Stop loss orders for Bitcoin - key points to remember before you place one.

For Bitcoin stop losses, avoid spots too close or far. Skip exact support or resistance levels.

A few pips (points) below the support or above the resistance levels is the optimal location.

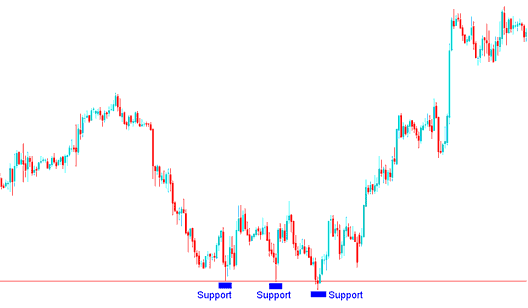

If you plan to buy a bitcoin tool, find a support level that is close to your entry point but lower, and then put your order about 10 to 20 pips below that level. The example here shows where you can place your stop loss orders just below where the support is on a bitcoin chart.

Support Level for Placing Stop Loss Bitcoin Order Level for a Buy Trade

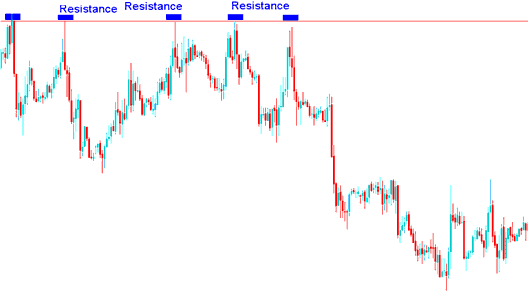

If you're planning to go short - basically, betting against a bitcoin instrument - just find a resistance level that's above where you enter the trade. Set your stop order about 10 to 20 pips above that resistance. In the example below, you can see exactly where to place your stop, just above resistance on a bitcoin chart.

Resistance Level for Placing Stop Loss Bitcoin Order Level for a Sell Trade

Use Stop Loss Crypto Orders to Secure Profits Not Just Cut Losses

The good thing about a stop loss order for cryptocurrency is that you don't have to check the btcusd market every day to see how it's doing. This is really helpful if you can't watch your trades for a long time, or if you want to go to sleep after trading all day.

A drawback is that the price of bitcoin designated for these stop orders might be triggered by brief, short-term swings in the bitcoin price. The crucial element is selecting a stop-loss order percentage that permits intraday fluctuations in the bitcoin price while simultaneously limiting downside risk exposure.

These orders are fundamentally conceived as a means to restrict potential losses, accounting for their name. An additional application for stop-loss orders is to secure accrued gains, a function known as a trailing stop-loss order.

A trailing stop order is placed at a certain percentage below the current bitcoin price in the market. This trailing level then moves as the trade goes on. Using a trailing stop loss lets you keep making money, but also makes sure you get some profit if the btcusd market changes direction.

These types of orders can also be used to take away risk if a Bitcoin trade starts making money. If a trade makes a good amount of money, the stop loss can be moved to the starting point, which is where you started the buy, making sure that even if the trade goes the other way, you won't lose money: you'll just break even on that trade.

Trailing stop orders are used to make the most money and protect it as the bitcoin price rises, and to limit losses when it falls.

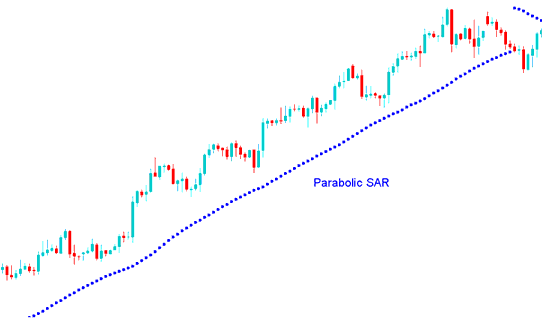

A practical illustration involves using the Parabolic SAR Crypto Indicator and consistently adjusting your stop order to align with the current parabolic SAR level.

Parabolic SAR Indicator for Setting Trailing StopLoss Crypto Order in Crypto

For instance, a trader may adjust their stop loss by a fixed amount of pips after a few hours, or perhaps after one hour or even every 15 minutes, depending on the timeframe of the Bitcoin chart they are utilizing.

In the above example the parabolic SAR which had a setting of 2 and 0.02 was used as the trailing stop loss order for the above chart. The trader would have kept shifting the trailing stop loss level upwards after every SAR was drawn until the moment when the Parabolic SAR indicator was hit and the bitcoin trend reversed.

Conclusion: A stop order is a simple tool, but many traders don't use it. It can help you avoid big losses or protect your profits, so almost every trading style can benefit from it.

Key Points to Remember When Setting Stop-Loss Orders

Remember these important things:

- Be careful with the points and levels where you put these stop loss orders. If bitcoin normally fluctuates 20 points, you do not want to put your stoploss order too close to that range else you'll be taken out by the normal market volatility

- Stop Loss Bitcoin Orders take the emotion out of a trading decisions & by setting one you set a predetermined point of exiting and getting out of a losing position, meant to control losses.

- Traders can always use indicators to calculate where to set these regions, or use the concepts of Resistance & Support to decide where to set these stop loss orders. Another good indicator used to set these stop loss order orders is the Bollinger bands where traders use the upper & lower band as the limits of bitcoin price therefore putting these orders outside the bands.

Learn More Lessons:

- Fibonacci Extension Levels vs Fibonacci Pullback Levels Lesson

- How to Interpret and Analyze BTC USD Signal of a Bear Flag Pattern

- Where Can I Find BTC USD Quotes on the MT4 Trade Platform?

- How to Trade Various & Different Types of Trade Candlestick Patterns

- How Do I Analyze MT4 Upwards Channel on MT4 Platform for Trading?

- How Do You Trade BTC USD & Place a Pending BTC/USD Order on MT5 iPhone App?

- BTC USD Trade Tools & Methods

- MACD BTC/USD Trading Indicator

- When Should You Not Trade BTC USD?

- How to Use BTC USD Trade Platform/Software Workspace