Keltner Bands Technical Analysis and Keltner Bands Signals

Chester Keltner is the originator and developer, as detailed in his published work, "How to Make Money in Commodities."

This mobile application furnishes users with a diverse array of trading functionalities that are also present in the desktop version of the MetaTrader 4 platform software.

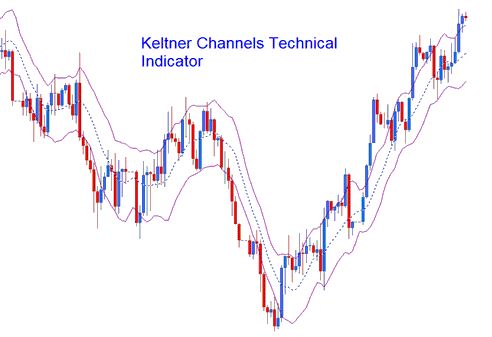

These Bands create Channels to assist in identifying trends in the forex market using this volatility channel.

Keltner Channels

Construction

Keltner Channels work like Bollinger Bands. The difference is Bollinger Bands use standard deviation to spot volatility and set the bands.

Keltner Bands Channels use Average True Range (ATR) instead of standard deviation to measure market volatility.

This indicator calculates an exponential Moving Average over 'n' periods based on the closing price. These associated bands are constructed by

Adding (for the top line) and

The subtraction operation (used for determining the lower band).

An (n-period simple Moving Average of an n-period ATR) * an ATR multiplier.

FX Analysis and How to Generate Trading Signals

This indicator can be traded and transacted in much the same way as a Bollinger Bands.

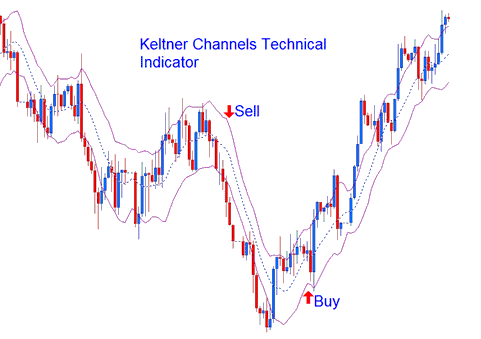

Continuation Trading Signals

If prices extend beyond the bands, it indicates a continuation of the current market trend. Upward-moving channels suggest a buy signal, while downward-moving channels reflect a sell signal.

Continuation Buy & Sell Trade Signals

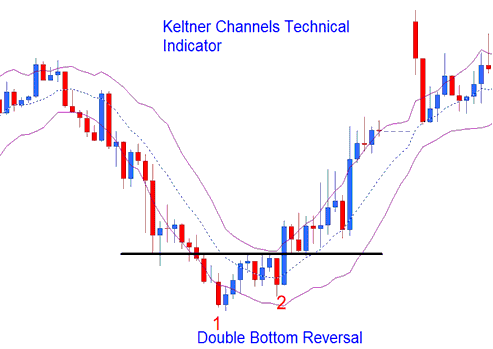

Reversal Signals - Double Top and Double Bottoms Setups

Highs and lows outside the bands, followed by highs and lows inside the Keltner channels and bands, show when the market trend might change.

Reversal Signals

Ranging Currency Markets

When prices stay within a certain range, a price movement that starts at one Keltner band or channel usually goes all the way to the other band.

Review Further Instructional Material & Subject Areas: