that the price momentum is accelerating.

Basic trading signals can also be generated using the Coppock Curve to identify price reversals at extreme levels. Incorporating the identification of divergence and trend-line breaks may help to further validate these trade signals.

Examine More Tutorials and Courses: