What's Trailing Stop Loss Levels Indicator? - Trailing Stop Loss Levels Indicator

Trailing Stop Loss Levels indicator - Trailing Stop Loss Levels indicators is a popular technical indicator that can be found on the - Indicators Listing on this website. Trailing Stop Loss Levels indicator is used by the traders to forecast price movement depending on the chart price analysis done using this Trailing Stop Loss Levels indicator. Traders can use the Trailing Stop Loss Levels buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Trailing Stop Loss Levels indicator. By using Trailing Stop Loss Levels and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Trailing Stop Loss Levels Indicator? - Trailing Stop Loss Levels Indicator

How Do You Combine Indicators with Trailing Stop Loss Levels? - Adding Trailing Stop Loss Levels in the MT4

Which Indicator is the Best to Combine with Trailing Stop Loss Levels?

Which is the best Trailing Stop Loss Levels indicator combination for trading?

The most popular indicators combined with Trailing Stop Loss Levels are:

- RSI

- MAs Moving Averages Trading Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic

- Ichimoku Indicator

- Parabolic SAR

Which is the best Trailing Stop Loss Levels indicator combination for trading? - Trailing Stop Loss Levels MT4 indicators

What Indicators to Combine with Trailing Stop Loss Levels?

Get additional indicators in addition to Trailing Stop Loss Levels indicator that will determine the trend of the market price and also others that confirm the market trend. By combining indicators which determine trend & others that confirm the trend and combining these indicators with Trailing Stop Loss Levels indicator a trader will come up with a Trailing Stop Loss Levels based system that they can test using a practice trading demo account on the MetaTrader 4 platform.

This Trailing Stop Loss Levels based system will also help traders to determine when there is a market reversal based on the indicators signals generated & hence trades can know when to exit the market if they have open trades.

What's Trailing Stop Loss Levels Indicator Based Trading? Indicator based system to interpret and analyze price & provide signals.

What is the Best Trailing Stop Loss Levels Strategy?

How to Choose & Select the Best Trailing Stop Loss Levels Strategy

For traders researching on What is the best Trailing Stop Loss Levels strategy - the following learn trading courses will help traders on the steps required to course them with coming up with the best strategy for market based on the Trailing Stop Loss Levels indicator trading strategy.

How to Create Trailing Stop Loss Levels Systems Strategies

- What's Trailing Stop Loss Levels Indicator Trading Strategy

- Creating Trailing Stop Loss Levels Strategy Template

- Writing Trailing Stop Loss Levels Strategy Trade Rules

- Generating Trailing Stop Loss Levels Buy and Trailing Stop Loss Levels Sell Signals

- Creating Trailing Stop Loss Levels Indicator Trading System Tips

About Trailing Stop Loss Levels Indicator Example Explained

Trailing Stop Loss Levels Technical Analysis Signals

Developed and Created by Tushar Chande.

This is a volatility based indicator that is used to estimate levels to set stoploss order levels. The distance at which it calculates trailing stop level is determined based on market volatility.

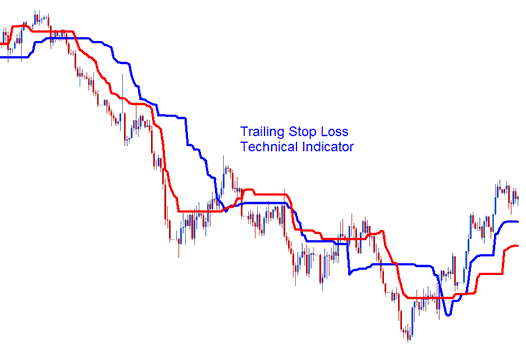

Levels of the 2 lines, these 2 lines represent:

- Long Stop Level - Blue Line

- Short Stop Level - Red Line

Long stop level line has a much wider range in terms of the level where it trails the stop loss as compared to the short stop level that implements a tight stop loss order.

This indicator is volatility based when it comes to trailing and following the price action. Trailing Stop Levels will trail the above the price in a downwards market trend & trails below the price in an upwards market trend.

Technical Analysis and How to Generate Trading Signals

These will be calculated using volatility to calculate where to draw the trading indicator - this is used to determine what levels to set stop loss orders.

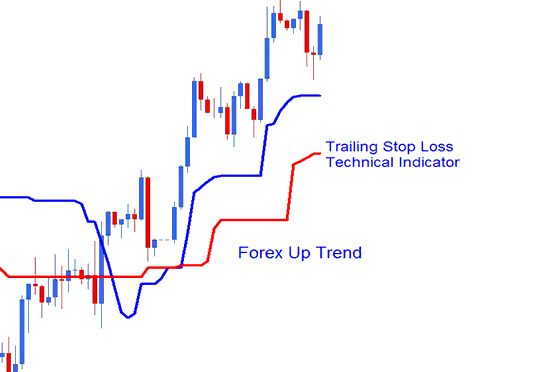

Upwards Trend

In an upward trend these levels will follow below the price. The trader can either use the short stop level line to set up a tight stop or the long stop level to set a stop loss that is not very tight. As the price goes higher the trailing level also goes higher. An exit signal is generated/derived when price crosses below these levels.

Uptrend

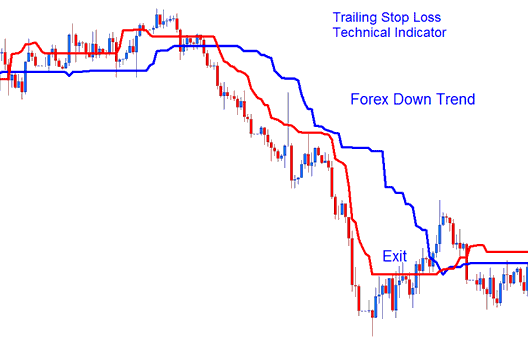

Downwards Trend

In a downwards trend the stoploss order levels will trail above the price these 2 levels can be used to set the stoploss levels. As the price drops further these levels will continue to drop lower and follow the price lower. An exit signal is derived & generated when the price crosses above these levels.

Downtrend

When price starts and begins to retrace these levels will not retrace but will remain at their levels, this will mean at some point the trade transaction will be closed by trailing stoploss order.

Get More Lessons and Tutorials and Courses:

- How Can I Add FTSE in MT5 Android App?

- How to Calculate Leverage and Margin

- What's UK100 Spread? UK100 Bid Ask Spread

- How Can I Use MetaTrader 5 Recursive Moving Trend Average Indicator on MetaTrader 5 Software?

- How to Set Hang Seng in Android MetaTrader 4 App

- How Can I Add FTSE100 Index in MetaTrader 5 Software?

- Learn How to Trade SWI 20 Tutorial Course Download

- USDNOK System USDNOK Trade Strategy

- How to Trade DAX 30 Index for Beginner Stock Index Traders

- MetaTrader 5 Linear Regression Slope Analysis Illustrated