What happens to Bitcoin price after reverse head and shoulders pattern

Inverse Head & shoulders BTCUSD Pattern

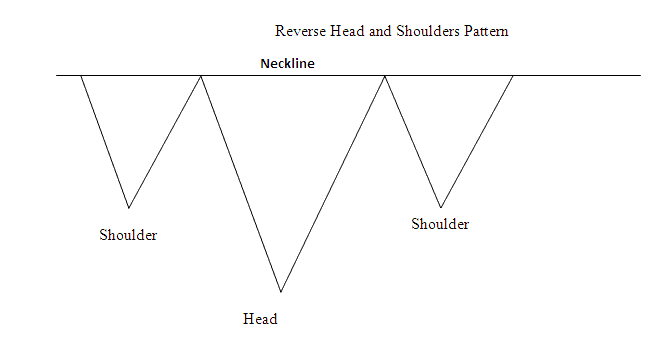

The Inverse Head and Shoulders is a reversal pattern in bitcoin charts. It forms after a long downtrend. It looks like an upside-down head and shoulders.

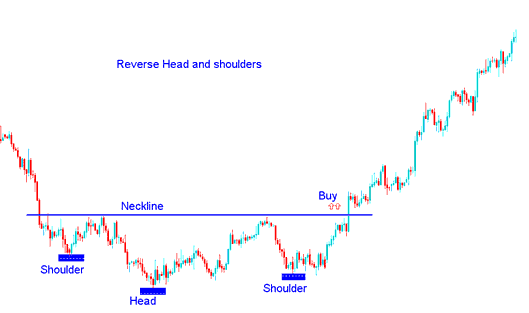

An Inverse Head and Shoulders pattern in BTC/USD cryptocurrencies is confirmed once the price breaks above the neckline formed by connecting two peaks between the shoulders in this reversal setup.

Utilizing this reversal pattern, traders initiate buy positions once the Bitcoin price concludes its movement above the neckline.

Summary:

- Inverse Head & Shoulders Bitcoin Setup forms after an extended move downward

- Inverse Head and Shoulders Bitcoin Pattern reflects that there will be a reversal in btcusd trading market

- Inverse Head & Shoulders Bitcoin CryptoCurrency Pattern setup resembles up-side down, thus its name Inverse Head and Shoulders Bitcoin Setup.

- We buy when bitcoin price breaks out above neckline: as described on the example illustrated below.

Potential Price Action Outcomes for Crypto Following the Formation of a Reverse Head and Shoulders Pattern in Bitcoin

Examples of Inverse Head & Shoulders Bitcoin Currency Pattern Setup on a BTCUSD Chart

How to Interpret and Analyze the Inverse Head & Shoulders Crypto Pattern

Pick up new lessons and courses

- How to Trade Hidden Divergence Trade Signal

- Bear Power Technical BTC USD Trading Indicator

- BTC USD Portfolio Excel Spreadsheet Download

- Day Trading Bitcoin Trend-Lines BTC USD Trading Plan

- BTC USD Equity Management Rules for Bitcoin Traders

- Example of How to Analyze Trend Signal with This How to Interpret and Analyze Signal Strategy

- Steps to Open a Real MT4 Account in the MT4 Platform

- How to Set Up the MT4 Platform for BTC/USD Trading on MAC.

- Commodity Channel Index Bitcoin Trading Indicator Analysis

- What's the Difference between Sell Stop BTC USD Order & Buy Limit BTC USD Order?