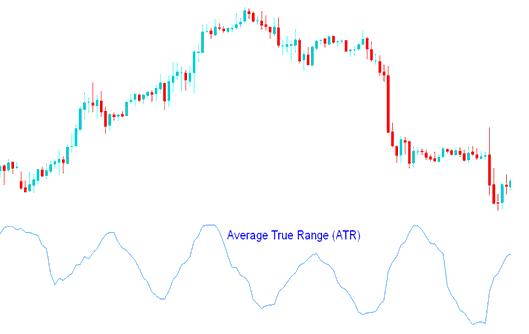

Average True Range Bitcoin Analysis & ATR Bitcoin Signals

Created and Developed by J. Welles Wilder

This BTCUSD tool tracks volatility. It gauges bitcoin price swings over a set time. The ATR stays neutral and skips trend direction.

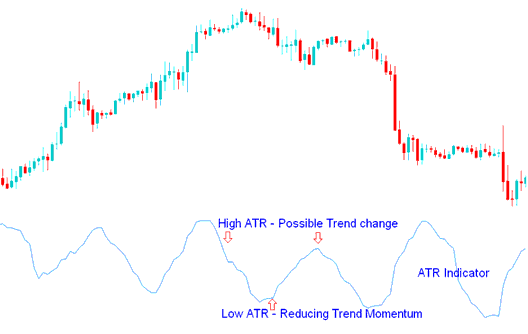

High ATR indicator values

High Average True Range indicator values indicated market bottom after a selloff.

Low ATR indicator values

Low Average True Range (ATR) values indicate prolonged periods of sideways movement in Bitcoin prices, such as those observed at market peaks and during consolidation phases. Low ATR values are characteristic of extended durations of sideways movement that occur at the top of the BTC/USD market and throughout consolidation periods.

Calculation

This btcusd technical technical indicator is calculated using the following:

- Difference between the ruling high and the current low

- Difference between the prior closing bitcoin price and the current high

- Difference between the prior closing bitcoin price & the current low

The final Average is calculated by adding these values & calculating the average.

BTC USD Crypto Analysis and How to Generate Trading Signals

The Average True Range indicator can be analyzed in the same way as other indicators of volatility.

This signals a possible Bitcoin trend shift. Higher indicator values mean a greater chance of change.

This measures how strong the bitcoin trend is - a lower indicator number means the bitcoin trend is getting weaker.

Analysis in BTC USD Trading

Study More Tutorials & Topics:

- Analysis of the Chandes Dynamic Momentum Index Indicator Applied to Bitcoin Charts

- Money Management Principles for Intraday BTC/USD Trading within a Training Course Context.

- How Can You Open MT4 Chart BTC/USD Tick Chart?

- How do you change the chart time for Bitcoin charts in MetaTrader 4?

- How to Trade and Draw a Trendline on a Chart

- How Do You Analyze/Interpret Trade Fibonacci Extension Levels in Trading Charts?

- Saving a Customized Bitcoin Trading Template Configuration within MetaTrader 4 Software

- How Can You Analyze/Interpret ++FiboFibonacci Extension Levels BTC USD Strategy?

- BTCUSD MT5 Line Chart Explained

- How Can You Draw BTCUSD Trendlines in MT4 Trading Software for Trade?