What is RSI Indicator? - Definition of RSI Indicator

RSI - RSI indicators is a popular forex technical indicator that can be found on the - Indicators Listing on this website. RSI is used by the traders to forecast price movement based on the chart price analysis done using this RSI indicator. Traders can use the RSI buy and Sell Signals explained below to determine when to open a buy or sell trade when using this RSI indicator. By using RSI and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's RSI Indicator? RSI Indicator

How Do You Combine Forex Indicators with RSI? - Adding RSI in MT4

Which Indicator is the Best to Combine with RSI?

Which is the best RSI combination for forex trading?

The most popular indicators combined with RSI are:

- MAs Moving Averages Forex Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic Indicator

- Ichimoku Kinko Hyo Indicator

- Parabolic SAR

Which is the best RSI combination for Forex trading? - RSI MT4 indicators

What Indicators to Combine with RSI?

Get additional indicators in addition to RSI that will determine the trend of the forex market & also others that confirm the trend. By combining forex indicators that determine trend and others that confirm the trend and combining these technical indicators with Forex RSI a trader will come up with a RSI based system that they can test using a forex practice trading demo account on the MT4 platform.

This RSI based system will also help traders to determine when there is a market reversal based on the indicators signals generated & hence trades can know when to exit the market if they have open trades.

What is RSI Based Trading? Indicator based system to interpret and analyze price and provide signals.

What's the Best RSI Trading Strategy?

How to Choose & Select the Best RSI Strategy

For traders researching on What is the best RSI strategy - the following learn fx tutorials will help traders on the steps required to course them with coming up with the best strategy for trading forex market based on the RSI system.

How to Create RSI Systems - Best Forex Indicators Combination for RSI

- What is RSI Strategy

- Developing RSI Trading Strategy Template

- Writing RSI Trading Strategy Trade Rules

- Generating RSI Buy and RSI Sell Signals

- Creating RSI Forex System Tips

About RSI Example Explained

RSI RSI Analysis & RSI Signals

Created and Developed by J. Welles Wilder, presented in the book "New Concepts in Technical Systems".

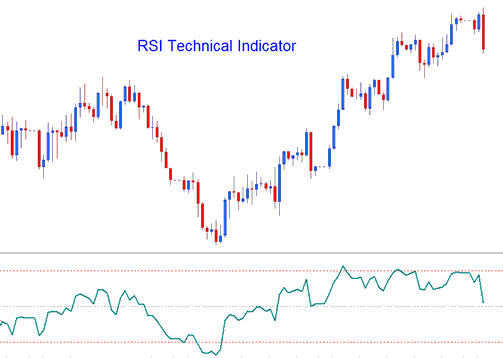

Relative Strength Index is the most popular/liked indicator & it's a momentum oscillator & a trend following indicator. RSI compares a trading currency magnitude of the recent price gains against its magnitude of recent losses price losses & plots this data on a scale of values which ranges between 0-100.

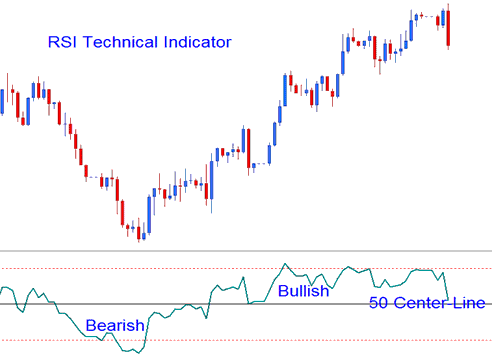

Relative Strength Index measures the energy of a currency pair; readings above 50 signify bullish momentum while values/readings below 50 center-line signify bearish energy.

- RSI is drawn as a green line

- Horizontal dashed lines are plotted to identifying overbought and over-sold levels are i.e. 70/30 levels respectively.

Forex Analysis and How to Generate Trading Signals

There are various methods used to trade, these are:

50-level Cross-over Signals

- Buy trade signal - when the indicator crosses above 50 mark a buy/bullish trade signal is given/generated.

- Sell Signal - when the trading indicator crosses below 50 mark a sell/bearish signal is given/generated.

RSI Trading Chart Setup Patterns

Traders can draw trendlines and map out chart patterns on the RSI. The RSI often forms patterns like head and shoulders pattern which might not have formed clearly on the price chart.

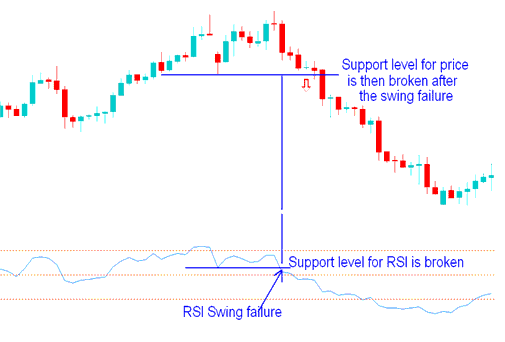

Forex Support/Resistance Breakouts

RSI is a leading indicator & can be used to predict the Support and Resistance Breakouts before price breaks its support/resistance level. RSI uses the swing failure signal to predict when price is about to break support and resistance zones.

Swing Failure - Support and Resistance Break-out

Over-bought/Oversold Conditions in Indicator

- Overbought levels above 80

- Over-sold- levels below 20

These levels can be used to generate FX signals like when RSI turns up from below 20 after oversold, buy & sell when the RSI crosses to below 80 after over-bought, sell. These signals are not suitable for Forex because they are prone to a lot of fake outs.

Divergence Setups

Divergence trading is one of the analysis method used to trade reversals of the market trends. There are 4 types of divergences that can be traded and transacted with this indicator covered & discussed on the divergence tutorial on this website.

Study More Courses & Lessons:

- Aroon Oscillator Gold Indicator Analysis in XAUUSD Charts

- Trading Leverage 1:400 Illustrated Using an Example

- FX Platform MT4 Terminal Panel

- How to Interpret/Analyze Pips in GBPHKD How to Count Pips in GBPHKD

- How to Calculate Leverage and Margin in XAUUSD

- RSI Divergence Analysis in Trading

- How to Set MetaTrader 5 Stochastic Momentum Index Indicator