Stochastic Bitcoin Indicator Over-bought & Over-sold Levels

The stochastic oscillator is used to find signals for when something is overbought or oversold. Overbought is above 80%, and oversold is below 20%.

The trick isn't just to watch the Stochastic oscillator when the %K or %D lines hit overbought or oversold. You want to pay attention when they cross those levels and then move back through.

Similar to other momentum indicators used in Bitcoin trading, such as the RSI cryptocurrency indicator, the Stochastic oscillator indicator retains the capacity to remain within its overbought and oversold zones for extended durations. When this Bitcoin trading Stochastic oscillator maintains its position within these extreme boundaries for a prolonged period, it signals either a robust upward trend (overbought condition) or a vigorous downward trend (oversold condition) in Bitcoin.

When stochastic lines cross back below or above where things are bought too much or sold too much, it often suggests that a bitcoin trend is going to change.

A trader may seek additional bitcoin signals to enhance the reliability of oversold or overbought levels if:

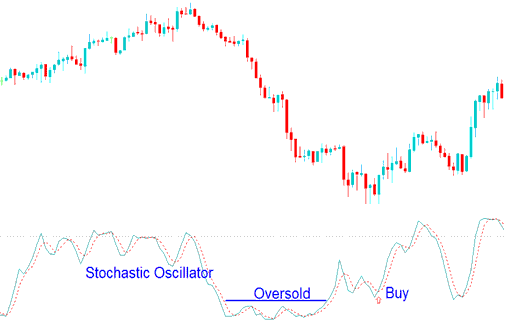

Buy Bitcoin Using Technical Oversold Signals from Stochastics

- Prior to Buying, the %K & %D lines turn upward from below 5%.

- A reading that is floating near 5% means that bitcoin trading bears are in control and there is selling of bitcoin crypto. A trader should wait out for the Stochastics Oscillator Technical to move back above 5% as a sign that the selling pressure is easing.

A buy signal appears when the stochastic oscillator crosses above the low zone. It dips back but bounces up quick without lingering.

Buy Signal Using Stochastics Oscillator Technical Oversold Levels

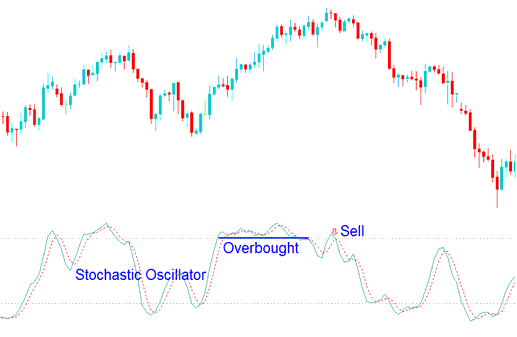

Sell Bitcoin Signal Using the Stochastic Indicator's Technical Overbought Levels

- Prior to Selling, the %K & %D lines turn downward from above 95 %.

- A reading that is floating above 95% means that bitcoin trading bulls are in control and there is buying of bitcoin crypto. A trader should wait out for the Stochastic indicator to move below 95% as a sign that buying pressure is easing.

- The sell cryptocurrency signal gets confirmed when the stochastic indicator goes below overbought, then after a while returns to over-bought but this time moves downward immediately without staying at the over-bought.

Sell Signal Using Stochastics Oscillator Technical Overbought Levels

Analyzing various chart timeframes alongside overbought and oversold level indicators can significantly assist in determining the most appropriate entry strategy when initiating a bitcoin trade.

The key idea is to trade with the BTCUSD trend. Check bitcoin signals against longer-term stochastic oscillators. This confirms them on shorter crypto chart times.

Explore More Tutorials:

- How to Interpret and Analyze BTC USD Trade Candles Patterns Analysis

- How Do I Use MT4 Bitcoin Platform Software iPhone Trade App?

- How Do I Interpret BTCUSD Chart Movement?

- Analyze BTCUSD Charts on MT4: Beginner Tutorial and Trade Platform Guide

- MetaTrader 4 Parabolic SAR BTCUSD Trading Technical Indicator for Day Trading

- Trade on Multiple Charts Scalping Method