RSI Bitcoin Indicator Overbought and Over-sold Levels

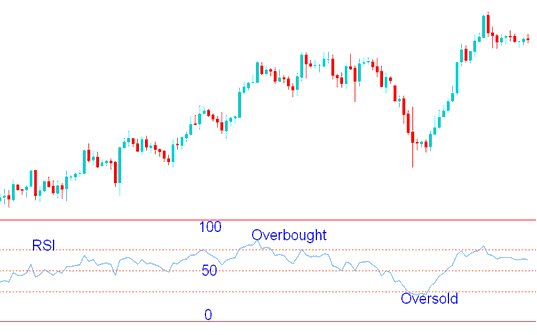

RSI over 70 means overbought. Bitcoin traders see it as a top. Time to lock in gains.

When RSI readings fall below the 30 mark, this condition is judged as oversold: bitcoin traders interpret levels under 30 as potential market troughs and opportune moments to secure profits.

The overbought and oversold levels in bitcoin trading should be validated by RSI center line crossovers as cryptocurrency trading signals. If these regions indicate a market top or bottom, this cryptocurrency signal should be corroborated with an RSI centerline crossover signal. This is due to the fact that these overbought and oversold levels are susceptible to generating whipsaws in the btcusd market.

In the crypto chart, RSI at 70 meant bitcoin was overbought. It hinted at a trend reversal for trades.

The crypto chart soon flipped its bitcoin trend downward. It hit oversold levels and formed a bottom. Then it climbed back up.

Overbought & Over-sold Levels - RSI Bitcoin Strategies

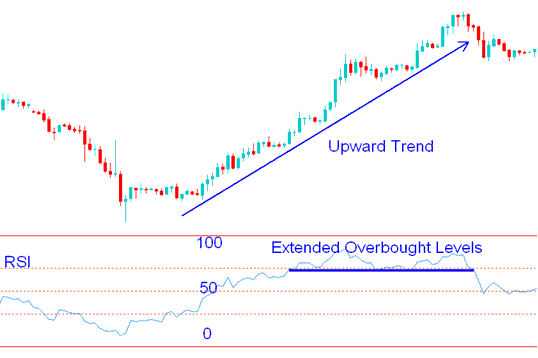

Over Extended Over-bought & Oversold Levels

In a strong up or down trend for BTCUSD, the RSI indicator stays in overbought or oversold zones for a while. These zones do not mark clear tops or bottoms in the crypto market. The RSI hangs there too long. That's why overbought and oversold areas often lead to false signals in Bitcoin trades. Use RSI centerline crossovers to check these crypto signals.

Over Extended Over-bought & Over-sold Levels - RSI Bitcoin Indicator Strategy

Discover More Instructions and Subjects:

- How Do I Read Lower Bearish Drop Triangle Setups?

- Learn MT4 Bitcoin Charts & MT4 BTCUSD Chart Analysis for Beginner Traders

- How Do I Analyze Piercing Line Candle Pattern Bullish or Bearish?

- Stochastic Oscillator Bitcoin Trend Reversal BTC/USD Strategies

- How Do I Interpret Fibonacci Pullback Bitcoin Chart Levels Settings?

- McClellan Oscillator Bitcoin Trading Indicators

- Generating MACD Bullish & Bearish Bitcoin Signals Systems

- How to Calculate BTC USD Trade Pips in BTC/USD Charts

- How Do I Draw Downwards Trend-lines in MT5 BTCUSD Charts?

- Candlesticks Chart BTC USD Crypto, Line Chart & Bar Chart Types