What's Inertia Trading Indicator? - Definition of Inertia Indicator

Inertia - Inertia indicators is a popular forex indicator which can be found in the - FX Indicators Listing on this website. Inertia is used by the traders to forecast price movement based on the chart price analysis done using this Inertia indicator. Traders can use the Inertia buy & Sell Trading Signals explained below to identify when to open a buy or sell trade when using this Inertia indicator. By using Inertia and other forex indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Inertia Indicator? Inertia Indicator

How Do You Combine Forex Indicators with Inertia? - Adding Inertia in the MT4 Software

Which Indicator is the Best to Combine with Inertia?

Which is the best Inertia combination for forex trading?

Most popular indicators combined with Inertia are:

- Relative Strength Index

- MAs Moving Averages Trading Indicator

- MACD

- Bollinger Band

- Stochastic

- Ichimoku Indicator

- Parabolic SAR

Which is the best Inertia combination for Forex trading? - Inertia MT4 indicators

What Indicators to Combine with Inertia?

Find additional indicators in addition to Inertia that will determine the trend of the market price & also others that confirm the market trend. By combining forex indicators that determine trend and others that confirm the trend and combining these technical indicators with FX Inertia a trader will come up with a Inertia based system that they can test using a demo account on the MT4 software.

This Inertia based system will also help traders to identify when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is Inertia Based Trading? Indicator based system to analyze and interpret price & provide signals.

What's the Best Inertia Strategy?

How to Choose & Select the Best Inertia Strategy

For traders researching on What is the best Inertia strategy - the following learn forex guides will help traders on the steps required to course them with coming up with the best strategy for forex market based on the Inertia system.

How to Make Inertia Strategies

- What is Inertia System

- Creating Inertia System Template

- Writing Inertia System Rules

- Generating Inertia Buy and Inertia Sell Trading Signals

- Creating Inertia Forex Trading System Tips

About Inertia Described

Inertia Analysis & Inertia Signals

Created and Developed by Donald Dorsey & was traditionally used to trade Stocks & Commodities market, before forex traders took it & started trading the market using this indicator.

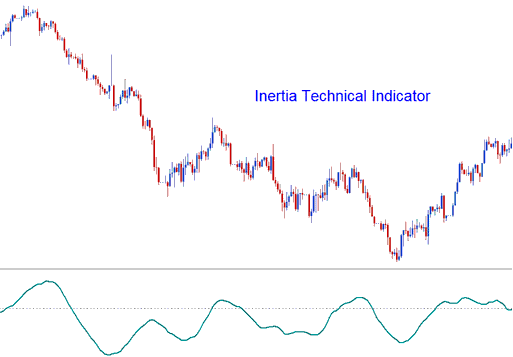

Dorsey chose to name it "Inertia" because of his interpretation of the price trend. He claimed that a trend is the overall result of inertia and thus it takes more energy for a trending market to reverse its direction than for it to continue heading in the same direction. Hence, a market trend is the measurement/gauge of the market inertia. This is an oscillator indicator that uses scale of zero to a hundred. Signals are generated/derived using the 50 level centerline crossover trading strategy.

In physics, the term Inertia is defined in terms of mass and direction of motion. Using the standard analysis, the direction of motion of the trend can be easily defined. However, the mass can't be easily defined. Dorsey claimed that the volatility of a financial instrument may be the simplest and the most accurate measurement of inertia. This theory led to the use of Relative Volatility Index RVI as the basis to be used as a price trend indicator. Hence Inertia is comprised of: RVI smoothed by linear regression.

Forex Analysis and Generating Signals

In trading the currency market using this trading indicator, the signals generated/derived are fairly simple to interpret. Below are 2 examples illustrated using forex charts showing how buy & sell trading signals are derived & generated using Inertia.

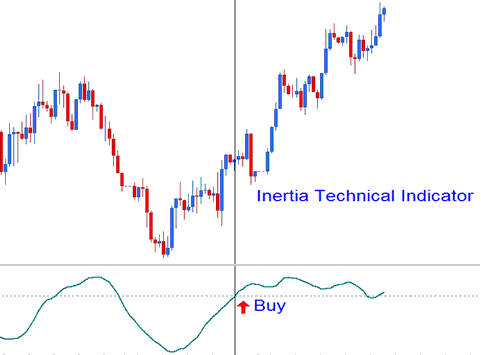

Upwards Trend - Bullish Buy Trading Signal

If the Inertia is above 50, positive inertia is indicated, this thence defines the long term trend as upward as long as the indicator remains above 50. When it crosses to levels below 50 then this is viewed as an exit trading signal. The chart below shows an example of how a buy signal is generated.

Up-wards Trend - Bullish Signal

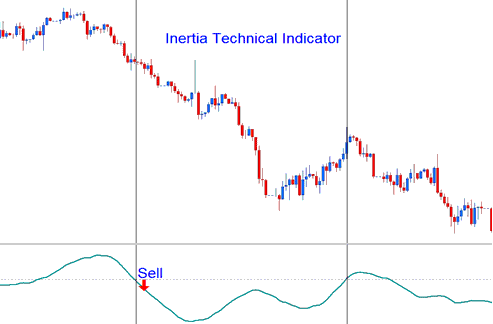

Downward Trading Trend - Bearish Sell Trade Signal

If the Inertia is below 50, negative inertia is indicated, this thence defines the long term trend as downwards as long as the technical indicator remains below 50. If it crosses above 50 then this is viewed as an exit trading signal. The currency chart below shows how a sell trading signal generated.

Downward Trend - Bearish Signal

Get More Tutorials & Courses:

- Multiple XAU USD Strategies That a Gold Trader Can Trade XAU USD with

- How To Open XAU USD Chart

- AEX 25 Technical Indicator MetaTrader 4 Trading Indicators

- Gold Maximum XAUUSD Leverage & Used XAU/USD Leverage

- Stochastic MACD RSI Index Trade Strategy

- S&PASX 200 MetaTrader 4 S&P ASX Name in MT4 Platform

- UKX100 Indices Trade Trade Strategy How to Create Indices Strategy for UKX100

- How to Add MACD on Forex Chart on MT4 Software Platform

- Technical Indicator Bull Power FX Technical Indicators MT4 Platform Software