Recursive Moving Trend Average Analysis & Signals for Bitcoin Trading

This specific Technical Indicator is mathematically derived using a polynomial fitting method, where the underlying calculation is known as a Recursive Moving Polynomial Fit.

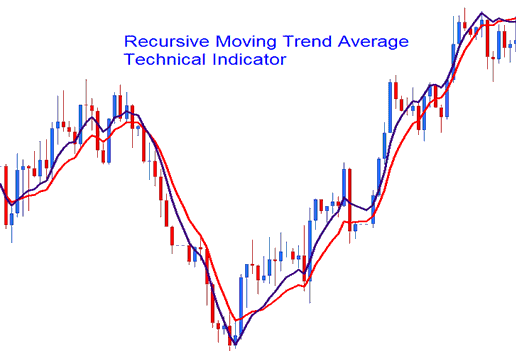

The calculation to find this technical indicator only needs a small amount of earlier info to figure out and guess the next way the price of bitcoin will move. The example shown here has two Recursive Averages that are used together to create a crossover system method.

BTCUSD CryptoCurrency Analysis and Generating Signals

The best way to analyze trades is the cross over method, where a bitcoin trader mixes two moving averages, like the 14 and 21. When they cross each other going up, that means prices will likely rise, and going down means they'll likely fall.

Buy Sell Trading Signal

The Recursive Average closely resembles the conventional moving average (MA): however, it is significantly smoother due to its calculation method and is less susceptible to whipsaws.

Examine More Guides & Courses:

- Why BTCUSD Traders Choose STP Broker & The Difference Between STP and ECN BTC/USD Broker

- Set Buy Limit BTC USD Order & Sell Limit BTC USD Order on MetaTrader 5 Platform

- Looking at Charts of BTC USD to Understand the Patterns

- How to Use BTC USD MT4 App for Beginners

- Learning How to Use the MT5 BTCUSD Platform Simply

- Adding Bitcoin Orders via MT4 iPhone App

- Which Timeframe is Best for Day Trading Crypto?

- How Do I Analyze MT5 Bitcoin Chart Data from MT5 Bitcoin Chart Data Window?

- How to Set Stop Loss and Take Profit for BTCUSD on MT4 Platform

- Fibo Extensions in MT4 Charts Described