Explain What is Leverage? Explain What is Gold Margin?

Leverage is defined as the capacity to command a substantial amount of capital by employing only a small portion of one's own funds and borrowing the remainder - a characteristic that significantly contributes to the market's appeal for numerous traders.

Start with leverage in this guide. Then cover margin to learn calculations.

Example:

We use this example to explain leverage. If your broker offers a 100:1 ratio, pick it as the highest for your account.

This means you borrow $100 for each one dollar you have in your account.

To put it simply, your trading company lends you $100 for every $1 you have in your account. This is known as using leverage.

For instance, if you open a trading account with $1,000 and opt for a leverage ratio of 100:1, every $1 in your account controls $100. In total, you will be managing the equivalent trading power of:

If for $1 the broker gives and provides you 100

Then if you have 1,000 you will get a total of:

$1,000 * 100 = $100,000 dollars

Now you control $100,000 of Investment

Many new traders wonder about the ideal leverage for accounts with $1,000, $2,000, or $5,000. The best option when creating a live account is 100:1 leverage instead of 400:1.

What's Gold Margin?

Gold Margin refers to the requisite capital demanded by your broker to permit you, the trader, to continue engaging in trading activities utilizing leveraged funds.

Alternatively articulated, the query concerning margin required for XAU/USD is defined as the capital necessary to secure active trade positions, often expressed as a percentage. For a 100:1 ratio, as illustrated previously, you gain control over an asset value equivalent to $100,000.

Can you compare a trader or investor who puts in $1,000 with another one who puts in $100,000? Of course, you cannot. Here is how it happens: it changes you from the investor who puts in $1,000 to the one who puts in $100,000. Where does the extra money come from? You, as a trader, borrow it from your online xauusd trading broker, and this is called Leverage. You borrow this money against the $1,000 of your own money that you, as a gold trader, put with your broker. If you wanted to show what this leverage means, it is the power to control a lot of money by using a small amount of your own money and borrowing the rest. Without this leverage, trading would not be as profitable: you can still choose not to use leverage and use the 1:1 leverage option, but you would not make much money, and it would take too long to make any trading profits.

Example of how to calculate leverage & margin:

The XAU/USD Margin needed here is $1,000 (your own money) if we say it's a part of $100,000 dollars in your account that you now control, it looks like this:

If leverage = 100:1

1,000 / 100,000 * 100= 1 %

Margin required = 1%

(1/100 *100= 1 %)

'Forex Trading - Could you offer a simplified explanation, as I currently identify as a Beginner Trader?'

(To simplify: If your equity is $1,000, employing leverage allows you to control $100,000 - what percentage is $1,000 of $100,000? It's 1%.) That 1% represents the required margin allocation for your trading account.

