What's Relative Vigor Index RVI Indicator?

Relative Vigor Index RVI indicator - Relative Vigor Index RVI indicators is a popular technical technical indicator that can be found in the - Indicators Listing on this website. Relative Vigor Index RVI indicator is used by the traders to forecast price movement based on the chart price analysis done using this Relative Vigor Index RVI indicator. Traders can use the Relative Vigor Index RVI buy & Sell Trading Signals described below to figure out when to open a buy or sell trade when using this Relative Vigor Index RVI indicator. By using Relative Vigor Index RVI and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Relative Vigor Index RVI Indicator? Relative Vigor Index RVI Indicator

How Do You Combine Indicators with Relative Vigor Index RVI? - Adding RVI Indicator on the MT4

Which Indicator is the Best to Combine with Relative Vigor Index RVI?

Which is the best Relative Vigor Index RVI indicator combination for forex trading?

The most popular indicators combined with Relative Vigor Index RVI are:

- Relative Strength Index

- MAs Moving Averages Indicator

- MACD

- Bollinger Band

- Stochastic Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best Relative Vigor Index RVI indicator combination for Forex trading? - Relative Vigor Index RVI MT4 indicators

What Indicators to Combine with Relative Vigor Index RVI?

Get additional indicators in addition to Relative Vigor Index RVI indicator that will determine the trend of the price and also others that confirm the trend. By combining technical indicators which determine trend and others that confirm the trend & combining these indicators with Forex Relative Vigor Index RVI indicator a trader will come up with a Relative Vigor Index RVI based strategy that they can test using a demo account on the MetaTrader 4 platform.

This Relative Vigor Index RVI based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is Relative Vigor Index RVI Technical Indicator Based Trading? Technical Indicator based strategy to analyze and interpret price and provide trade signals.

What's the Best Relative Vigor Index RVI Forex Strategy?

How to Select and Choose the Best Relative Vigor Index RVI Forex Strategy

For traders researching on What is the best Relative Vigor Index RVI forex strategy - the following learn forex tutorials will help traders on the steps required to guide them with creating the best strategy for market based on the Relative Vigor Index RVI indicator system.

How to Develop Relative Vigor Index RVI Forex Systems

- What is Relative Vigor Index RVI Trading Indicator Strategy

- Creating Relative Vigor Index RVI Forex Strategy Template

- Writing Relative Vigor Index RVI Forex Strategy Rules

- Generating Relative Vigor Index RVI Forex Buy & Relative Vigor Index RVI Sell Trading Signals

- Creating Relative Vigor Index RVI Indicator Trading System Tips

About Relative Vigor Index RVI Trading Indicator Described

RVI Analysis and Relative Vigor Index Signals

Developed and Created by John Ehler

The Relative Vigor Index combines the older concepts of trading analysis with modern digital trading signal processing theories and filters to come up with a practical and useful indicator.

The basic principle behind it is simple -

- Prices tend to close higher than where they open in up-trending markets and

- Prices close lower than where they open in down-trending markets.

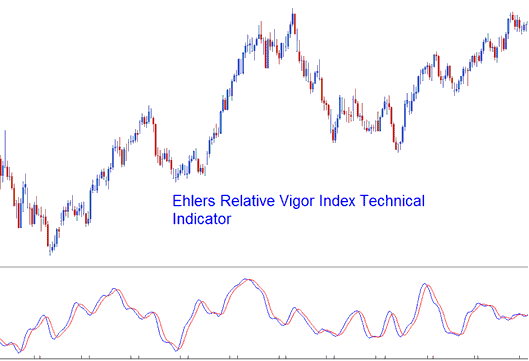

The force (vigor) of the move will therefore be established by where prices end up at the close of the candle. The Relative Vigor Index plots/draws 2 lines the RVI Line and the trading signal Line.

The RVI index is essentially based on measuring of the average difference between the closing & opening price, and this value is then averaged to the mean average daily range & then plotted.

This makes the index a responsive oscillator trading indicator that has quick turning points that are in phase with the market cycles of prices.

Technical Analysis and Generating Signals

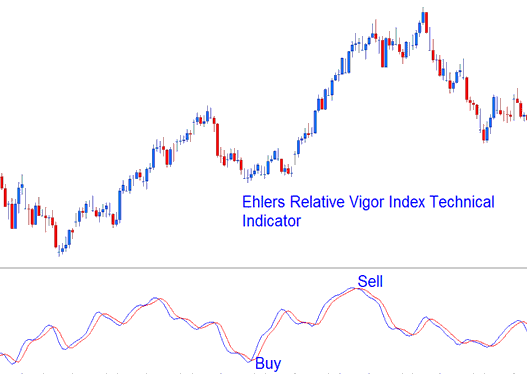

The Relative Vigor Index is an oscillator indicator. The basic technique of interpreting the index is to use the crossover of the RVI & the SignalLine. Signals are generated/derived when there is a crossover of the 2 lines.

Bullish Signals - a buy signal forms when the RVI crosses above the Signal-Line.

Bearish Signals - a sell trade signal forms when the RVI crosses below the Signal-Line.

Buy & sell trade signals derived/generated using the crossover strategy

Get More Tutorials:

- SX 50 Stock Indices Trade Strategy List & Best SX 50 Stock Indices Trade Strategy to Trade SX 50

- Stochastics Oscillator Bullish Forex Trading Divergence & Bearish Divergence

- Chande Trendscore MetaTrader 4 Trading Indicator in FX MT4 Charts

- CCI Gold Indicator MetaTrader 4 Technical Indicator Analysis

- Characteristics of the Three Major XAUUSD Market Sessions