How is Forex Used Margin Calculated?

Forex Used Margin

What is Used Margin? : amount of money in your trading account that has been already used up when buying a trade order, this forex order is the one that is displayed in open trades. As a trader you can't use this sum of money after opening a transaction order transaction because you have already used it and it is not available to you.

In other terms, because your broker has opened up a position for you using capital you've borrowed, you must maintain this usable margin for your account as a collateral so as to allow you to continue using this leverage that the broker has given you.

Example of How is Forex Used Margin Calculated on MetaTrader 4?

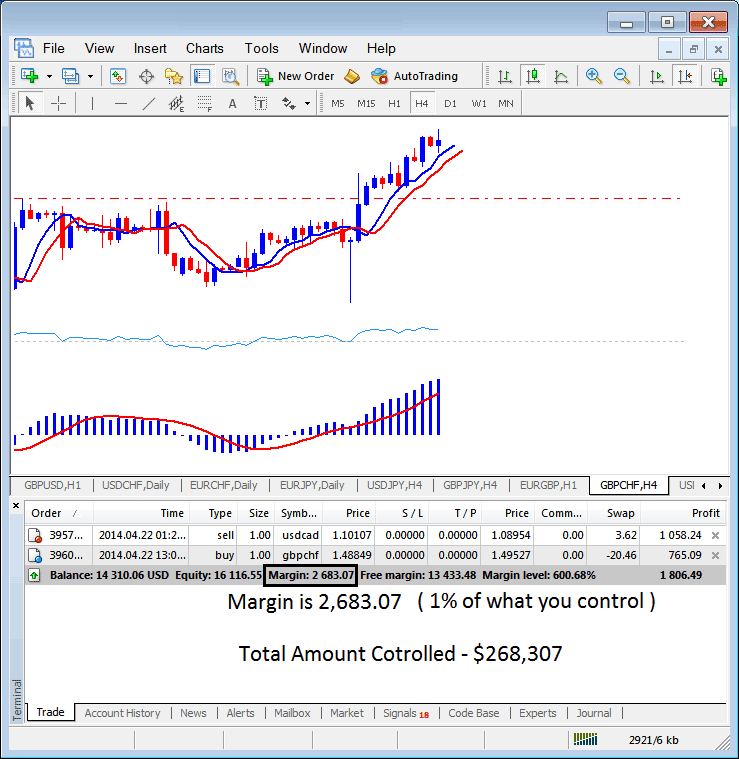

The forex margin examples in MetaTrader 4 below, the set leverage option is 100:1, the forex margin which is 1 % is $2683.07, hence the total sum controlled by trader is: $268,307 - this is because with this leverage a trader has used little of his money & borrowed the rest of the money, with this set at 100:1, the trader is using 1 % of their own capital, this 1 % is equivalent to $2683.07, if 1% is equal to $2683.07 then 100% is $268,307

MetaTrader 4 Leverage Margin Calculator - How is Forex Used Margin Level Calculated?

FX Used Margin - $2683.07

Forex Margin used to open trades on MetaTrader 4 examples above

To Learn More about FX Leverage and Margin - Read the Topics Below:

Forex Leverage & Margin Described