How Do I Calculate XAUUSD Gold Margin Requirement in XAUUSD

Now if Your Leverage is 100:1

If you have $1,000 and borrow at 100:1 for XAUUSD, you purchase one standard lot worth $100,000, making your margin the $1,000 in your account, which is the money you risk if the trade goes wrong. The broker loans the other $99,000 and ends the trade when your $1,000 runs out.

However, this is only true if your broker has configured the Margin Requirement to 0% before forcibly liquidating your trade positions.

Set a 20% rule to auto-close positions. For XAUUSD, trades shut when balance hits $200.

For 50% prerequisite of this level before closing out your transactions mechanically/automatically, then your xauusd transactions will be closed once your balance gets to $500

If they set 100% requirement of this level before closing out your open trade positions mechanically/automatically, then your trade will be stopped out once your balance gets to $1,000: Meaning the trade transaction will close out as soon as you the trader executes it because even if you pay a 1 pip spread then your account balance will drop to $990 dollars and the needed margin % is 100% i.e. $1,000, therefore your open trade positions will immediately get closed out.

While the majority of brokers don't mandate a 100% margin, some do, and those setting requirements at 100% or 50% are completely unsuitable for you. Opt instead for brokers requiring a 20% margin: brokers with this 20 percent margin level are often superior because they significantly lower the probability of your active positions being stopped out, as evidenced in the examples below.

To know about this margin level which is calculated by your MT4 automatically - the MetaTrader 4 Platform Software will indicate this as "Gold Margin Requirement", This will be shown as a percentage the higher the margin percentage the less likely your open positions are to get closed.

For Examples if - for a broker requiring 20% margin requirement

Using 100:1 leverage

If trading leverage is 100:1 & you transact 1 Mini Lot, equals to $10,000 dollars

$10,000 (mini lot) divided by 100:1, used capital is $100

Calculation:

= Capital Used * Percentage

Equals $1,000 divided by $100 multiplied by 100%:

XAUUSD Margin Requirement = 1000%

Investor and Trader has 980% above the margin required amount

Using 10:1

If leverage is 10:1 & you transact 1 Mini Lot, equals to $10,000

$10,000 (mini lot) divided by 10:1, used capital is $1000

Calculation:

= Capital Used * Percent

Equals $1,000 times the percentage

XAUUSD Margin Requirement = 100%

Investor and Trader has 80% above the margin required amount

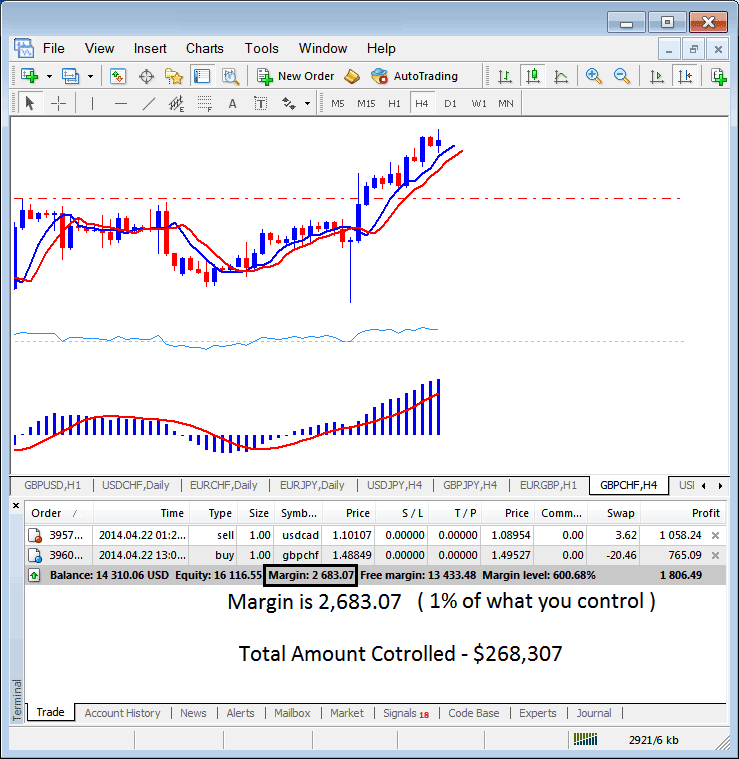

The margin example presented below demonstrates that with a leverage set at 100:1, the required margin is 1%, which totals $2,683.07. As a result, the total amount managed by the trader is $268,307. This occurs because, with this leverage, the trader has employed a small fraction of their own capital and borrowed the rest. With a leverage ratio of 100:1, the trader is utilizing 1% of their trading capital, which is $2,683.07. If 1% corresponds to $2,683.07, then 100% translates to $268,307.

Calculating Margin Requirements for Gold: How to Determine the Necessary XAUUSD Gold Margin in XAUUSD

Study More Lessons & Tutorials: