The EUROSTOXX 50 Index

The EURO STOXX 50 Index shows how the top 50 Euro Zone Stocks move. These stocks come from the Euro Zone's most profitable parts. The Top 50 Stocks are picked from different EU Zone countries. These 50 stocks are the easiest to trade in the Euro Zone. The countries Included total 12, which are:

- Germany

- France

- Netherlands

- Portugal

- Spain

- Belgium

- Finland

- Italy

- Austria

- Greece

- Ireland

- Luxembourg

The EUROSTOXX 50 Index is charted as a financial trading instrument, similar to currencies and stocks. This index can be traded in much the same way as currency charts.

You can study EUROSTOXX 50 Index moves with technical analysis and add other tools to its chart.

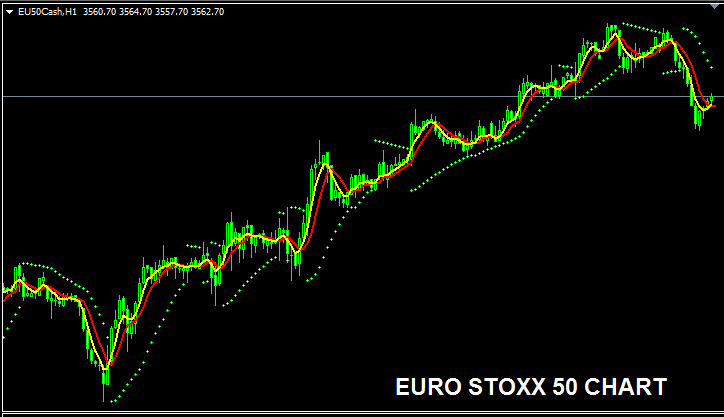

The EURO STOXX 50 Index Chart

The EUROSTOXX 50 Index chart is illustrated and shown below. On the illustration laid-out below this financial trading instrument is referred to as EU50CASH . As a forex trader you want to search and find a broker that offers the this The EUROSTOXX 50 Index chart so that you can begin to trade it. The example illustration put on display below is of EURO STOXX Index on the MetaTrader 4 FX & Stock Indices Trading Platform .

Just currencies a trader can use their own strategy or trading system to trade these indices the same way which they trade currencies. Traders can even use their EAs to trade these Stock Index.

Other Data about EURO STOXX 50 Index

Market Hours - 0900 to 1800 Central European Timezone

Official Symbol - SX5E or SX5E

The 50 stocks that make up the EUROSTOXX 50 Index are checked once a year to see if any changes need to be made.

Strategy for Trading EUROSTOXX50 Index

The EUROSTOXX 50 Index is made up of top-notch shares from the best areas in the Euro Zone, so a good way to trade the EUROSTOXX 50 Index is to mostly buy. This is because usually the best shares in Europe will generally keep going higher because the companies behind them are the best and make the most money in Europe.

The EURO STOXX 50 Index undergoes annual reviews, ensuring poorly performing stocks are replaced by better-performing ones. This adjustment helps the index maintain a steady upward trajectory over time.

As an index trader, you should favor a buying bias and continue to enter the market as the stock index rises. When European economies are robust, this upward trend is more likely to dominate. A prudent strategy would be to buy pullbacks.

Contracts and Specifications

Margin Required Per 1 Lot/Contract - €40

Value for a single Pip (Point) - 0. 1 euros

Note: The main trend heads up in general. Forex traders still face daily price changes. Stocks can swing or dip on certain days. Dips might grow large now and then. Time trades sharp with the Indices strategy. Apply good money rules for sudden price shifts in trends. Tutorials on money rules: What equity management covers and its methods.

Study More Subjects and Tutorials

- What Time is The Asian Session of FX?

- How to Add RSI to Your Trading Chart?

- What's DJ 30 Indices Strategy?

- Technique for Charting Downward Trend-lines in Forex Analysis

- Forex Courses List of Trading Analysis Course Tutorials

- SX 50 MetaTrader 5 SX 50 Trade Software Platform

- How to Become a Better Trader Through Trading FX Psychology

- Gann Trend Oscillator for Day Trade

- Gold MT4 Platform Download Lesson

- Linear Regression Slope Automated Forex Expert Advisor