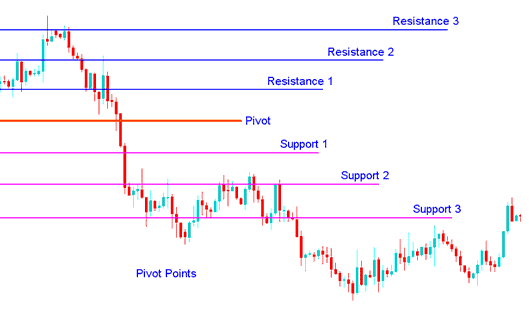

XAUUSD Pivot Points

Pivot points is a set of indicators created by floor traders in the commodities markets to ascertain the potential turning points, also referred to as "pivots". These points are calculated to determine levels in which the sentiment of the trend could change from "bullish" to "bearish." traders use these points as markers of support & resistance.

these factors are calculated because the average of the excessive, low and near from the previous session:

XAUUSD Pivot Point = (High + Low + Close) / 3

Day traders use the pivot points that are figured out to find good spots for entries, stops, and taking profit, by guessing where many other traders might do the same.

A pivot point is a price level of significance employed in the technical analysis of a financial trading market, utilized by online traders as a predictive indicator of future price trajectory. It is calculated by averaging the significant prices (high, low, and close) from the market's performance during the preceding trading interval. If prices during the subsequent period trade above this central point, it is generally interpreted as a bullish indication: conversely, price movement below the center point suggests bearish sentiment.

The main point is used in figuring out more levels of support and resistance, both lower and higher than the main point, by either taking away or adding the price differences figured out using the past trading ranges.

A pivot point, along with its corresponding support and resistance levels, frequently serves as a turning point for price movement direction in the market.

- In an up trend, the pivot point & the resistance zones may represent a ceiling level for the price. If price goes above this level the upward trend is no longer sustainable and a trend reversal may & might occur.

- In a downtrend, a pivot point & the support levels may represent a low for price level or a resistance to further decline.

The valuable pivot can then be utilized in calculating the guide and resistance stages as follows:

Pivot points include a main central level. Below it sit three support levels. Above it lie three resistance levels. Floor traders on stock and futures markets first used them. They offered a fast way to gauge daily market moves with basic math. Over time, these points have helped traders in many other markets too.

One reason they're popular now is that they are seen as a "leading" (or telling the future) tool and not one that follows behind to tell you what already happened. To figure out the pivot points for the next trading day, all you need is the high, low, and close prices from the day before. The 24-hour cycle pivot points in this tool are found using these formulas:

The crucial pivot then can be used to calculate the help and resistance ranges as follows:

Resistance 3

Resistance 2

Resistance 1

Pivot Point

Support 1

Support 2

Support 3

Pivot Points Support and Resistance Areas

Pivot Point as a tool

The pivot point level itself is a level where there is a lot of resistance or support, depending on how people generally feel about the market. If the market does not have a clear direction, prices will often change a lot around this point until the price goes up or down a lot. Prices above or below the center point show that people generally feel the market will go up or down, accordingly. This indicator is something that tells you what might happen, giving market signs of possible new highs or lows in a specific time period on a chart.

Use support and resistance from the central pivot and prior range as exit points for trades, not entries. In an uptrend that breaks the pivot, aim for the first or second resistance to close. The odds of a pullback grow at each resistance area.

In pivot-point analysis, there are usually 3 levels seen above and below the main point. These are found using the price range from the last period, added to the main pivot point for resistance levels and taken away for support areas.

Pivots Points

Pivot points can be used in quite a few different ways when trading. Here are some of the most typical ways to use them:

Trend Direction: When used in conjunction with supplementary analytical inputs, such as oscillators measuring overbought/oversold conditions or volatility metrics, the central pivot point can prove instrumental in discerning the overarching directional bias of the price trend. Trade positions ought to be initiated exclusively in alignment with the prevailing market direction. Buy trade positions are only authorized when the asset price is situated above the established center point, while sell trades are only executed when the price falls beneath these central pivot references.

Price Break Outs: When prices break out, a signal to buy happens when the price goes up past the middle point or a point where prices often stop rising (usually Resistance Area 1). A signal to sell happens when the price goes down past the middle point or a level where prices often stop falling (usually Support Zone 1).

When trends change: In trend changes, a buy signal happens when the price goes toward a support zone, gets very close to it, touches it, or goes just past it, and then turns around and begins going in the other direction.

To download this Pivot points Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

After you download the indicator, open it in the MQL4 Language Meta-Editor. Press the Compile button to build the indicator. It then loads into your MT4.

A quick note: If you add a specific technical indicator to your MT4, you may notice some additional lines called Mid Points. To remove these extra lines, open the MQL4 Meta Editor using the F4 shortcut, and modify line 16 accordingly.

Extern bool mid-pivots = true:

To

Extern bool mid-pivots = false:

Then Click Compile button again, & the technical indicator will then appear such as illustrated on www.tradeforextrading.com website.

Get More Topics:

- Instruction on Incorporating the Volumes Indicator onto a Forex Chart in MT4

- MACD MT5 Forex Chart Indicator

- Exploring Bollinger Percent B Bot EA for FX Trades

- XAU USD Templates on Trading Charts Menu in the MT4 Trading Software

- Which FX Brokers Trade DowJones30?

- Identification of Alligator Buy and Sell Signals in Forex Trading

- Using MetaTrader 5 Forex Software for FX Trading

- What various types of risks exist in Forex?

- Inquiry Regarding the William % R Indicator's Functionality

- Day XAU USD System