What are the Fibonacci Retracement Levels?

Definition of Fibo Retracement Areas

The Fib Retracement Levels technical indicator is a popular Bitcoin tool used by many cryptocurrency traders to identify Bitcoin price retracements, sometimes referred to as Bitcoin price pullbacks.

Fib Retracement Levels is a way to study lines when trading bitcoin to predict and figure out the possible areas where bitcoin prices may pull back.

Fib Retracement Levels indicator is placed directly on the cryptocurrency chart within the bitcoin platform provided by your cryptocurrency broker, This Fibo Retracement Levels indicator will then mechanically calculate these retracement bitcoin price pull-back levels on the bitcoin chart.

What are the Fibonacci Retracement Levels? - What is Fibo Retracement?

- 23.6 % BTCUSD Fibo Retracement Areas

- 38.2% BTCUSD Fibonacci Retracement Areas

- 50.0 % BTCUSD Fibo Retracement Areas

- 61.8% Fibonacci Retracement Areas

Traders often use 38.2% and 50.0% Fibonacci Retracement levels. Bitcoin price usually pulls back to these spots. The 38.2% level is the top choice in bitcoin trading.

The 61.8% Fibonacci retracement level is frequently employed to establish stop losses for trades executed through this BTC/USD retracement trading strategy.

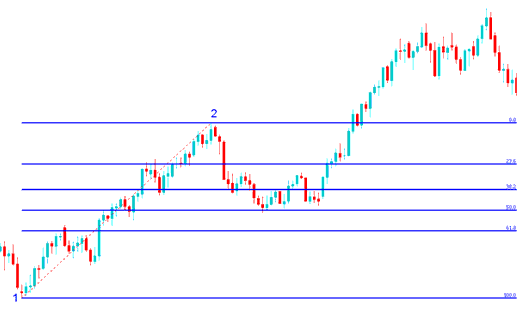

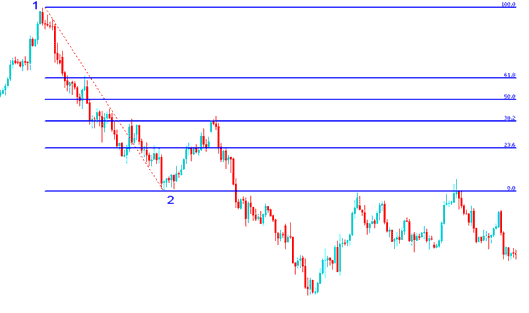

This Fib Retracement Levels tool is drawn in direction of the btcusd trend like shown in the two examples below.

What are BTCUSD Fibo Retracement Levels?

Fib Retracement Areas on Upwards Trend

What are BTCUSD Fibonacci Retracement Levels?

Fib Retracement Areas on Downward Bitcoin Trend

Learn More Guides:

- What's Morning Star Bitcoin Candlesticks in BTC USD Trade?

- How Do I Login in to MetaTrader 5 Account?

- How to Place a BTCUSD Market Execution Order on MT4 Platform

- BTC USD Price Action Continuation Patterns on BTC USD Charts Described

- How Do I Sign up a MT4 BTCUSD Account?

- How Do I Draw Downwards Trend line in MT5 Platform?

- How Do I Analyze When a BTCUSD Upward Trend is Starting?

- How Do I Draw Upward BTCUSD Trend Lines in MT4 Platform/Software?

- How to Calculate BTC USD Trade Pips in BTC/USD Charts

- How Do You Add Trading CCI Technical Indicator in Trade Chart?