Characteristics of the three major trading sessions: Asia, Europe, and USA

Asian Market Session

In the Asia session, only 8% of daily trades pass through Tokyo. It is the quietest of the main sessions. Most trades involve yen pairs, with few others. This makes it a poor time to trade. Skipping it saves time and cash.

European Session

The London/European market takes the lion's share of the overall total trade turnover transactions, 34 % of all trade transactions are carried out during this session. London time zone is also well placed in terms of business hours for both eastern & western economies, this is when there are market over-laps and this results in high No. of trade transactions during the period. This time is most liquid & most volatile market session for all the xauusd.

The Europe time zone covers Euro zone countries. It has 17 members. Major banks there are open, creating high liquidity from many trades.

US Market Session

The United States market accounts for 20% of all global trade volumes. The peak activity window for trading consistently falls between approximately 8:00 AM and 12:00 PM, coinciding with the hours when both the London and New York dealing desks are simultaneously operational. This period typically exhibits the highest degree of volatility, largely because it is also when the majority of significant US economic data releases occur.

European USA Market Session Over-lap

These are times when lots of trades happen, making it easier to find chances to make money.

For day traders, the best hours are when the London and USA sessions happen at the same time, and this is the busiest time for trades because there are a lot of transactions and the market is very active.

During this over-lap a substantial amount of economic news data is released generating a lot of price volatility & the prices move fast and there is plenty of opportunities to open trades, this over-lap offers the best market opportunity for those traders wanting to maximize profit.

The best hours for trading happen when markets overlap, because prices change a lot then and give clear signals, providing the best chance to make money.

This behavioral pattern explains why Asian traders, particularly those in Japan, defer initiating their order executions until the afternoon, as this timeframe aligns with the operational overlap of the European and US market sessions.

Asian traders skip XAUUSD in their session. Others should too, as even big funds wait. Liquidity picks up in US-UK overlap for better trades.

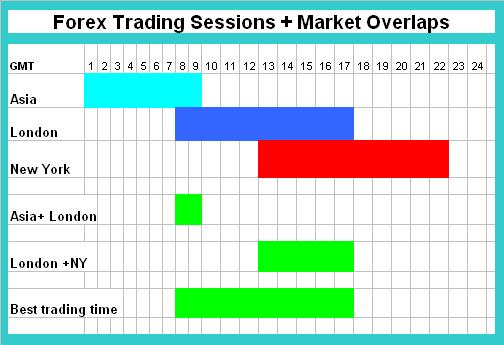

Thus, to optimize trading hours, one can consider the three active market sessions illustrated below.

Market Hours and Overlaps

The accompanying chart details the start and end times for each market session. It also illustrates periods where sessions overlap and highlights the most advantageous trading hours based on these overlaps.

Summary:

Determine Your Schedule

Your trader type sets your schedule. Little time? Go for longer-term plans. Lots of time? Try intraday trades during peak hours. Open XAUUSD positions then. The chart above lists best GMT times, from 8:00 to 18:00.

Determine your time frame

To setup a schedule you need to identify your chart time-frame. Try using different chart timeframes until you find the most appropriate & suitable/comfortable to use in accordance with your schedule.

Test your strategy

Try out your plan on a fake trading account for some time to gain experience. Keep a record of each trade and watch how your plan is doing. Try to figure out when your trading plan works best for you.

Your strategy should be specified on the trade plan that you use.

To gain further insight into how you can incorporate this into your plan, please study the tutorial regarding the XAUUSD plan. This learn XAUUSD tutorial will provide you with an example format that you can utilize to outline your schedule.

Get More Topics and Guides: