RSI Bitcoin Indicator Divergence Bitcoin Trade Setups

Bitcoin divergence is a common trade setup utilized by Bitcoin traders. It requires analyzing charts alongside a technical indicator: in this example, we will use the RSI (Relative Strength Index).

Spot this divergence by finding two chart points. Bitcoin price makes a new high or low, but RSI does not. This signals a momentum gap.

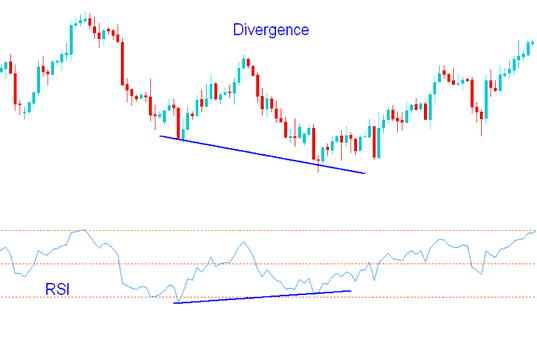

RSI Bitcoin Divergence Example:

In the chart below we identify 2 chart points, point A & point B (swing highs)

Then, using RSI, we look at and study the high points made by the bitcoin RSI technical indicator, which are right below the bitcoin chart points labeled A and B.

We then draw one line on the trading chart and another line on the RSI.

RSI Divergence Setup for Bitcoin - Utilizing the RSI Indicator to Identify Divergence in Bitcoin Trades

How to spot bitcoin divergence

To identify this divergence trade setup, we need to look for the following:

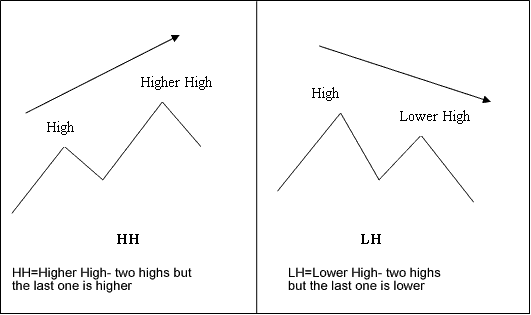

HH = Higher High : two highs but last is higher

LH = Lower High : 2 highs but last is lower

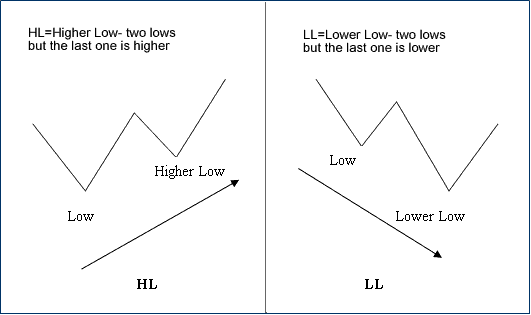

HL = Higher Low : two lows but last is higher

LL = Lower Low - 2 lows but the last is lower

First let us look at the illustrations of these bitcoin terms

Divergence Bitcoin Trading Terms Definition

Bitcoin Divergence Terms Definition Examples

There are 2 different types of divergence setups:

- Classic BTCUSD Trading Divergence

- Hidden Bitcoin Trading Divergence

More Topics and Tutorials:

- Instructions for Placing Limit BTC USD Orders within Bitcoin Trading Applications

- 3 Stochastic Oscillator Strategies for BTC/USD

- Opening a BTCUSD Demo Account on MetaTrader 4

- Technical indicators and systems for BTCUSD

- MT5 Market Watch for BTC USD Symbols List

- Use Zigzag Indicator for Bitcoin on MT4 Trading Charts

- Bitcoin Trading: MetaTrader 5 Charts and Toolbars Guide