Nikkei 225 Index

The Nikkei225 Index is a stock market index for the Tokyo Stock Exchange Market in Japan. This stock index monitors the shares of the top 225 companies listed in the Tokyo Bourse.

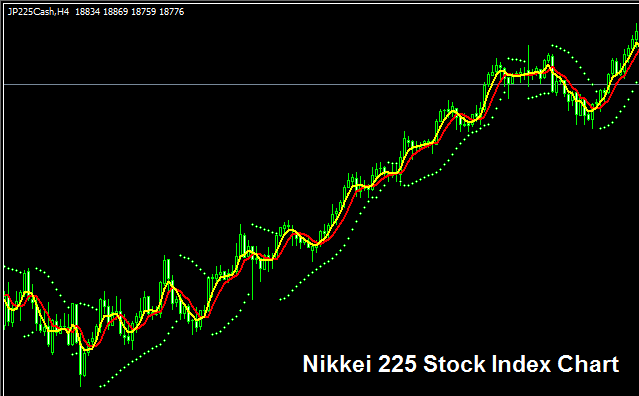

The NIKKEI 225 Index Chart

The NIKKEI 225 Index chart is showcased above. In this illustration, the index is designated as JP225CASH. Your goal as an FX trader is to identify and secure an online broker that furnishes the NIKKEI 225 Index chart for trading purposes. The image above specifically depicts the NIKKEI 225 Index on the MT4 FX and Stock Index Software.

Other Data about NIKKEI 225 Index

Official Symbol - NKY:IND

The NIKKEI 225 Index comprises 225 stock components, all selected from leading Japanese corporations. This index is closely monitored as a gauge reflecting the health and performance of Japanese enterprises. Its calculation employs a straightforward formula rooted in market capitalization.

Strategy for Trading NIKKEI-225 Index

The NIKKEI 225 Index indicates how the 225 biggest stocks in Japan are doing overall. Since this stock index follows 225 different businesses, its movements can be bigger compared to an index like the Germany DAX 30, which only watches 30 businesses.

As someone who trades currencies and wants to trade this index, it's usually more up and down, and even though it usually goes up over time, it goes up and down more than other stock indices. Your plan for trading should include the fact that it goes up and down a lot.

Japan's economy often stays strong. That supports an uptrend. A smart plan is to buy on pullbacks.

Contracts and Specifications

Margin Required Per 1 Lot/Contract - JPY 90

Value of 1 Pip(Point) - JPY 0.1

Note: Even though the general and overall trend is in general upwards, as a forex trader you have got to factor in the daily price volatility, on some of the days the stock may oscillate or even retrace, the retracement may also be substantial some times and hence as a currency trader you need to time your trade entry accurately using this strategy: Indices strategy and at the same time use appropriate and proper & suitable money management strategies and guidelines in case there's unexpected price market trend volatility. About equity management methods and guidelines lessons: What's money management and money management techniques.

Find More Lessons and Studies:

- Index Trade Strategies for Trading AUS200 Indices

- How Can I Use MetaTrader 4 DeMarks Range Extension Indices Technical Indicator?

- What's SMI20 Spreads? SMI20 Index Spread

- Moving Average MetaTrader 5 Technical Analysis in Forex

- How Can I Read Fibonacci Levels FX Trading System?

- HSI 50 Trade Strategies Course Tutorials

- Inquiry Regarding Account Types: Opening Micro, Mini, or Standard Gold Accounts

- US 100 MetaTrader 4 US 100 Name in MT4 Platform