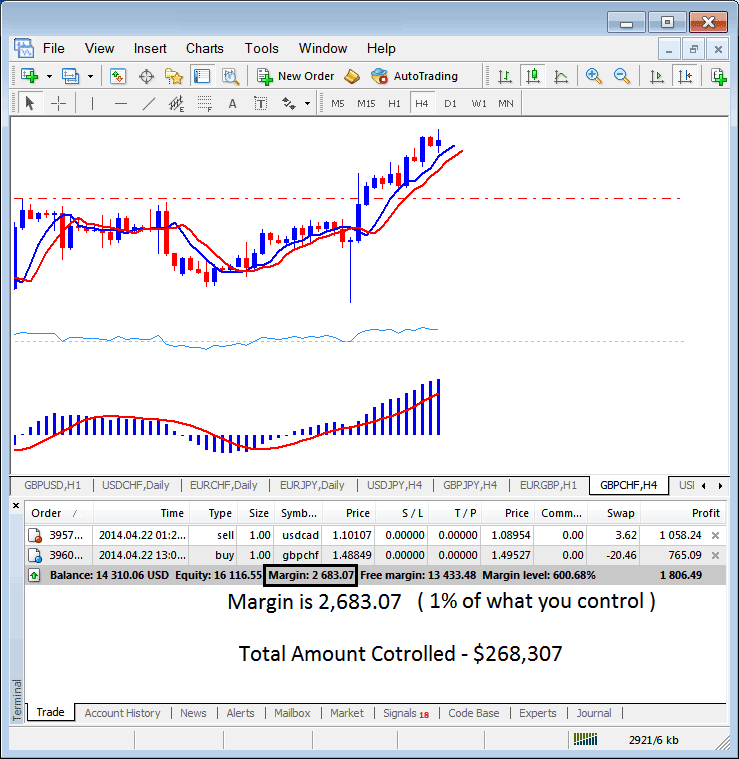

In the margin example below, leverage sits at 100:1. The 1% margin comes to $2683.07. The trader controls $268,307 total. Leverage lets them use just a bit of their own cash and borrow the rest. At 100:1, 1% of capital equals $2683.07. So full 100% hits $268,307.

MT4 Transactions Window Panel - Leverage and Margin Explained

- If = 50:1 Leverage

Then margin requirement = 1/50 *100= 2%

If you have $1,000,

1,000* 50 = $50,000.

1,000 / 50,000 * 100= 2 percentage

(Simply put, if you have $1,000 and use leverage, you control $50,000 - what percentage of $50,000 is $1,000? - it's 2%), which is your account's margin requirement.

- If = 20:1 Leverage Ratio

Then the margin requirement = 1/20 *100= 5 %

If you've got $1,000 dollars,

1,000* 20 = $20,000.

1,000 / 20,000 * 100= 5 %

Simplify: your capital is $1,000. With leverage, you control $20,000. So $1,000 is 5% of $20,000. That is your margin need.

- If = 10:1 Leverage

Then the requirement is = 1/10 *100= 10%

If you have $1,000,

1,000* 10 = $10,000.

1,000 / 10,000 * 100= 10%

(Simplify - Your equity sits at $1,000. After leverage, you handle $10,000. $1,000 is 10% of that. That's your margin need.)

What's the difference between maximum leverage and the leverage you're actually using?

Note the gap between max leverage from your broker and the leverage you use. Max is the highest your broker allows. Used leverage ties to your open lot sizes. The example above explains this point.

If your broker gives you a 100:1 Maximum Leverage Ratio, but you only trade $10,000, then your Used Leverage is:

$10,000: $1,000 (your money)

10:1

You are using 10:1 Leverage, but you can use up to 100:1 Leverage. This means that even if you can use 100:1 Max Leverage Ratio or 400:1 Max Leverage Ratio, you don't have to use it all. It's best to keep your leverage at 10:1, but you will still pick 100:1 max leverage ratio for your account. The extra leverage will give you, as a gold trader, what we call Free Margin. As long as you have Free Margin in your account, your trades won't be stopped by your broker because the margin will stay above the needed amount.

When it comes to gold trading one of your rules: money management rules & guidelines on your trading plan should be to use leverage below 5:1.

In the screenshot examples, the trader uses $2683.07. Total control is $268,307. Trading equity sits at $16,116.55. So leverage is $268,307 divided by $16,116.55, which equals 16.64 to 1.

16.64 : 1 Used Leverage Ratio

XAU/USD Margin accounts allows traders to control a large amount of xauusd units using little of their own while borrowing the rest

Acquiring this account status grants you the facility to secure borrowed funds from the brokerage for leveraged trading in commodities like gold lots.

Your account's borrowing limit is called XAUUSD leverage. It shows as a ratio. A 100:1 setup lets you handle assets 100 times your deposit size.

What this means in Gold terms is that with 1% margin in your trading account you as a gold trader can control a position worth $100,000 with $1,000 dollars deposit.

However, this kind of account increases the chance of making money and losing money. You can't lose more than you put in: losses stop at your deposits, and brokers will usually end a trade that goes past your deposit by using a margin call. Traders should always try to keep their margin level higher than what's needed by using money management rules and keeping their leverage below 5:1.

Study More Lessons and Guides:

- List of Top 100 Index Brokers

- JP225 Stock Index: Strategies in Action

- How to use the Triple Exponential Average (TRIX) indicator on MetaTrader 5

- Using MetaTrader 5 Linear Regression for Advanced Trading

- How do you analyze MACD for indices? What's the best way to use the MACD indicator?

- RSI XAU/USD Indicator Divergence: Spotting RSI Divergence in Gold Trading

- Finding a Sample XAU/USD Trading Plan Template

- Average Spread on EURO STOXX50