SMA, EMA, LWMA & SMMA

There are 4 types of moving averages MAs:

- Simple moving average MA

- Exponential moving average

- Smoothed MA

- Linear weighted moving average

The variation among these four moving averages lies in the weight assigned to the most recent price data.

SMA Indicator

The XAUUSD SMA indicator gives all data the same importance when finding the simple moving average, and it does this by adding up the price periods of a chart and then dividing this total by the number of gold price periods. For example, simple moving average 10 adds price data from the past 10 periods and divides it by 10.

EMA Indicator

The XAUUSD EMA indicator gives more importance to recent price info. It's figured out by giving the newest trading prices more weight using a multiplier to emphasize current market price data.

LWMA Trading Indicator

XAUUSD LWMA indicator moving averages applies more weight to the most recent price data and the latest data is of more value than earlier gold price data. Linear Weighted MA(Moving Average) is calculated by multiplying each of the closing prices within the series, by a certain weight coefficient.

SMMA Indicator

The XAUUSD SMMA Indicator is computed by applying a smoothing factor of N, which consists of N smoothing for N price bar periods.

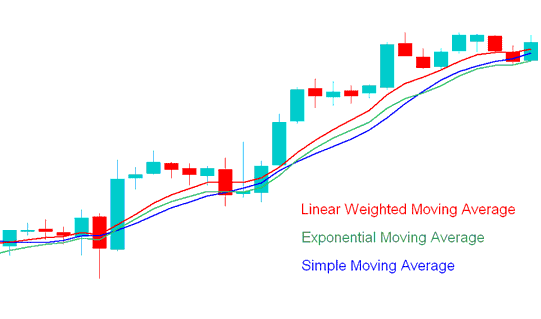

The chart example immediately following depicts the SMA, EMA, and LWMA. The SMMA moving average is generally less prevalent and thus is omitted from this specific illustration.

The LWMA indicator responds most rapidly to gold price data, followed by the EMA, and then the SMA.

SMA, LWMA, EMA - Types of MAs - SMA, EMA and LWMA

Day XAUUSD with Exponential & Simple Moving Averages

SMA and EMA are top moving averages for XAUUSD. EMA uses a smarter calc method, so it gains more fans than SMA.

Simple Moving Average is the arithmetic average of the closing prices in price period based on the set timeframe period where each timeframe period is added and then it is divided by the number of time gold price periods chosen. If 10 is price period used price for the last 10 price periods added up then it is divided by 10.

The SMA technical indicator represents a simple arithmetic mean. Traders often associate it with detecting trends because of its ability to closely follow price movements, such as gold prices.

EMA adds a speed factor, so it reacts faster to price changes.

The SMA average is shown in graphs to study how gold prices change. If the price changes for more than 3 or 4 gold price periods with the SMA, it means that long trade positions should be closed right away and the buy trade's strong push is fading.

A shorter lookback period for the Simple Moving Average (SMA) results in a quicker reaction to fluctuations in the price of gold. The SMA indicator is instrumental in conveying direct current information about the market's prevailing trend and its intensity, determined by observing its angle. A steeper, more defined slope on the SMA suggests a more robust trend.

The Exponential Moving Average is utilized by many in a similar fashion, but it responds more swiftly to fluctuations in the market, making it the favored choice for some gold traders.

The SMA and EMA can also be employed to pinpoint precise entry and exit points within XAUUSD trading. These Moving Averages can be used in conjunction with Fibonacci tools and the ADX indicator to secure corroboration for signals generated by the MAs.

Access Further Subjects and Learning Materials:

- How to Trade DAX 30 Lesson Guide for Trading DAX30 Indices

- How to Find the SX 50 Index Trade Chart in MT4

- Stock Indices Strategy for Trading HSI50 Indices

- Use Chande QStick Indicator in MT4 Charts

- DJ 30 Pips Count for DJ30 Stock Market Indexes

- The FX Morning Trades are The Most Traded Times in FX

- Study FX Stochastic System for Opening Trades

- How Do You day trade Stock Index Over-bought & Oversold Levels?

- How to Trade Classic Bullish Trade Divergence & Bearish Trade Divergence on Gold Charts

- Reviews Listing for FX MT4 Brokers