Trendline Break

Following a protracted movement in one direction within the confines of a channel, the price eventually reaches a point where its motion within those bounds halts. This event signifies that the trendline has been breached.

Since the line is where the price finds support or resistance, we think the market will go in the opposite direction. When this happens, traders will close the orders they had previously bought or sold. This is what we call taking profit.

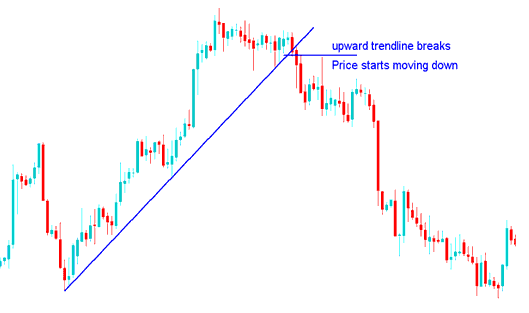

Up trend Reversal

When trading price breaks-out up-ward line (support) the market will then move down

The signal confirms with a lower high or lower low. It offers a chance to sell short after the break.

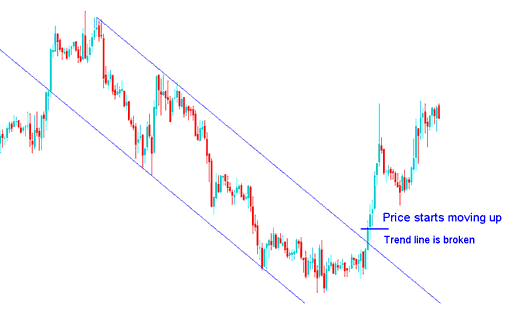

Down trend Reversal

When price breaks downward line (resistance) the market will then move up

Downward Channel break

A signal is deemed complete upon the formation of a higher low or higher high, which also presents a trading opportunity to go long once it is breached.

NB: Be aware that following a trend break, the price might enter a consolidation phase before proceeding in the new, opposing market direction. Regardless of the immediate path, it remains prudent to secure take-profit orders when the market's direction fundamentally reverses.

For a trader to execute this setup, upon initiating a new transaction in the direction indicated by a market trend reversal, the price should immediately move in that anticipated direction, manifesting as a price breakout. This implies the market must advance in the specified direction without encountering substantial corrective pressure.

If the market doesn't move right away after a price breakout, just close the trade. That usually means the trend hasn't actually changed yet.

An additional helpful suggestion is to wait until the established trendline is decisively breached, accompanied by a closing price definitively situated above or below that line to affirm the signal.

What often happens is that most traders start trades expecting a change even before the trend breaks, but the price only touches the line and the main market trend stays strong and keeps going in its current direction.

So, when trading this way, it's best to wait until the price has definitely broken through the trend line by closing above or below it, depending on which way the market is going.

- Upward Market Direction Reversal - this signal is confirmed once the market closes below this upward line, this should be the correct and right time to execute a sell short trade position, so as to avoid a whipsaw.

- Downwards Market Direction Reversal - this signal is confirmed once the market closes above the downwards line, this should be the correct and right time to open a buy long trade, so as to avoid a whipsaw.

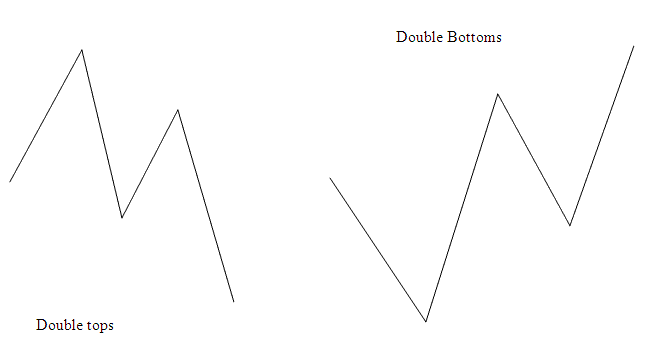

Combining with Double Tops or Double Bottom Chart Patterns

A good trade set up to combine this setup with is the double tops and double bottoms patterns. Read Double Tops and Double Bottoms Chart patterns Guide.

Form this setup before the trend break signal appears. Double tops and bottoms signal reversals too. Pairing them cuts whipsaw risks and boosts odds.

In the chart screenshots above, these setups can be verified to have formed even prior to the emergence of the reversal signal.

Initial Explanation Instances of Reversal in an Upward Direction - the chart pattern known as Double tops had already established itself prior to the appearance of the reversal signal setup on the chart.

Another Example of When the Price Changes to Go Up - the Double bottoms pattern had already appeared before the trend change signal showed up on the trading chart.

Double Tops or Double Bottom Combined with other Reversal Signals

Study More Subjects and Tutorials