20 Pips Price Range MA Moving Average System

The 20-pip moving average strategy is applied utilizing both the 1 Hour Index trading chart and the 15-minute Indices trade chart timeframe. For these specific chart periods, the 100-period and 200-period simple MA technical indicators are employed.

For both the 1 Hour and 15 Minute Index trade charts, use the 100 and 200 SMA indicators to spot which way the price is trending.

The 1-Hour Stock Index trade chart timeframe is used to ascertain the sustained directional trend of the price, whether upward or downward, based on the orientation of the Moving Averages. All initiated trades should align with this established trend.

Traders often utilize the 15-minute index trade chart to pinpoint optimal entry points. Positions are only opened when prices remain within a range of 20 pips from the 200 Simple Moving Average. If this condition isn't met, no trades are executed.

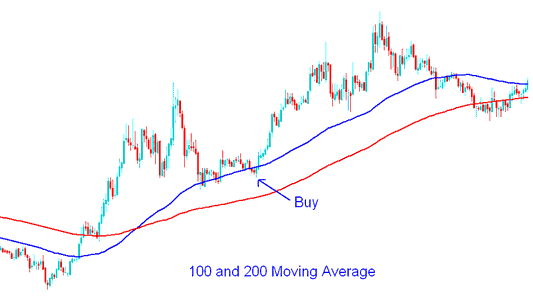

Buy Trading Signal - Uptrend/Bullish Market

To make buy signals using the 20 pips MA strategy, use the 1-hour and 15-minute timeframes on the Indices trade chart.

On a one-hour chart for stock indexes, prices must sit above both the 100 and 200 simple moving averages. Then switch to the 15-minute chart to find entry signals.

On a 15-minute chart for stock market trading, if the price goes 20 pips higher than the 200 SMA, we start a trade to buy stocks and set a stop loss 30 pips lower than the 200 SMA. You can change the stop loss to fit how much risk you're okay with, but to keep your trades from being stopped out by normal stock market changes, it's best to use a 30-pip stop loss.

A buy trade for indices can also be initiated when the price retests or touches the 100 Simple Moving Average, provided this level is situated reasonably close to the 200 SMA. Typically, the 100 SMA should lie within a 20-pip proximity of the 200 SMA.

Buy Signal Generation with 100 and 200 Simple Moving Averages - Moving Average Index Trading Strategy

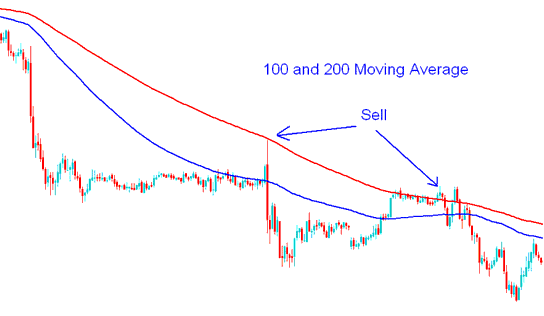

Sell Signal - Downtrend/Bearish Market

To create signals for selling (short Stock signals) using a 20 pip MA plan, we'll also use the 1-hour and 15-minute Index trade charts.

On the 1-hour stock indices chart, price stays under 100 and 200 SMA. Switch to 15-min chart for signals.

On the 15-minute Indices chart, if the price drops to a 20-pip distance below the 200 SMA, we initiate a sell trade and set a stop loss 30 pips above the 200 simple moving average.

Selling Signal Using 100 and 200 Simple Moving Average Indices - A Trading Strategy Based on Moving Average (MA) Indices

In this strategy, price often bounces off support and resistance. Many traders eye these spots. They place similar index trades near the same levels.

These support and resistance levels serve as short-term barriers in the price charts.

Profit Taking level For This Trading System

With this strategy the price will bounce & head in the direction of the initial trend. This move will range and vary from 60 - 70 pips.

Aim for 60 to 70 pips from the 200 SMA as the best profit target.

Learn More Lessons & Guides:

- What's the Wall Street 30 index chart on MetaTrader 4?

- How to Interpret and Analyze Margin Trade Levels for XAUUSD

- Correct Placement of a Stop Loss Order in a Forex Transaction

- Analysis of Ultimate Oscillator for Trading

- Inquiries Regarding Trading the Described Pairs

- GBPNZD Bid-Ask Spread

- How to Trade Using Managed Trade Accounts