McClellan Oscillator for Bitcoin Analysis and Trade Signal Generation

Created and Developed by McClellan.

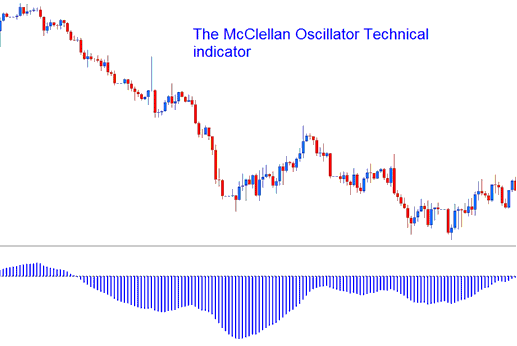

The McClellan Oscillator is an indicator that is based on smoothing the difference between the number of bullish candles and bearish candlesticks. This btcusd technical indicator bears a strong resemblance to the traditional MACD technical indicator.

McClellan Oscillator Indicator

BTCUSD Analysis and How to Generate Trading Signals

This oscillator tracks momentum like the MACD. Use its three ways to spot bitcoin trading signals.

Zero Center-Line Crossover Signals:

Bullish Signals: A buy signal for bitcoin is triggered or produced when the oscillator line crosses upward over the center-line marked at zero.

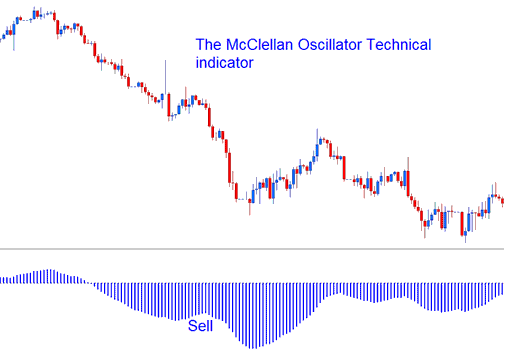

Bearish Signals - A sell signal for bitcoin is generated when the oscillator crosses beneath the zero centerline.

Analysis in BTCUSD Crypto Trading

Divergence Bitcoin Signals:

Spot divergences between the McClellan Oscillator and Bitcoin price. They highlight reversal or trend continuation spots well.

There are different types of divergence-setups:

Classic Bitcoin trade divergence (regular Bitcoin divergence)

- Bullish Divergence: Lower lows in bitcoin price action and higher lows in the McClellan Oscillator.

- Bearish Divergence: Higher highs in bitcoin price and lower highs in the McClellan Oscillator.

Hidden BTC USD Crypto Currency Divergence Trading Setup

- Bullish Divergence: Higher lows in bitcoin price action and lower lows in McClellan Oscillator.

- Bearish Divergence: Lower highs in bitcoin price action and higher highs in McClellan Oscillator.

Overbought/Over-sold Levels in Trading Indicator

The McClellan Oscillator also helps find possible overbought and oversold points in how the bitcoin price changes. The overbought and oversold situations happen when the oscillator trading goes to very high or very low points and starts to change direction, but in a strong market trend, the oscillator will stay at these extreme levels for a long time. It's not a good idea to trade based on overbought and oversold levels to create cryptocurrency signals. The best signal to use is when the signal crosses the center line to make bitcoin signals.

More Courses:

- Getting Bullish & Bearish MACD Signals for BTC USD

- Key Rules for Managing BTC/USD Finances Effectively

- What Makes a Bitcoin Fibonacci Pullback Different from a BTC USD Fibonacci Extension?

- BTCUSD Scalping, Day Trading, Swing Trading, and Position Trading for Bitcoin

- Analyzing Bitcoin Price Retracement with Real BTC/USD Example Scenarios

- Demark's Projected Range: BTCUSD Indicator

- Comparative Exercise: Fibo Extension Levels Versus Fibonacci Pullback Levels.