S&P/ASX 200 Index

The ASX 200 index follows top firms on the Australian Stock Exchange. It uses the 200 biggest Australian companies. The index bases on their market value. It gets checked every quarter.

Although this index is based on capitalization, it does not track capitalization itself: rather, it monitors the changes in stock prices of the various individual stocks within the index.

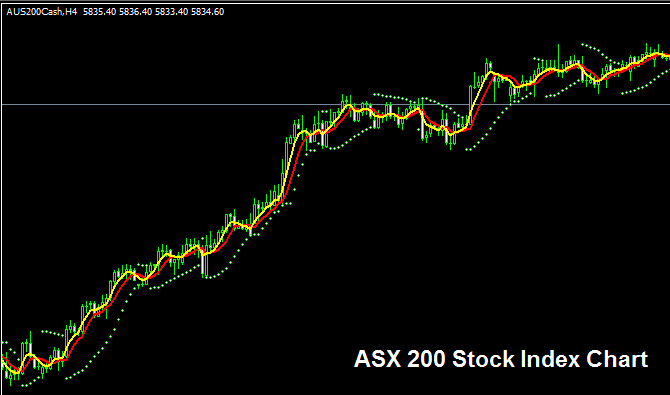

The ASX 200 Index Chart

The ASX 200 Index chart is shown above. On the illustration put on display above this trading instrument is named as AUS200CASH . As a fx trader you want to look for & find a broker that offers this The ASX 200 Index chart so that you can begin to trade it. The example above is of ASX 200 Index on the MetaTrader 4 Forex and Indices Platform .

Other Info about ASX 200 Index

Official Symbol - AS 51:IND

The ASX 200 Index is composed of 200 stocks selected from the largest Australian firms, ranked by their market capitalization. This index utilizes a specific baseline against which the aggregate market capitalization is calibrated. Furthermore, the calculation formula incorporates a divisor, ensuring that the stock index reflects movements based strictly on changes in share prices, rather than fluctuations in total market capitalization. Consequently, this index primarily displays variations in per-share pricing rather than the overall market cap. This mechanism operates because the base value represents the initial collective price of all shares, and the index calculation then monitors the total shift in those share prices.

Strategy for Trading ASX200 Index

The ASX 200 Index will in general move upwards because share prices always move upwards over time. This index generally moves up over the long-term because Australia economy also displays robust growth backed up by their mining industry that has great reserves of XAUUSD and other valuable commodities.

If you are a currency trader who wants to trade this index, the index will go up more quickly when the Australian economic numbers show faster economic growth.

As a stock index trader you want to be biased and keep buying as the stock index heads and moves upward. When Australian economy is doing well (most of the times it's doing well) this upwards trend is more likely to be ruling. A good trading strategy would be to buy the dips.

Contracts and Specifications

Margin Required for 1 Lot/Contract - AUD 70

Value per 1 Pip(Point) - AUD 0.1

Note: Even though the general and overall trend is in general upwards, as a forex trader you have got to factor in the daily market volatility, on some of the days the stock may & might oscillate or even retrace, the retracement might also be substantial sometimes and thence as a forex trader you need to time your trade entry precisely using this strategy: Indices strategy & at the same time use the appropriate/proper money management principles and guidelines just in case of more unexpected market trend volatility. About equity management techniques and guidelines lessons: What's money management and funds management techniques.

Learn More Topics and Tutorials:

- Calculate Value/Size of 1 Pip for FTSE 100 Index

- Consolidation Patterns in XAUUSD

- Forex Chande Trendscore EA: Setup Guide

- Using the Alligator Indicator in MetaTrader 4

- Using the Bulls Power Indicator in MT4

- Basic Study Tutorial for Newbies

- Want to add the Hull Moving Average to your chart? Here's what to do.

- Accumulation/Distribution – MetaTrader 5 Signal Analysis

- What's the strategy for trading the SPX500 index?

- Best gold leverage ratios for beginner traders