What's ATR Indicator? - Definition of ATR Indicator

ATR indicator - ATR indicators is a popular technical indicator which can be found in the - FX Indicators Listing on this website. ATR indicator is used by the traders to forecast price movement depending on the chart price analysis done using this ATR indicator. Traders can use the ATR buy & Sell Trading Signals explained below to figure out when to open a buy or sell trade when using this ATR indicator. By using ATR and other indicators combinations traders can learn how to make decisions about market entry & market exit.

What's ATR Indicator? ATR Indicator

How Do You Combine Forex Indicators with ATR? - Adding ATR Indicator on MT4 Platform

Which Indicator is the Best to Combine with ATR?

Which is the best ATR indicator combination for trading?

The most popular indicators combined with ATR are:

- RSI

- MAs Moving Averages Indicator

- MACD

- Bollinger Bands

- Stochastic Trading Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best ATR indicator combination for trading? - ATR MT4 indicators

What Indicators to Combine with ATR?

Get additional indicators in addition to ATR indicator that will determine the trend of the price and also others that confirm the market trend. By combining indicators which determine trend and others that confirm the trend & combining these indicators with Forex ATR indicator a trader will come up with a ATR based system that they can test using a demo account on the MT4 software.

This ATR based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is ATR Indicator Based Trading? Indicator based system to analyze and interpret price and provide trade signals.

What's the Best ATR Strategy?

How to Select and Choose the Best ATR Strategy

For traders researching on What is the best ATR strategy - the following learn forex tutorials will help traders on the steps required to guide them with coming up with the best strategy for market based on the ATR indicator system.

How to Develop ATR Systems - Best Indicators Combination for ATR

- What is ATR Indicator Strategy

- Creating ATR Strategy Template

- Writing ATR Strategy Rules

- Generating ATR Buy and ATR Sell Trading Signals

- Creating ATR Indicator System Tips

About ATR Indicator Described

Average True Range - ATR Analysis and ATR Signals

Created and Developed by J. Welles Wilder

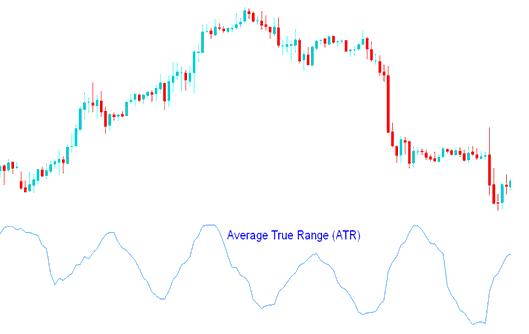

This indicator is an estimate of price volatility - it gauges the range of price movement for a particular price period. The ATR is a directionless indicator and it doesn't determine the direction of the Forex trend.

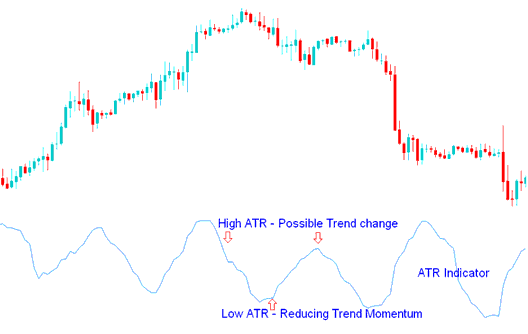

High ATR indicator values/readings

High ATR indicator values indicated market bottoms after a sell-off.

Low ATR indicator values/readings

Low ATR values showed extended periods of sideways price movement - Price Range/Sideways Market, like those found at the market tops and consolidation market periods. Low ATR indicator values/readings are typical for the periods of sideways range bound movement of long time duration which happens and occurs at the top of the market & during a consolidation.

Calculation

This trading indicator is calculated using the following:

- Difference between the current high and the current low

- Difference between previous closing price & the current high

- Difference between previous closing price & the current low

The final Average is calculated by adding these values and calculating the average.

FX Analysis and How to Generate Trading Signals

ATR indicator can be analyzed using the same principles as the other volatility technical indicators.

Possible trend reversal signal - The higher the value of trading indicator, the higher the probability of a trend change;

Estimate of the trend force - The lower the trading indicator's value, the weaker the trend move.

Analysis in Forex Trading

Learn More Topics & Courses:

- How to Use MetaTrader 4 Moving Average MA Moving Average Envelopes Indicator

- S&P Pip Calculation for S&P500 Indices

- MetaTrader 4 Online XAU USD MetaTrader 4 Brokers

- McClellan Oscillator Strategies Buy and Sell Trade Signal

- EURCAD System EURCAD Trade Strategy

- No Nonsense Pivot Points Buy and Sell Trade Signals Indicator

- How Can I Add FTSEMIB 40 in MT5 Mobile Trade App?

- How Do I Place T3 Moving Average on Chart?

- Introduction to FX Currency Pairs and Pairs Symbols

- Bollinger Percent B Forex Technical Analysis