What is Stochastic Momentum Index Indicator? - Definition of SMI Indicator

Stochastic Momentum Index - Stochastic Momentum Index indicators is a popular indicator which can be found on the - Indicators List on this site. Stochastic Momentum Index is used by the traders to forecast price movement depending on the chart price analysis done using this Stochastic Momentum Index indicator. Traders can use the Stochastic Momentum Index buy and Sell Signals explained below to determine when to open a buy or sell trade when using this Stochastic Momentum Index indicator. By using Stochastic Momentum Index and other indicators combinations traders can learn how to make decisions about market entry and market exit.

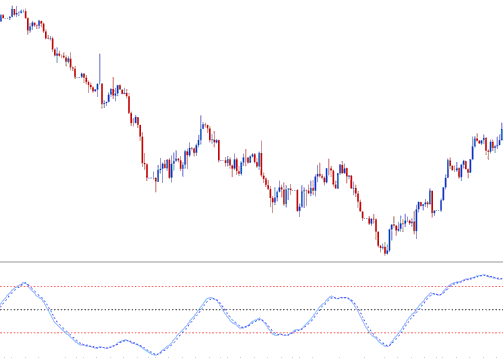

What is Stochastic Momentum Index Indicator? Stochastic Momentum Index Indicator

How Do You Combine Indicators with Stochastic Momentum Index? - Adding SMI in MT4

Which Indicator is the Best to Combine with Stochastic Momentum Index?

Which is the best Stochastic Momentum Index combination for forex trading?

The most popular indicators combined with Stochastic Momentum Index are:

- RSI

- Moving Averages Indicator

- MACD

- Bollinger Band

- Stochastic

- Ichimoku Indicator

- Parabolic SAR

Which is the best Stochastic Momentum Index combination for Forex trading? - Stochastic Momentum Index MT4 indicators

What Indicators to Combine with Stochastic Momentum Index?

Get additional indicators in addition to Stochastic Momentum Index that will determine the trend of the market price and also others that confirm the market trend. By combining indicators that determine trend and others that confirm the trend & combining these indicators with Forex Stochastic Momentum Index a trader will come up with a Stochastic Momentum Index based system that they can test using a practice demo trading account on the MT4 software.

This Stochastic Momentum Index based system will also help traders to determine when there is a market reversal based on the technical indicators signals generated & hence trade positions can know when to exit the market if they have open trades.

What is Stochastic Momentum Index Based Trading? Indicator based system to interpret and analyze price and provide signals.

What is the Best Stochastic Momentum Index Forex Strategy?

How to Select and Choose the Best Stochastic Momentum Index Forex Strategy

For traders researching on What is the best Stochastic Momentum Index forex strategy - the following learn forex tutorials will help traders on the steps required to guide them with coming up with the best strategy for market based on the Stochastic Momentum Index system.

How to Create Stochastic Momentum Index Forex Systems Strategies

- What is Stochastic Momentum Index Strategy

- Creating Stochastic Momentum Index Forex Strategy Template

- Writing Stochastic Momentum Index Forex Strategy Trade Rules

- Generating Stochastic Momentum Index Forex Buy and Stochastic Momentum Index Sell Signals

- Creating Stochastic Momentum Index System Tips

About Stochastic Momentum Index Example Explained

SMI Technical Analysis Signals

Developed by William Blau.

Stochastic Momentum Index, SMI is an adaptation of the classic Stochastic Oscillator that smoothens the stochastics oscillations.

Construction of SMI Indicator

This indicator is calculated by comparing the price compared to the average/mean of an n-number of periods.

Then instead of plotting these values directly, smoothing using an Exponential Moving Average is applied and then the values plotted to form the SMI.

When the closing price is higher than the average/mean of the range, the SMI will move upwards.

When the closing price is less than the average/mean of the range, the SMI will move downward.

This oscillator ranges between the values of +100 and -100, this trading indicator also is less prone to whipsaw fakeouts compared and analyzed to the stochastic oscillator trading indicator.

Technical Analysis and How to Generate Trading Signals

Buy and Sell Signals/ Forex Crossover Signals

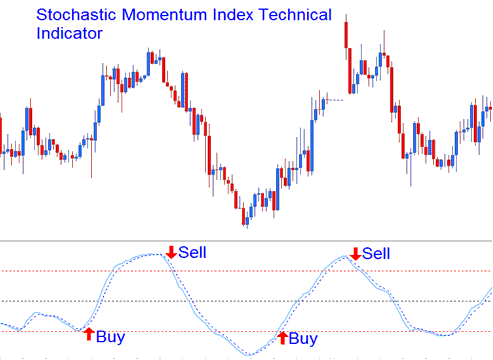

The Stochastic Momentum Index can be used to generate buy & sell trade signals using the method illustrated below, Buy when the SMI is going upwards and sell when its going downward.

Buy & Sell Signals/ Forex Crossover Signals

Overbought/Oversold Level FX Cross overs

- Overbought levels above +40

- Over-sold levels below -40

Buy signal is generated/derived when this oscillator falls below oversold level and then rises above this level & begins to move upwards.

Sell Signal is derived & generated when this oscillator rises above overbought level and then falls below this technical level & starts and begins to move downwards.

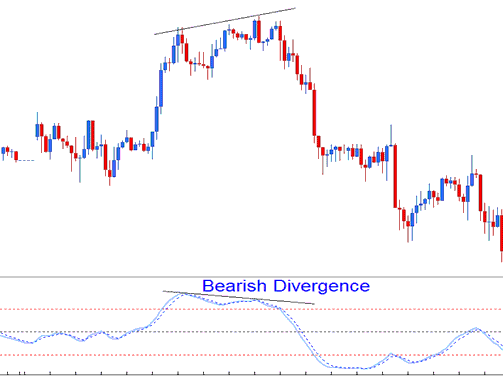

Forex Divergence Forex Trading

The exemplification laid-out below indicates a bearish classic divergence between the price and the SMI. When the SMI showed this divergence the market trend reversed and started to move in a downwards direction.

Bearish Divergence Trading Setup

Get More Lessons and Tutorials and Courses:

- How to Trade AEX 25 Course to Trade AEX25 Indices

- Linear Regression Automated Forex Trading Strategy

- How to Set Nikkei on MT5 Android Mobile App

- Forex Currency Pair Convention Naming Format and Nicknames

- How to Develop a Good Trading Systems

- How Do I Trade Standard Forex Contract in Trading?

- How to Interpret/Analyze Forex Candlesticks Patterns Strategy

- How to Trade AS51 Tutorial Guide to Trade AS51 Index

- Calculate Pip Value for Standard FX Account Standard Lots

- Moving Average Envelope XAU/USD Indicator Technical Analysis